Why traders are licking their wounds in ETC price action

- Ethereum Classic price action fell over 4% in the aftermath of Coinbase’s negative earnings.

- ETC price shows resilience as investors pick up the pieces in the downturn.

- Expect to see a nervous session with CPI in the US setting the tone for the rest of the week.

Ethereum Classic (ETC) price got dragged to the downside in the aftermath of Coinbase earnings that came out late on Tuesday evening just prior to the US closing bell. Hand in hand with the crypto winter, exchange platform Coinbase’s earnings printed red, disappointing investors. The platform was hit by its dependence on transactions in the most battered asset class of financial markets this year. Several cryptocurrencies got tackled and rolled over to the downside, with ETC recovering this morning in the ASIA PAC session as investors picked up the price action at a short-term discount, although risk looms around the corner with the US inflation print this afternoon setting the tone for the rest of the week.

ETC price could go either way depending on the tone of US CPI

Ethereum Classic price action could flip a coin on this afternoon’s US CPI numbers and go either north or south of where it is currently trading, near the close of the ASIA PAC session. A bullish move is slightly favoured as investors quickly picked up the small drop suffered in the aftermath of the Coinbase earnings. Next, the Relative Strength Index (RSI) had a chance to cool down and dip further below the overbought barrier, making it ready for a turnaround.

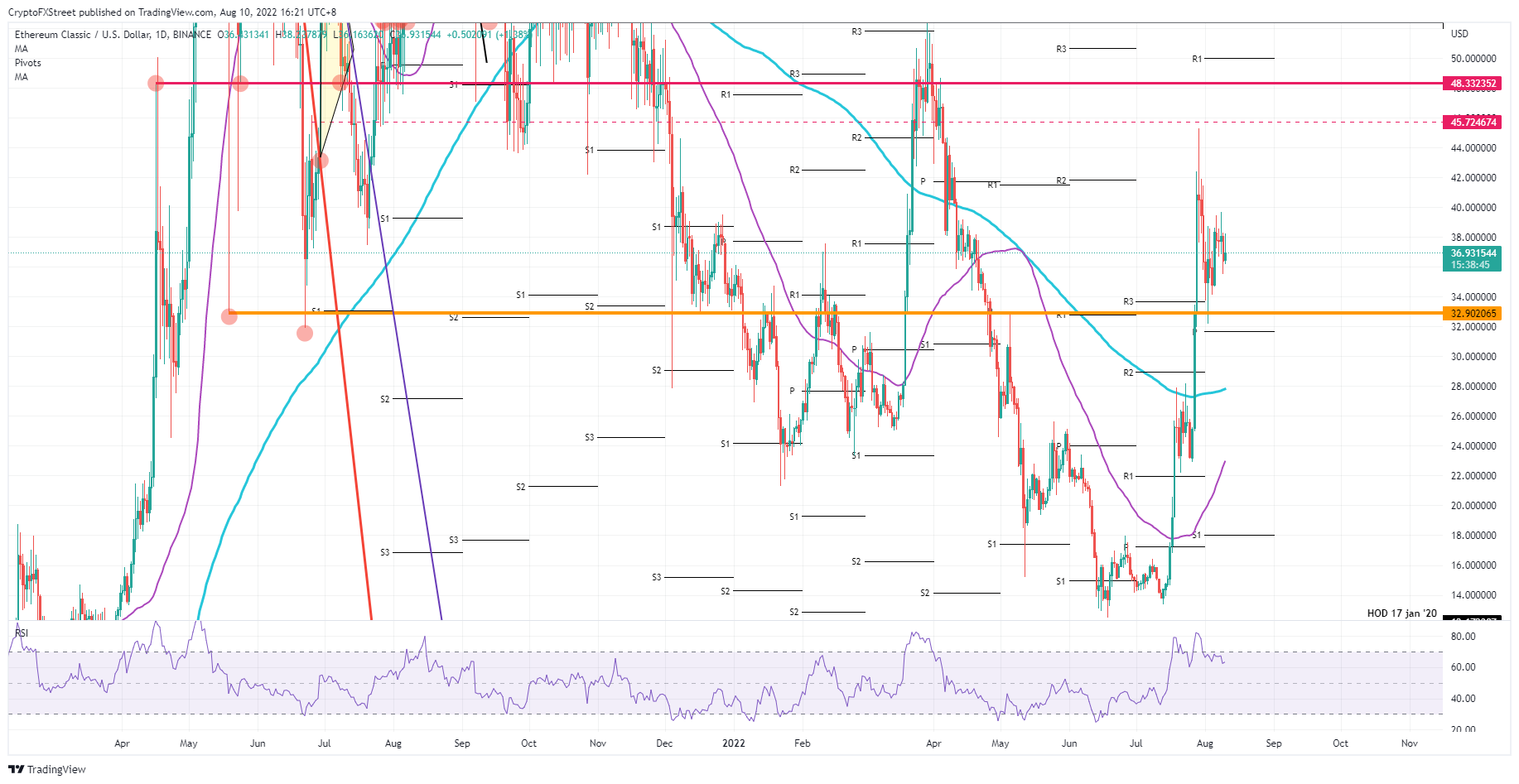

ETC price will see bulls still targeting $45 to the upside where it got to on July 29, with the ultimate price target still at $48, the high of April 16, 2021. That is a staggering 30% return in the making if inflation drops, further supporting a goldilocks scenario amongst the possible outcomes for the coming months. In the spillover effect, an end to the crypto winter could be viewed as near, as the 55-day Simple Moving Average (SMA) has moved up sharply and is catching up with the 200-day SMA, to break the death cross and set up a golden cross, preluding another leg higher in the crypto rally.

ETC/USD Daily chart

Event risk comes on the back of the same CPI print which, if the drop should be minor or even show an increase in inflation, it would be a huge setback for investor sentiment. Traders would quickly pull their risk-on positions and close their trades in profit that have built up since mid-July. ETC price would collapse back to that orange support line at $32.90 and leave investors with a 12% loss from where ETC price is trading today.