Polkadot price to return to $40 if near-term support holds

- Polkadot price lost nearly 30% of its value during the Saturday flash crash.

- A strong recovery indicates Polkdaot may be positioned for another leg higher.

- Downside risks remain, and risks must be monitored.

Polkadot price has substantially recovered since hitting a low of $23.95. A return above the $30 level gives buyers and long-term hodlers significant psychological support that Polkadot may, again, move higher.

Polkadot price must close above $32 before it can test $40

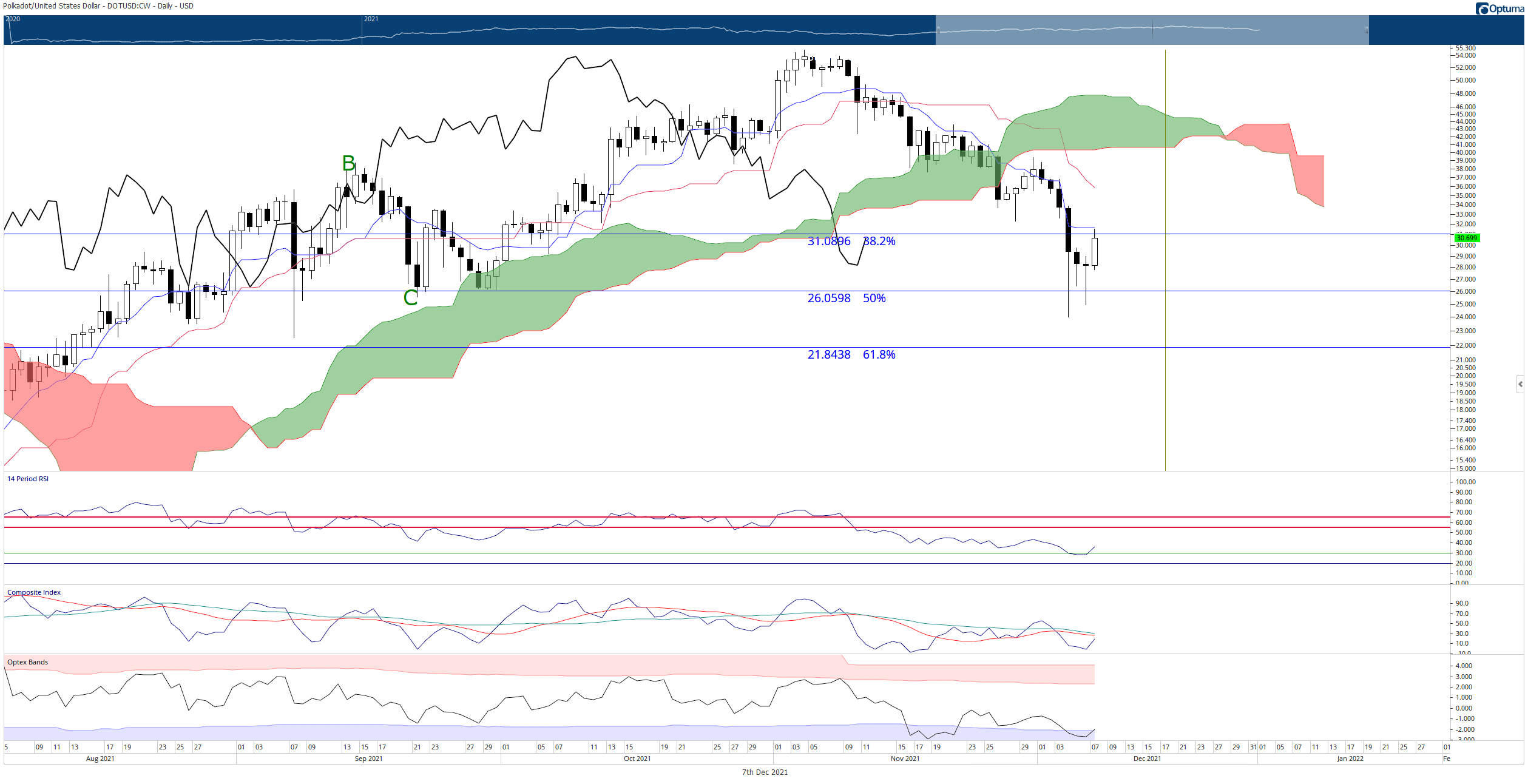

Polkadot price faces near-term resistance against the 38.2% Fibonacci retracement at $31.08 and the Tenkan-Sen at $31.66. It will need to close above both levels to prevent any near-term continuation of selling. Ideally, there would be enough momentum to close above the Kijun-Sen at $36, but that may not be possible.

After Saturday’s flash crash, an unfortunate event is the conversion of the Relative Strength Index from bull market conditions to bear market conditions. This does not mean or imply that Polkadot is entering into a bear market, but that momentum has dwindled enough to generate some warnings.

Despite the conversion to bear market conditions in the Relative Strength Index, there are some bullish signs. First, there is a regular bullish divergence between the candlestick chart and the Composite Index – hinting at a bullish reversal. Additionally, the Optex Bands oscillator is moving above and out of the extreme oversold levels it has been in.

DOT/USDT Daily Ichimoku Chart

Considering the present position of the Relative Strength Index, Composite Index, and Optex Bands, a breakout above $32 would likely have enough momentum to see Polkadot price test the Senkou Span B at $40 as resistance.

Failure to close above the Tenkan-Sen could see Polkadot return to the 50% Fibonacci retracement at $26.