USD/CAD Weekly Forecast: Resistance becomes support

- USD/CAD touches nearly three-year low, finishes a figure higher.

- Weak American Retail Sales, Initial Claims do not deter US dollar gains.

- WTI fails at $54 resistance on Friday, undermining USD/CAD.

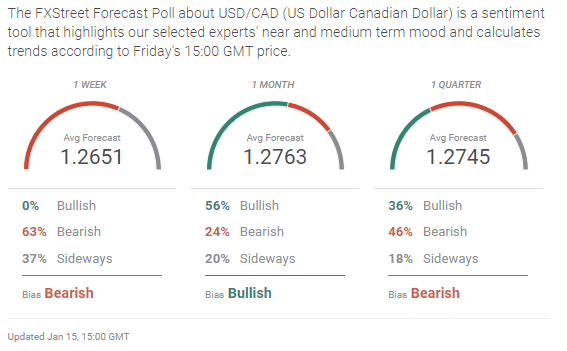

- The FXStreet Forecast poll sees modest gains in USD/CAD.

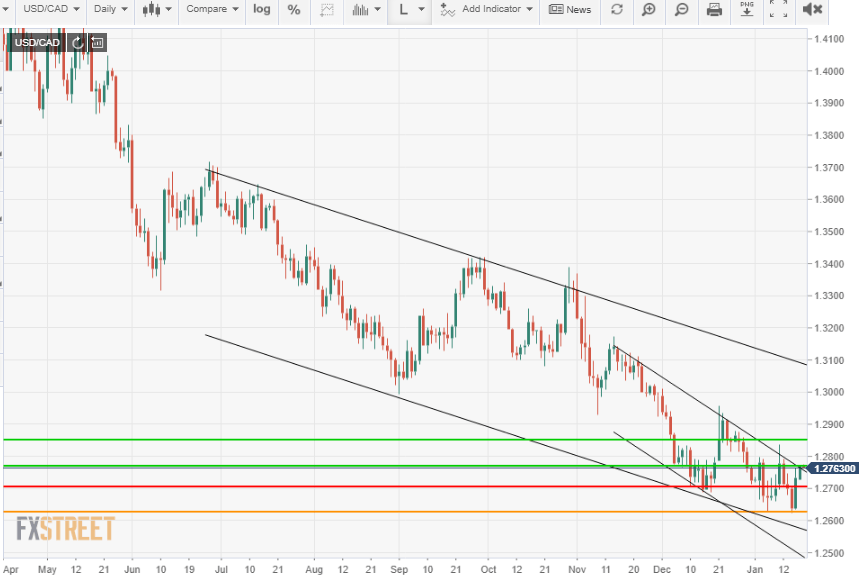

For the second week in a row the USD/CAD plumbed the bottom of its three-year range and then rebounded from support at 1.2625.

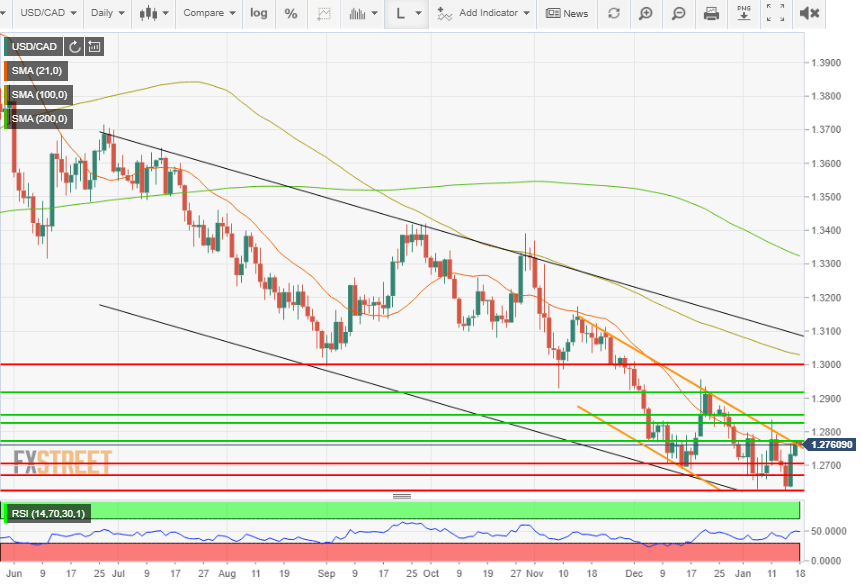

As has been true for eight months, the classic sell signal of ever lower highs continues to point the USD/CAD down even as rising interest rates have aided the US dollar.

