Gold Price Analysis: XAU/USD drops below $1,740 despite USD selloff

- Gold fell below $1,740 during the American trading hours.

- Recovering US T-bond yields weigh on XAU/USD on Wednesday.

- Next support aligns at $1,730 ahead of $1,725.

After edging higher to $1,750 area earlier in the day, the XAU/USD pair lost its traction during the American session and was last seen trading at $1,735, losing 0.45% on a daily basis. Despite the broad-based selling pressure surrounding the greenback, a more-than-1% increase seen in the benchmark 10-year US Treasury bond yield is making it difficult for gold to attract investors.

Gold technical outlook

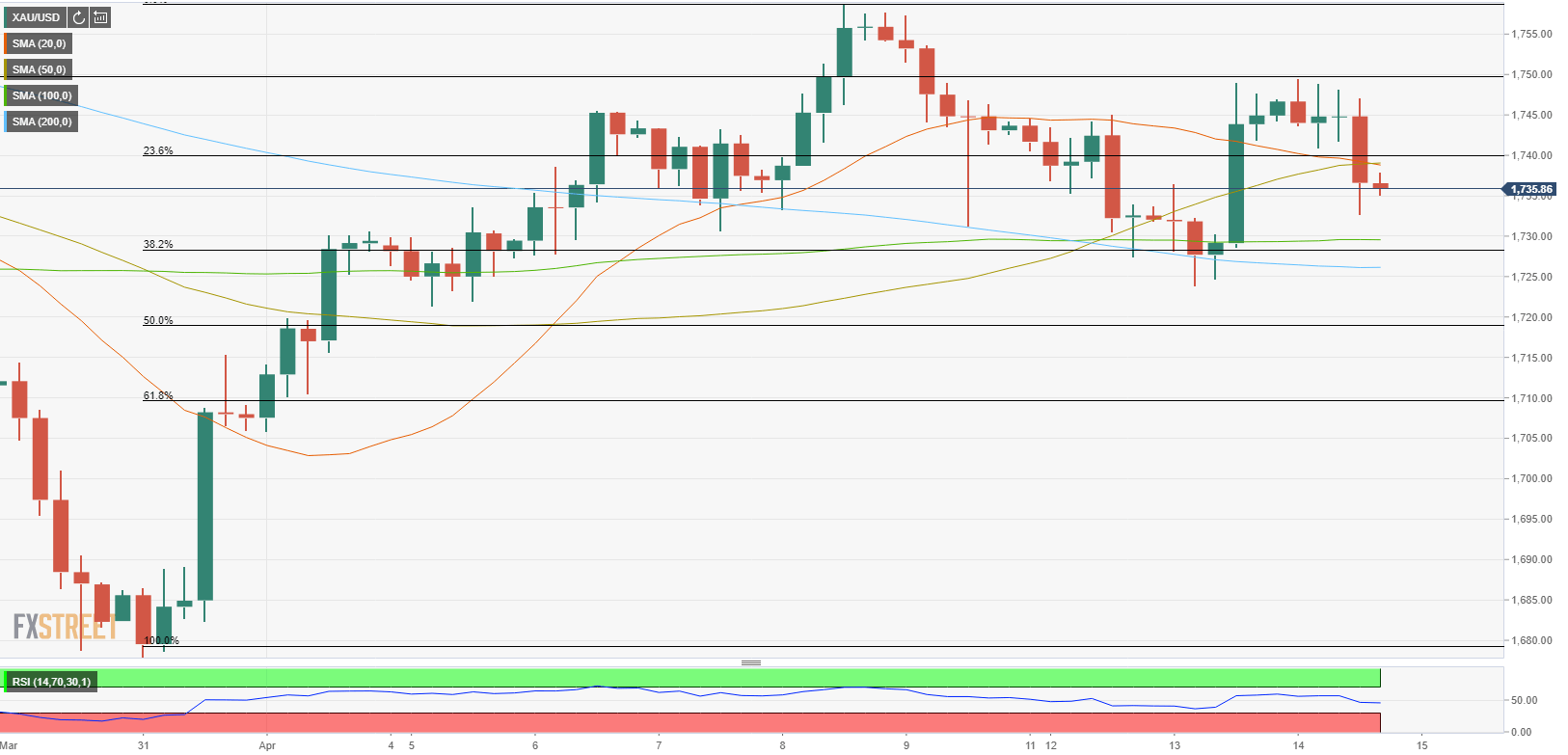

On the four hour chart, the Relative Strength Index (RSI) indicator fell slightly below 50, suggesting that the pair is struggling to gather bullish momentum. On the downside, the next support is located at $1,730 (Fibonacci 38.2% retracement of Mar. 31-Apr. 8 rally, 100-period SMA) ahead of $1,725 (200-period SMA) and $1,720 (static level, Fibonacci 50% retracement).

In case gold manages to hold above $1,730, it could retest $1,740 (Fibonacci 23.6% retracement) and continue to push higher toward $1,750 (daily high, static level). Additional gains toward $1,758 (Apr. 8 high) are likely if XAU/USD makes a daily close above $1,750.