Bitcoin price is outperforming major US stock indexes despite recent volatility

- Bitcoin price is rising faster than traditional finance indexes in the one-year time frame.

- The US has become a new hotspot for miners, accounting for nearly 17% of all global Bitcoin miners.

- Three times more US investors are holding BTC now than in 2018, according to a new poll.

Despite the recent drop of 50%, Bitcoin price has outperformed major US stock indexes over a one-year timeframe. BTC has become a treasury management tool for large corporations, and the growing interest from institutional and retail traders is likely to boost price growth.

JP Morgan becomes first bank to give clients access to crypto funds

JP Morgan has offered crypto funds to its retail wealth management clients. Nearly all JP Morgan’s clients, including ones on the bank’s self-directed retail trading app, now have access to crypto funds. Grayscale’s Bitcoin trust, Bitcoin Cash trust, Ethereum trust, Ethereum Classic trust, and Osprey’s Bitcoin trust funds are the products offered to clients.

The news broke out through an internal memo that said clients can now trade crypto fund products from Grayscale Investments and Osprey Funds, effective July 19. According to an anonymous source, advisors at JP Morgan are not recommending crypto products; however, they may trade at a client’s request.

The bank’s move marks a shift in traditional financial institution’s take on cryptocurrencies and Bitcoin, pointing to a change in sentiment among US clients. A recent study conducted by Gallup, a global analytics and advice firm, revealed that Bitcoin has gained traction with younger buyers. The number of investors (adults with $10,000 or more invested in stocks, bonds, and mutual funds) is up from 2% in 2018 to 6% as of June 2021. A three-fold growth in three years demonstrates increased awareness, interest, and ownership of Bitcoin among young investors.

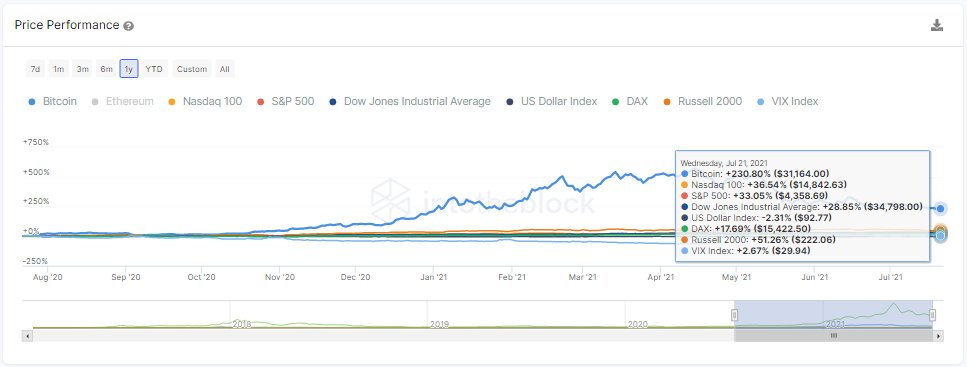

In the past year, Bitcoin has offered faster growth than major US stock indexes. This is one of the likely causes for its rise in popularity among retail clients. BTC price moved back and forth in the $30,000 range, and despite range-bound price action, one-year price performance data from IntoTheBlock shows the asset has offered the highest returns compared to traditional stock indexes.

As of July 2021, Bitcoin offered a 230.80% return over the past year, against Nasdaq that offered 36.54%, and S&P 500 that offered 33.05%.

Bitcoin price performance compared to major US stock indexes

The US is an emerging hotspot for Bitcoin traders and miners. After Beijing pulled the plug on BTC mining farms in China, the US jumped from fifth to second among mining destinations.

US accounts for over 17% of global BTC miners, a new hub for mining operations

Fred Thiel, CEO of Marathon Digital, a major player in the US mining industry, says that most miners new to North America will be powered by renewables or gas offset by renewable energy credits. Miners migrating from China are preparing for a future in which their energy usage is renewable and possibly regulated.

As Bitcoin mining is headed towards a cleaner future, Elon Musk, billionaire CEO of Tesla, opened up about the possibility of accepting Bitcoin as payment for his electric cars. In ‘The B word’ conference, Musk told Jack Dorsey of Twitter and Cathie Wood of ARK invest,

I want to do a little bit more due diligence to conclude and confirm that signs of renewable energy usage is most likely at or above 50% and that there is a trend towards increasing that number. If so, then Tesla will resume accepting Bitcoin.