The USD/CAD touched 1.2625 on Thursday, the lowest the pair has been since April 19, 2018 and closed at 1.2637. Friday’s return reached 1.2765 and finished at 1.2734.

On January 6 the pair dropped to 1.2630, closed at 1.2670 on next day, and topped at 1.2778 on January 11. On December 15 the low was 1.2688, next day’s close was 1.2742 with a finish of 1.2912 on December 22.

In order: December 15 low 1.2688, following high close 1.2912; January 6 low 1.2630, high 1.2778; January 14 low 1.2625, high 1.2734 (just one session).

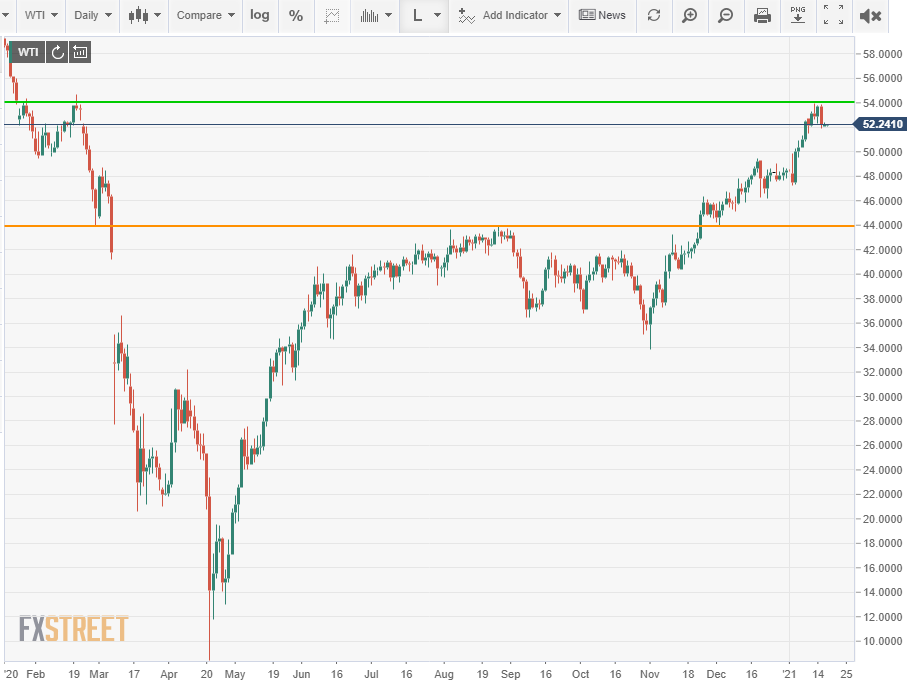

The technical USD/CAD momentum lower has been assisted, at least since the beginning of December, by rise of West Texas Intermediate (WTI) through the $44 barrier that had marked the pandemic recovery to that point. After three attempts this week the WTI failed at $54.00 resistance and closed at $52.24.

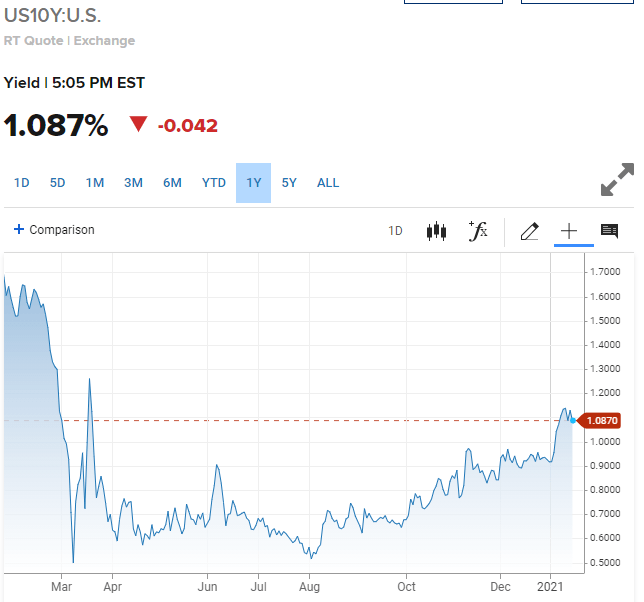

Countering the fall in USD/CAD is the prospective economic recovery in the United States and the incipient increase in US Treasury interest. The yield on the 10-year bond closed above 1% on January 6 for the first time since March and has retained that level in subesequent trading. The Federal Reserve’s $120 billion a month in bond purchases will restrain any increase in Treasury rates that the FOMC deems too rapid or to far, but it is not intended to freeze yields or to completely prevent rising rates justified by an improving economy.

