Gold Technical Analysis: $1,244.00/oz is a brick wall – 1,233.00 bear target

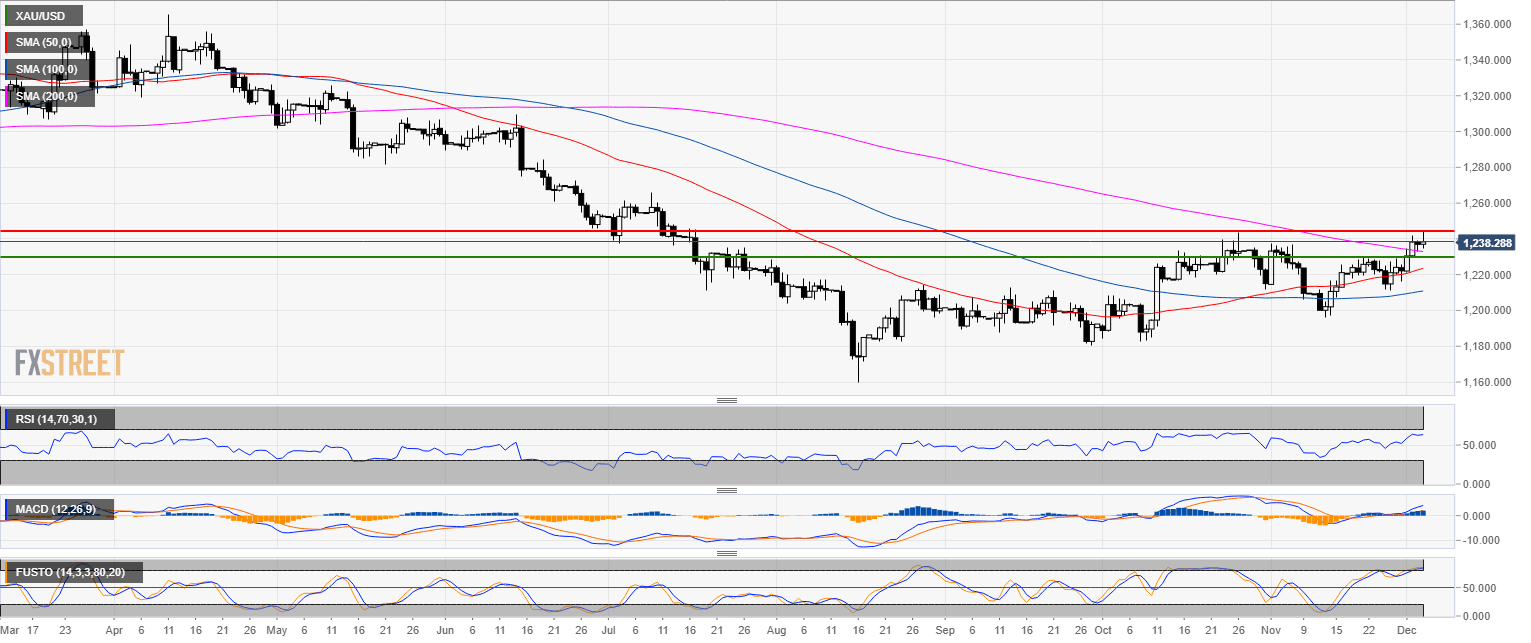

Gold daily chart

- Gold broke above the 200-day simple moving average (SMA) which is considered bullish. Technical indicators are bullish although the Stochastic is overbought.

- Thursday is a shooting star pattern, which is considered bearish.

- As forecast Gold found strong resistance at 1,244.00 resistance.

