Adapt or die: Is the 60/40 stock/bond ratio dead?

Read full post at forexlive.com

Read full post at forexlive.com

Inflation to run higher?

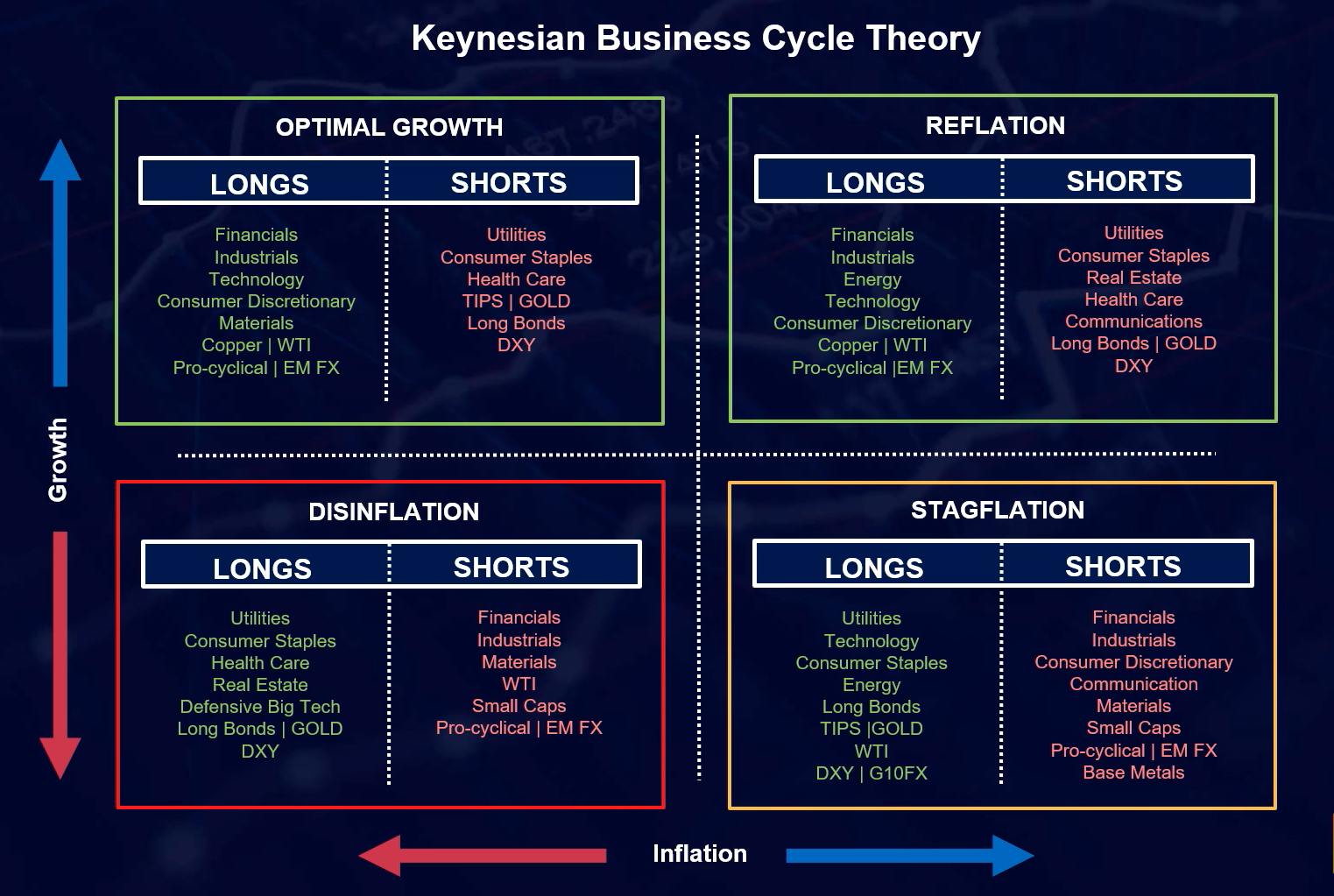

Bloomberg had an interesting piece out this week on how the 60/40 stock bond ratio mix that has been the bedrock of many investors portfolios could be dead. The reason is if we see a stagflationary environment where inflation is high, but growth is slow. See this helpful crib sheet from the folks over at Financial Source for a help in seeing the different outcomes

The concern is that rising inflation will see central banks around the world seek to slow down their economies by raising interest rates. This will hurt both bonds and stocks at the same time. The low growth era of the last 20 years or so have boosted the 60/40 strategy as it is built on the premise that rising stocks = falling bonds and vice versa. In September both bonds and stocks have fallen together.

Now the caveat with this of course is if inflation really is transitory. We know that central banks are dropping the ‘transitory’ word more and more, but the issues driving inflation are not insurmountable. Supply chain issues can be fixed. Oil prices can fall on rising supply, and natural gas prices can return naturally even during the warmer months. So, in theses situations the shifts in the narratives day to day can be traded intraday. However, the longer question still remains, ‘will inflation still rise in a world dominated by automation and globalisation?’. It is hard to say ‘yes’ with conviction. So, maybe inflation is transitory, but transitory may mean 2-3 years. So, it all depends on you timescale and reference point. See the full article here.

For the short term it may be worth looking at gold. If inflation rises more quickly than yields that will force real yields lower. If the USD then starts to fall as well that is rocket fuel for gold. So, this is a key market to watch going forward.

However, the lesson is clear. Markets change rapidly at times. When they do it is a case of adapting with them.