CNBC

Federal Reserve Chairman Jerome Powell repeated the central bank’s commitment to low interest rates and an accommodative monetary policy in an interview at Princeton University on Thursday but that assertion is not new. It has been the Fed policy response for some time and reinforces the latest forecast in December’s Projection Materials that has the fed funds rate unchanged through the end of 2023.

The US dollar’s modest gain this week despite the dismal Initial Claims and Retail Sales figures is evidence that the currency market, like the equities for some time and more recently credit, is beginning to look beyond the current economic situation to a recovery in the second and third quarters.

Downward momentum in the USD/CAD has waned in the New Year. The pair opened on January 4 at 1.2723 and closed on Friday at 1.2734. The weaker US dollar scenario that has prevailed since the COVID-19 panic relented in late May has not reversed or been replaced by an outlook based on a global economic recovery, but that is the next logical move.

There were no Canadian statistical releases this week.

In the US, Retail Sales for December fell in every category reflecting the worsening employment picture. Initial Jobless Claims jumped to 965,000 in the January 8 week (released January 14) the highest total in five months. National payrolls (released January 8) shed 140,000 jobs in December. It was the first decrease since the pandemic lockdown crash in March and April April deleted 22.16 million employees.

Prospects for a large economic stimulus package from the incoming Biden administration, including $1400 individual and family grants on top of $600 already approved under President Trump, are also providing a boost for the dollar. The stipend will help invigorate consumer spending.

In addition, a number of state and city leaders that have been in the forefront of advocating for business closures and social restrictions to control the pandemic have begun to change their minds, now saying that their economies must reopen because the cost is too high.

USD/CAD outlook

Technically, the aging down trend remains in control. From the end of June to the third week of November the USD/CAD lost 5% (6/26,13687- 11/24, 1.3000). In the following two months the pair has gone down another 2%. Support at 1.2625 has proven resilient despite its relatively tyro status, but of more importance is the approach to the tight channel that originated in mid-November. A break of the upper border of this formation at abut 1.2770, will provide lift, even though the USD/CAD remains in the overall and much wider descending channel that dates to late July.

Nearest resistance outside of the narrow channel is at 1.2800 but the first substantial technical impediment is at 1.2850. As with most US dollar based pairs the long decline has left many more resistance lines above the current level than support point below. However, any sizable move higher, will convert these to a varied and relevant support structure.

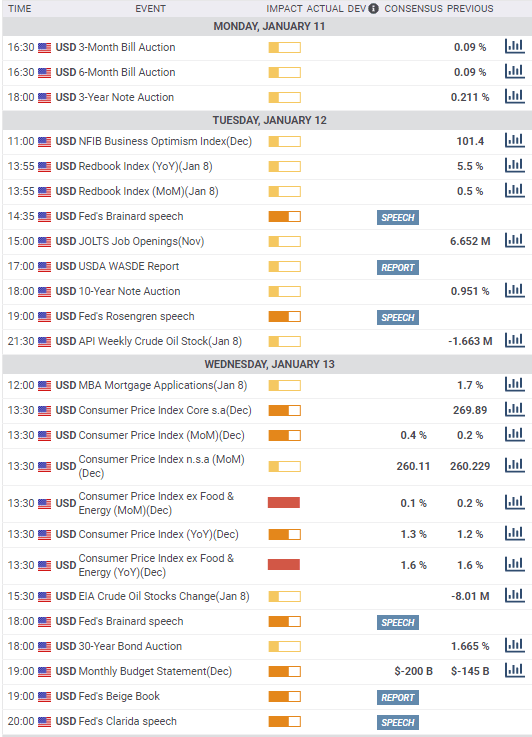

Canada statistics January 11-January 15

No economic information of importance.

US statistics January 11-January 15

Retail Sales in December were far worse than expected as were Initial Claims but had little impact on the dollar. Market remain focused on the prospective federal stimulus package and US Treasury rates.