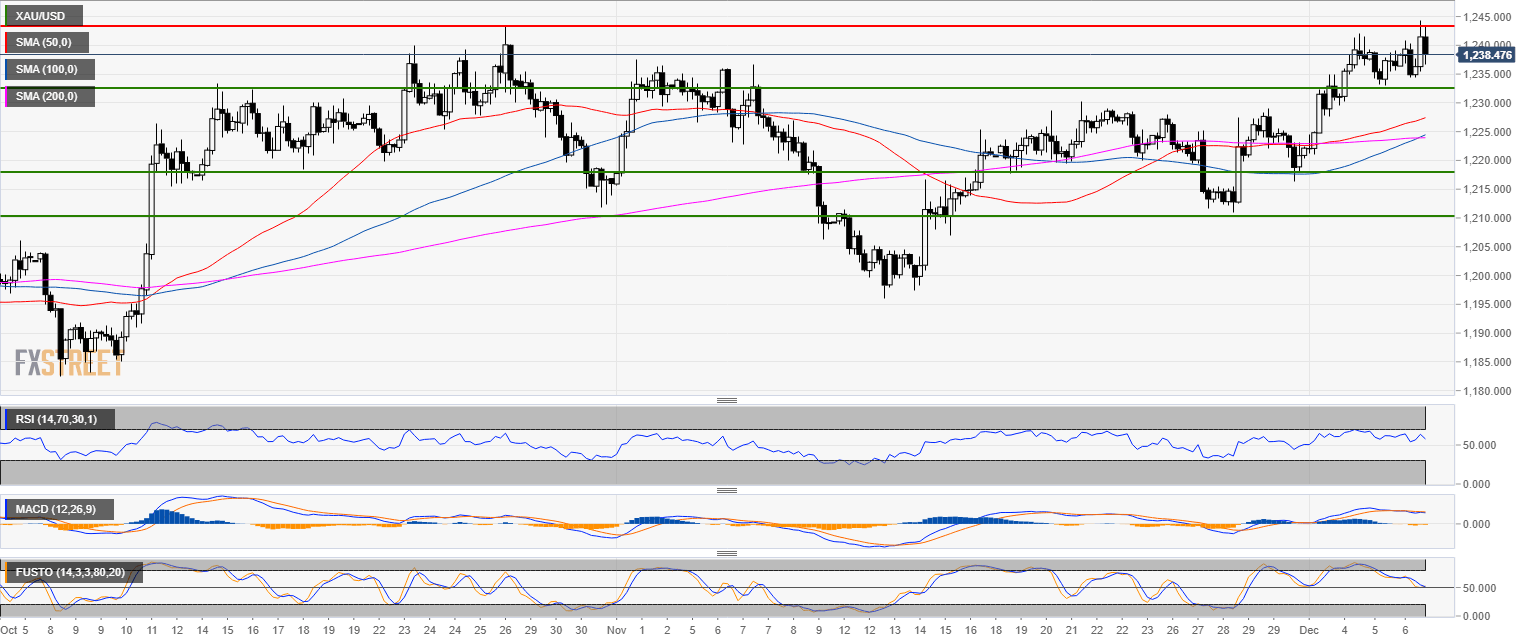

Gold 4-hour chart

- Now that the strong resistance at 1,244.00 is confirmed there is little in the way for the bears to drive the market to the 1,233.00 target.

Gold 30-minute chart

- The market is likely to slip through the 50 and 100 SMAs en route to the 200 SMA and 1,233.00.

- Technical indicators are bearish.

Additional key levels

XAU/USD

Overview:

Today Last Price: 1238.52

Today Daily change: 1.2e+2 pips

Today Daily change %: 0.0986%

Today Daily Open: 1237.3

Trends:

Previous Daily SMA20: 1220.4

Previous Daily SMA50: 1222.65

Previous Daily SMA100: 1210.42

Previous Daily SMA200: 1233.32

Levels:

Previous Daily High: 1239.36

Previous Daily Low: 1233.5

Previous Weekly High: 1231.8

Previous Weekly Low: 1211.2

Previous Monthly High: 1237.4

Previous Monthly Low: 1196.4

Previous Daily Fibonacci 38.2%: 1235.74

Previous Daily Fibonacci 61.8%: 1237.12

Previous Daily Pivot Point S1: 1234.08

Previous Daily Pivot Point S2: 1230.86

Previous Daily Pivot Point S3: 1228.23

Previous Daily Pivot Point R1: 1239.94

Previous Daily Pivot Point R2: 1242.57

Previous Daily Pivot Point R3: 1245.79