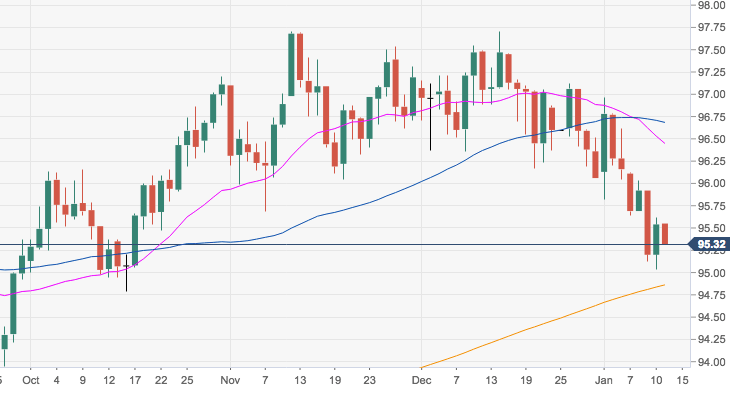

US Dollar Index Technical Analysis: The recent breakdown of the consolidation range opens the door for a visit to 94.80

- The greenback remains under pressure after breaking below the multi-month sideline theme between 95.80 and 97.70 earlier in the week.

- The probability of further downside thus remains in place, with the immediate target at the 94.80 region, where converge the critical 200-day SMA and October lows.

- In case the selling impetus picks up extra pace, the 38.2% Fibo retracement of the 2017-2018 drop at 94.20 should come next ahead of September lows in the 93.70 zone.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 95.33

Today Daily change: -21 pips

Today Daily change %: -0.220%

Today Daily Open: 95.54

Trends:

Previous Daily SMA20: 96.5

Previous Daily SMA50: 96.7

Previous Daily SMA100: 96

Previous Daily SMA200: 94.84

Levels:

Previous Daily High: 95.62

Previous Daily Low: 95.03

Previous Weekly High: 96.96

Previous Weekly Low: 95.82

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Previous Daily Fibonacci 38.2%: 95.39

Previous Daily Fibonacci 61.8%: 95.26

Previous Daily Pivot Point S1: 95.17

Previous Daily Pivot Point S2: 94.81

Previous Daily Pivot Point S3: 94.58

Previous Daily Pivot Point R1: 95.76

Previous Daily Pivot Point R2: 95.99

Previous Daily Pivot Point R3: 96.35