EUR/USD remains under pressure, loses traction near 1.1790

- EUR/USD’s bullish attempt loses momentum near 1.1790.

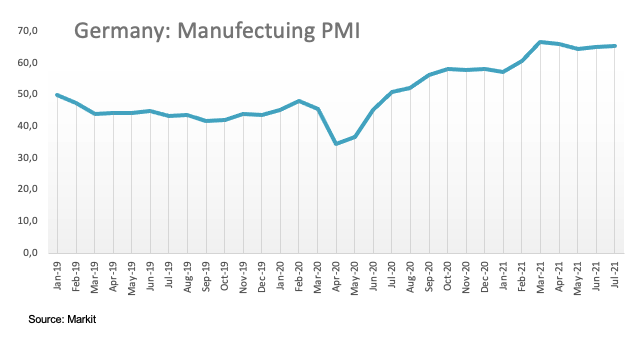

- German, EMU Manufacturing PMI surprised to the upside in July.

- US flash Manufacturing PMI comes up next in the docket.

The single currency moves within a narrow range, with EUR/USD navigating around 1.1770 on Friday.

EUR/USD offered despite upbeat data

EUR/USD comes under further downside pressure in the second half of the week, always below 1.1800 the figure, as the recovery in the greenback grabs extra steam.

In fact, the dollar’s bounce off Thursday’s lows picks up further pace, as market participants continue to adjust to the recent dovish message at the ECB event. It is worth recalling that the ECB left the policy rates unchanged – as broadly expected – although the “revised” forward guidance showed a more dovish tone. On the latter, the ECB now see rates at current/lower levels until inflation reaches the 2% target “well ahead of the end of its projection horizon and durably for the rest of the projection horizon…”.

On the data front, positive results from advanced PMIs in the core Euroland failed to ignite a more lasting rebound earlier in the session. Indeed, the German and EMU Manufacturing PMI came in at 65.6 and 62.6, respectively, for the month of July, while the French gauge missed estimates at 58.1.

Later in the NA session, the US flash Manufacturing and Services PMIs will be the sole data releases on Friday.

What to look for around EUR

The outlook for EUR/USD remains fragile for the time being. Failure to re-test and surpass the 1.18 area should expose spot to further retracements. As usual in past weeks, price action around the pair is expected to exclusively hinge on dollar dynamics, particularly as investors continue to adjust to the Fed’s hawkish message, prospects of higher inflation in the US and potential QE tapering earlier than anticipated. On the euro side of the equation, the renewed dovish stance from the ECB (as per its latest meeting) is expected to keep the upside limited despite auspicious results from key fundamentals and the persistent high morale in the region.

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities in the wake of the pandemic.

EUR/USD levels to watch

So far, spot is losing 0.02% at 1.1768 and a breakdown of 1.1751 (monthly low Jul.21) would target 1.1704 (2021 low Mar.31) en route to 1.1602 (November 2020 low). On the other hand, the next hurdle is located at 1.1895 (weekly high Jul.6) followed by 1.1975 (weekly high Jun.25) and finally 1.2002 (200-day SMA).