AUD/USD Forecast: Limited bearish potential

AUD/USD Current Price: 0.7707

- The Australian dollar was weighed by the poor performance of equities and commodities.

- At the beginning of the week, the focus will be on Chinese data.

- AUD/USD is at risk of falling further but needs additional technical confirmation.

The AUD/USD pair eased on Friday, ending the week with modest losses just above the 0.7700 level. The pair was weighed by the dismal market’s mood and followed the lead of equities and commodities, which posted sharp losses at the end of the week. Spot gold settled at $1,827.80 a troy ounce, its lowest settlement in a month.

The aussie was quite resilient to dollar’s demand, backed by the better coronavirus-related situation in the country, which translates into better economic performance. On Friday, the country published upbeat housing data, as in November, Home Loans jumped to 5.5% from 0.8% in the previous month. The country won’t publish macroeconomic figures on Monday, but the focus will be on Chinese Q4 GDP, November Industrial Production and December Retail Sales.

AUD/USD short-term technical outlook

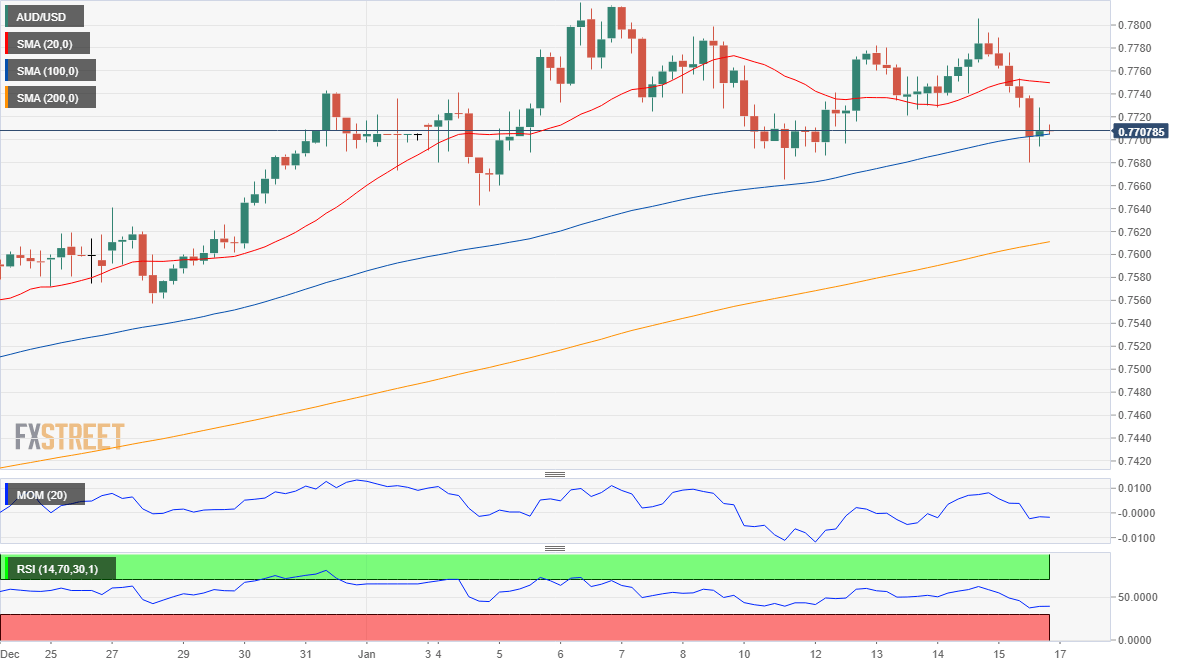

The AUD/USD pair has a limited bearish potential, as the daily chart shows that buyers surged around a firmly bullish 20 SMA. Technical indicators head lower but within positive levels, somehow suggesting further declines ahead without confirming the downward case. In the 4-hour chart, the pair is developing below a flat 20 SMA but met buyers around its 100 SMA. Technical indicators are within negative levels with the RSI heading south around 41, skewing the risk to the downside.

Support levels: 0.7670 0.7620 0.7580

Resistance levels: 0.7720 0.7770 0.7815

View Live Chart for the AUD/USD