Tuesday

The National Federation of Independent Business Optimism Index (NFIB) dropped to 95.9 in December from 101.4 prior. The forecast was 102.8. The JOLTS Job Openings saw 6.527 million places in November, down from 6.632 in October and below the 6.916 million forecast.

Wednesday

The Consumer Price Index (CPI) rose 0.4% on the month and 1.4% on the year in December up from 0.2% and 1.2% in November. Core CPI rose 0.1% and 1.6% from 0.2% and 1.6% prior. The Fed’s Beige Book, prepared for the January 29-30 FOMC meeting, said the economy grew “modestly” in the final weeks of 2020, with the return of COVID-19 cases hampering activity.

Thursday

Initial Jobless Claims jumped to 965,000 in the week of January 8, the highest in five months, from 784,000 previous, 795,000 had been expected. Continuing Claims rose to 5.271 million from 5.072 million, 5.061 had been forecast.

Friday

Retail Sales fell 0.7% in December far worse than the flat expectation and the November result was revised to -1.4% from -1.1%. Control Group Sales fell 1.9% from -1.1% in November, its forecast was 0.1%. Sales ex-Autos dropped 1.4% on a -0.1% forecast. November was revised to -1.3% from -0.9%. The Producer Price Index (PPI) rose 0.3% in December after a 0.1% gain in November. On the year it was unchanged at 0.8%. The Core PPI Index was unchanged at 0.1% on the month, and 1.2% on the year after 1.4% in November. Industrial Production jumped 1.6% in December, quadruple its 0.4% forecast and more than three times the 0.5% November rate. Capacity Utilization in December fell to 79.2% from 80.7%. The Michigan Consumer Sentiment index slipped to 79.2 in January from 80.7 prior. The forecast was 80.

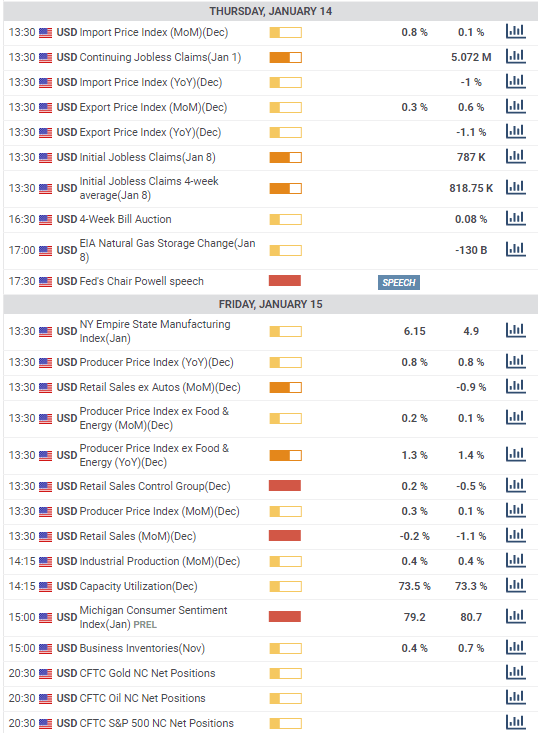

Canada statistics January 18-January 22

The Bank of Canada view on the economy is the most relevant for markets followed, at a good distance, by consumer prices.

Monday

Housing Starts for December (YoY), November saw 246,000.

Tuesday

Manufacturing Sales for November are expected to rise 0.6% after a 0.3% gain in October. Wholesale Sales for November are predicted to climb 0.9% after a 1% increase prior.

Wednesday

The Bank of Canada (BoC) Consumer Price Index Core is expected to fall 0.2% on the month and rise 1.2% on the year in December after 0.2% and 1.5% in the previous month. The Consumer Price Index is forecast to drop 0.1% on the month in December after a 0.1% rise in November and to be unchanged at 1% on the year. The Bank of Canada is projected to leave it base rate unchanged at 0.25%.

Thursday

ADP Employment Change for December is due. In November 40,800 positions were added.

Friday

Retail Sales for November will be released. October Retail Sales rose 0.4% and Retail Sales ex-Autos were flat.

