Gold Price Forecast: XAU/USD consolidates heaviest losses since January above $1,800

Update: Gold (XAU/USD) licks its wound around $1,816-17, up 0.30% intraday, following the heaviest drop since January 08 led by US Federal Reserve (Fed) actions. That said, the gold traders keep bounce off $1,803, near to the $1,800 psychological magnet, even as US Treasury yields remain firmer by the press time of Thursday’s Asian session.

Read: Forex Today: Long live King Dollar

US 10-year Treasury yield marks 1.7 basis points (bps) of intraday gain to 1.586%, the highest level in two weeks, but the US dollar index (DXY) struggles to extend the strongest daily jump in over a year while taking rounds to 91.40-38.

Although the US dollar’s sluggish move helps gold prices, strong Treasury yields keep gold buyers in check. Even so, the quote bounces back towards the previous support structure around $1,845, comprising the early May’s tops and Monday’s low.

Moving on, gold traders should keep their eyes on how market players digest the Fed’s drama for fresh impulse.

Gold prices have dropped some 22 bucks on the Federal Reserve’s hawkish statement and interest rate decision.

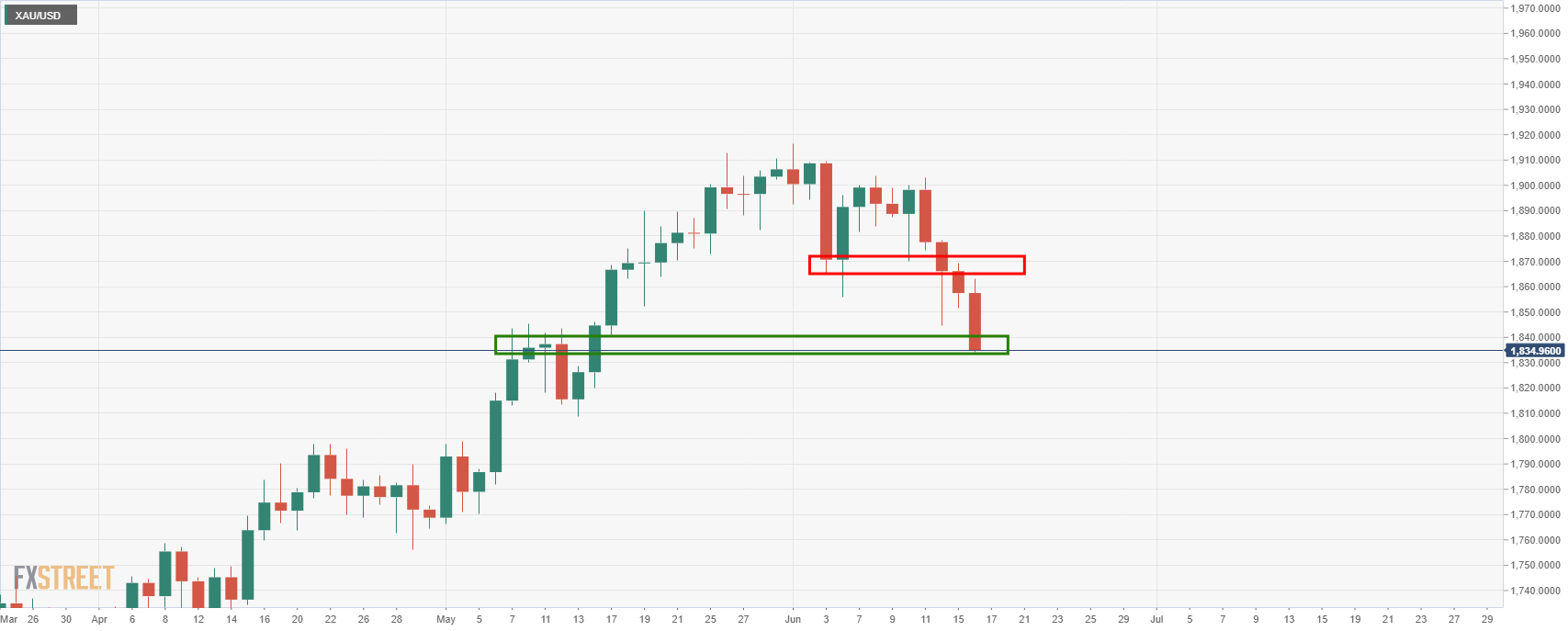

At the time of writing, XAU/USD is trading at $1,839.65, lowest since 12th May and now at daily support structure.

Gold prices are driven by the US Treasury yield curve and the performance of the US dollar in the main and have been more recently linked to the performance of the Us stock market.

Immediately on the release of the statement, the US stock market is down a touch, the US dollar has started to climb by 0.44% to 90.94 in the DXY, the highest since 13th May, while the yield on the US 10-year has also perked up to 1.5310% risking 3%, but the US 5-year yields have jumped to 0.837% from 0.780%.

However, there is nothing dramatic in the immediate aftermath and the focus will now be on the Fed’s chairman, Jerome Powell.

Key notes on the Fed, so far

- Benchmark interest rate unchanged; target range stands at 0.00% – 0.25%.

- The interest rate on excess reserves raised to 0.15% from 0.10%

- The median projection shows two hikes in 2023, which suggests FOMC has overall shifted more hawkish.

- US Fed funds futures price in a full rate hike by April 2023.

Overall, this is seen as positive for the greenback, bearish for gold and sets up an AugustJackson Hole taper announcement.

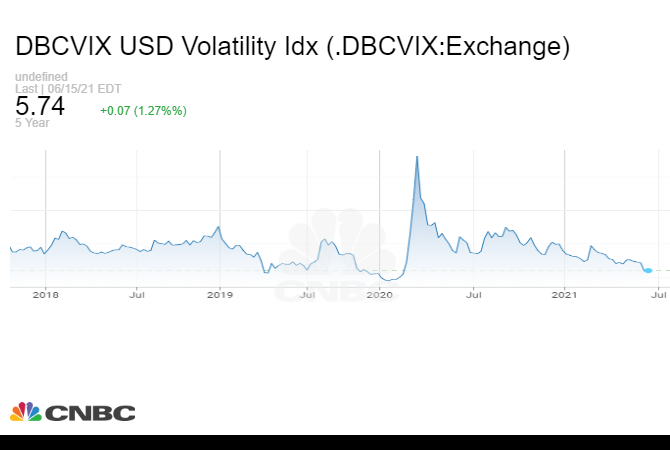

It will be especially important for forex volatility over the summer months that has been at the lowest levels in over a year:

Watch Live

Jerome Powell may talk the hawkish reaction down in his presser which can be seen live here:

Gold reaction

Lower hanging fruit for counter-trend traders

This makes for some lower hanging fruit if Powell intends to play down the hawkish statement, considering that that gold is now at a daily support and would be expected to correct higher according to the M-formation:

On the hourly chart, bulls can look for a higher probability setup once immediate resistance is broken to target the prior daily lows: