The Chart of the Week: EUR/USD enters the bears lair

- EUR/USD on the brink of an upside correction on the lower time frames before resuming medium-term downtrend.

- Monthly demand below the market would be targetted prior to the resumption of the longer-term uptrend.

EUR/USD has been rejected from the montly support in a correction of the monthly bullish impulse. With some more work to do below structure, the bears have the upper hand, albeit potentially only momentarily.

The following is a top-down analysis from which deciphers where the next bearish opportunity could evolve before the resumption of the uptrend.

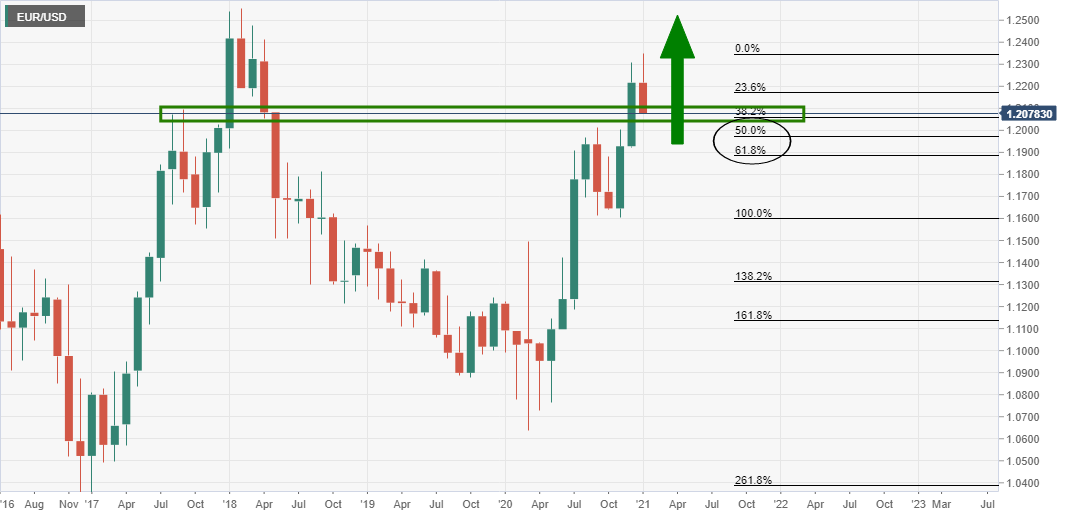

Monthly chart

The monthly chart has corrected to a 38.2% Fibonacci retracemrent level, but there could still be some more room to go until the correction meets prior resistance.

Ibn doing so, there will be a bearish prospect on the lower time frames before the bulls take back control.

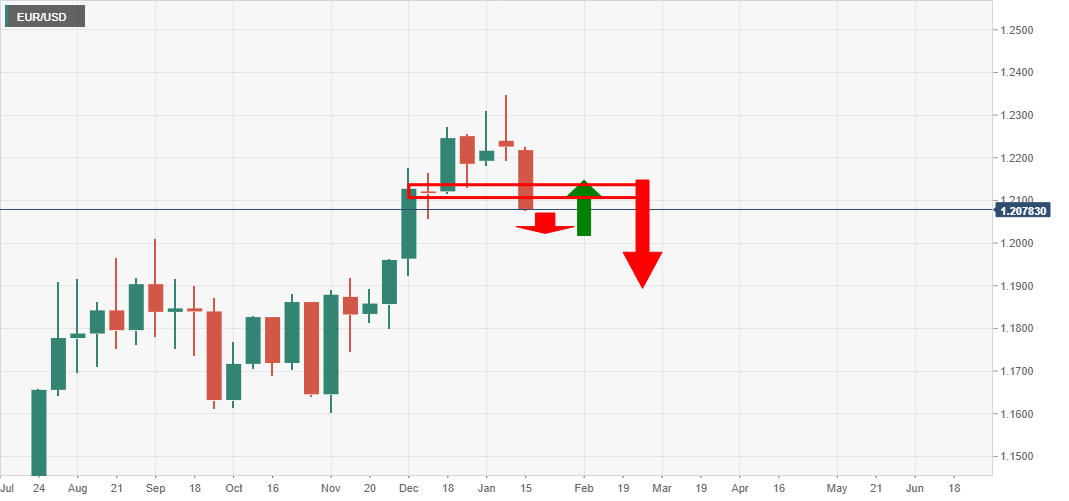

Weekly chart

The weekly charts show that the price is now below an important resistance structure.

In a continuation on the lower time frames to the downside for the week ahead, the cart will be forming a weekly overextended M-formation.

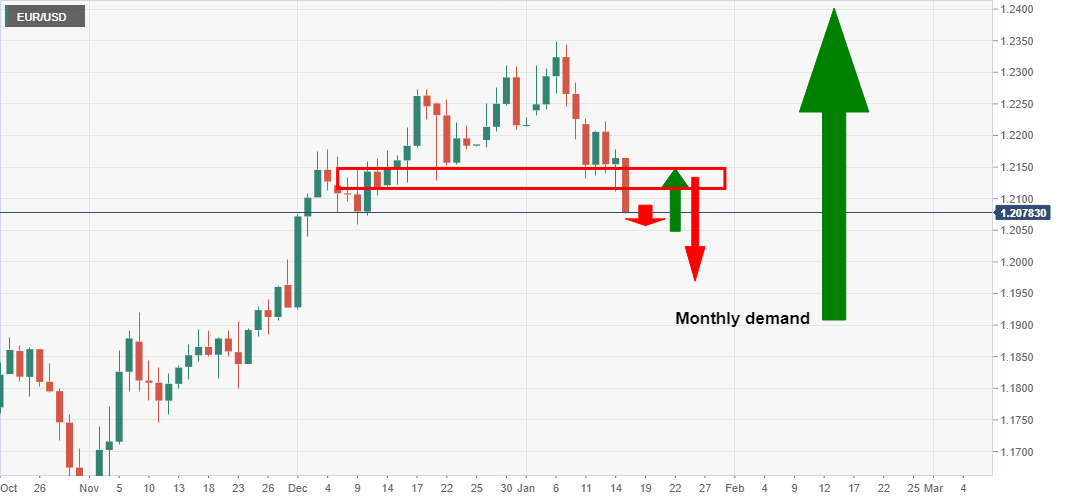

Daily chart

The weekly price action would enable a retest of the daily structure before the downside continues.

4-hour chart

The price on the 4-hour chart is overextended and due for a correction. Bears will wait for the price to correct before seeking an optimal entry to target monthly demand.