Crude Oil Futures: Door open to a near-term rebound

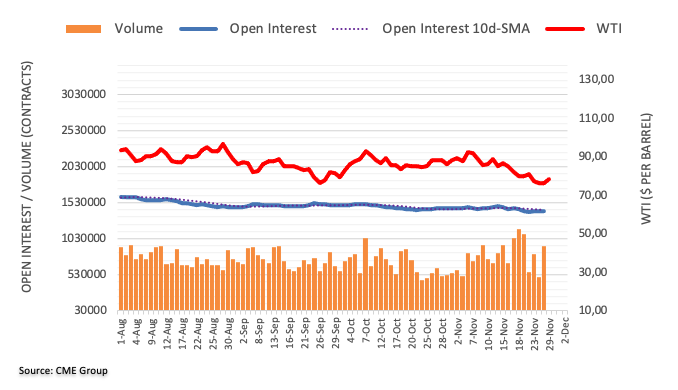

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by more than 6K contracts on Monday, reversing two daily builds in a row at the same time. Volume, on the other hand, kept the choppiness unchanged and rose by nearly 432K contracts.

WTI: A test of $70.00 is not ruled out

Prices of the WTI charted an inconclusive session on Monday, reversing an initial drop to new 2022 lows. The move was amidst shrinking open interest and a marked build in volume, exposing a probable bounce in the very near term while not ruling out further weakness in the longer run. On the latter, the $70.00 mark per barrel emerges as the immediate support.