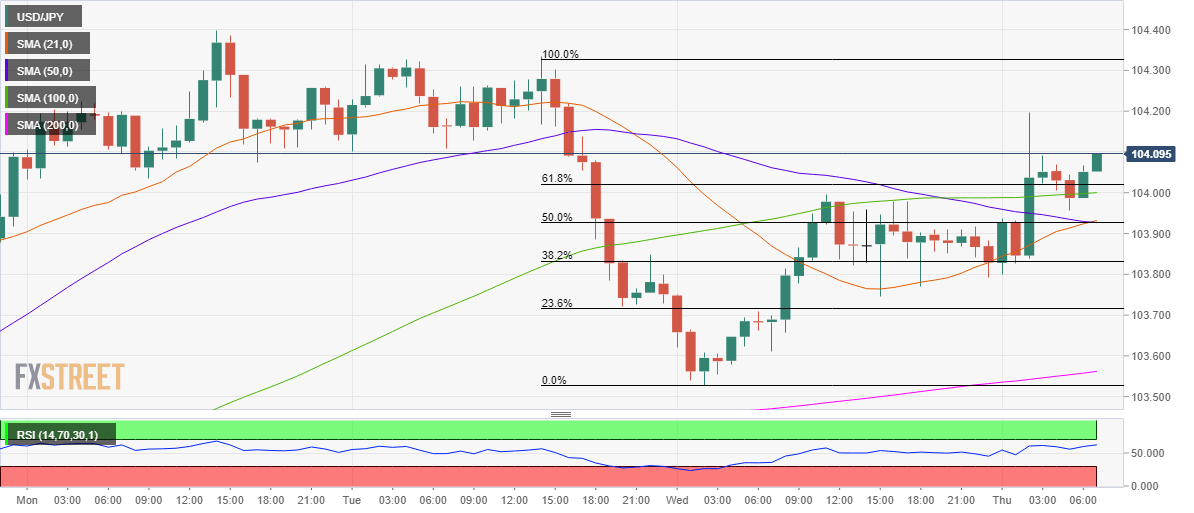

USD/JPY Price Analysis: Bulls looking to find acceptance above 61.8% Fibo level

- USD/JPY consolidates the spike to 104.20 in Asia.

- Bulls clings to 61.8% Fib resistance on the hourly chart.

- 103.92 is the strong support, RSI stays bullish.

USD/JPY is looking to extend the gains above 104.00, having hit a daily high of 104.20 earlier in the Asian session.

The bulls are trying hard to find acceptance above the critical resistance at 104.03, which is the 61.8% Fibonacci Retracement level of the January 12 decline on the hourly chart.

However, the path of least resistance appears to the upside amid a bullish Relative Strength Index (RSI), which currently trades at 61.06.

The daily highs at 104.20 could be retested, above which January 12 highs at 104.33 will be on the buyers’ radars.

To the downside, the 100-hourly moving average (HMA) at 104.00 could cap immediate pullbacks.

The confluence of the 50% Fibo level and 100,21-HMA at 103.92 will be a tough nut to crack for the bears.

USD/JPY: Hourly chart