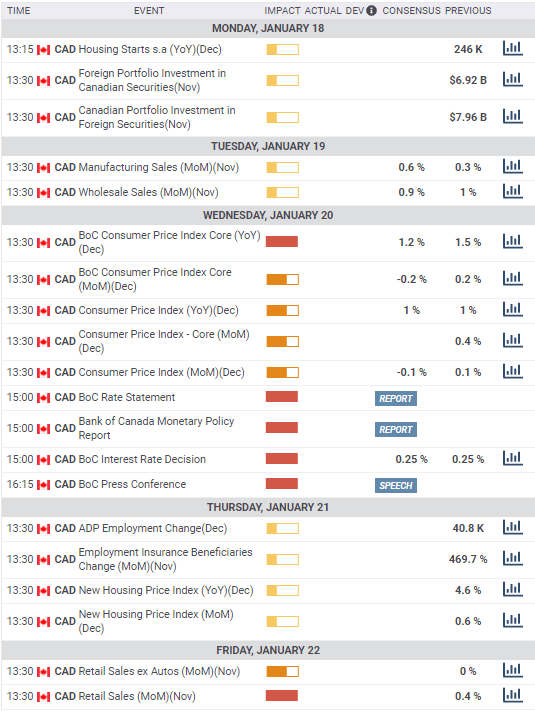

US statistics January 18-January 22

Initial Jobless Claims are front and center for all markets.

Wednesday

National Association of Home Builders (NAHB) Housing Market Index is expected to be unchanged at 86 in January.

Thursday

Housing Starts in December should rise to 1.562 million annualized in December from 1.547 million in November. Building Permits are forecast to drop to 1.61 million annualized from 1.635 million. Initial Jobless Claims are projected to drop to 860,000 in the January 15 week, Continuing Claims were 5.271 in the January 1 week.

Friday

Markit Manufacturing PMI is expected to fade to 56.5 in January from 57.1. The Services PMI is forecast to drop to 54 from 54.8. Existing Home Sales should drop to 6.46 million annualized in December from 6.69 million prior.

USD/CAD technical outlook

The resistance at the upper border of the narrow channel at 1.2770 is supported by the 21-day moving average at 1.2759. The 100-day average at 1.3030 is a strong back-up for the important resistance line at 1.3000. The 200-day at 1.3323 is out of the current picture. The Relative Strength Index at 49.0, though nearly neutral should be considered a buy signal after the long decline and sharp reversal on Friday.

The USDCAD is in the interesting position where any ascent converts the many resistance lines from the long downtrend into a potentially plentiful support system. In effect a fundamentallly based move higher would automatically gain technical credence.

Resistance: 1.2770; 1.2825; 1.2850; 1.2915; 1.3000

Support: 1.2700; 1.2670; 1.2625

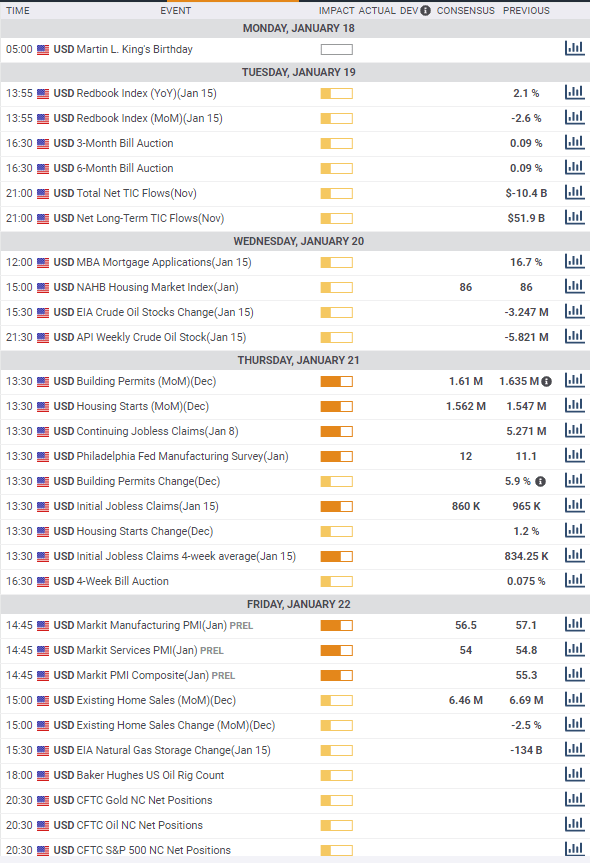

FXStreet Forecast Poll

The FXStreet Forecast Poll bearish view in the one-week does not forsee a successful test of the 1.2625 support line. The one-month and one-quarter outlooks have been largely superseded by Friday’s move to 1.2764 and respect the upper inner channel border. A break of that formation would clear the immediate area north of 1.2800.