Tuesday 21st May: Dollar teases underside of 98.00 ahead of Fed speak.

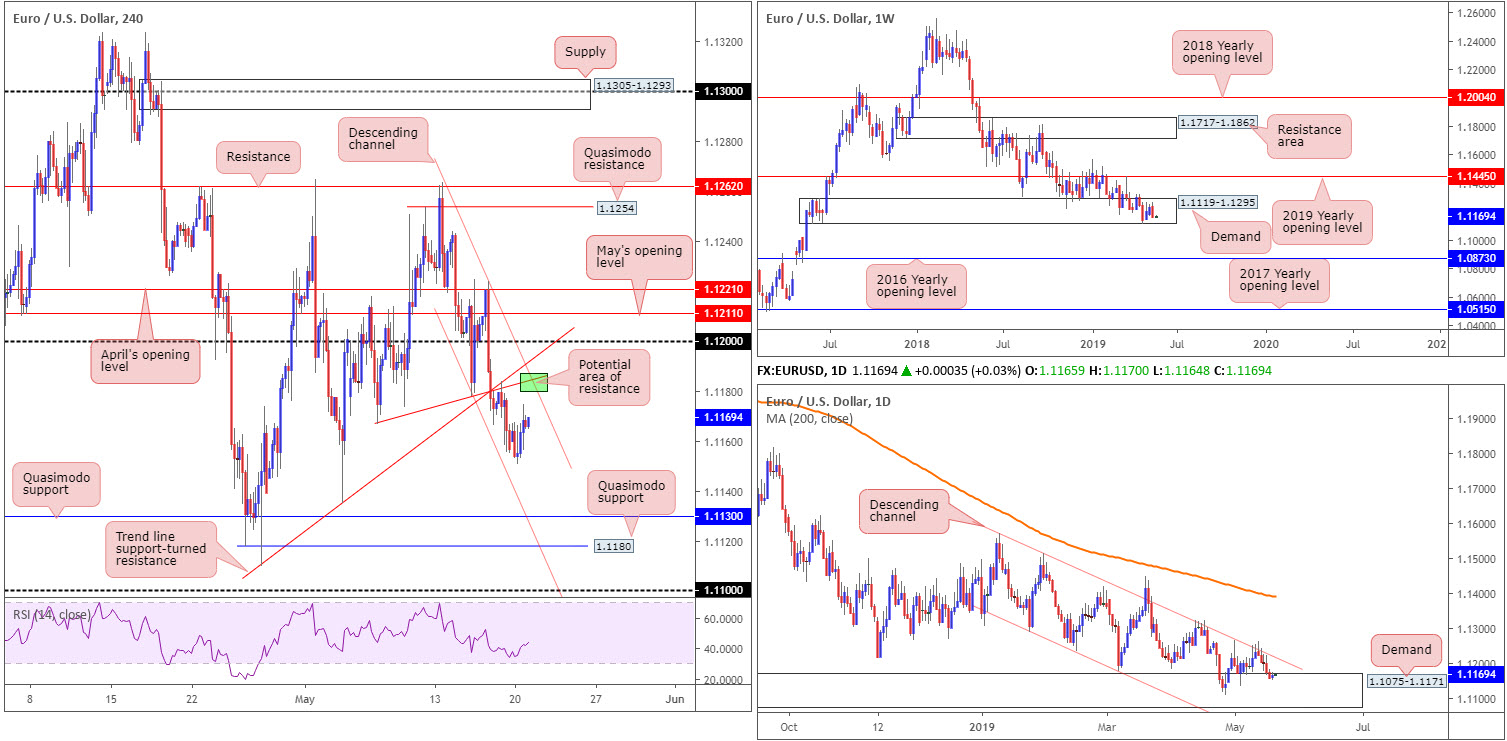

EUR/USD:

Outlook unchanged.

Monday observed minimal price change, with the EUR/USD ranging no more than 25 points amid a light economic calendar and likely a cautious tone ahead of this week’s ECB minutes and speakers.

On account of yesterday’s lacklustre activity, the area where channel resistance (taken from the high 1.1263) and the local trend line support-turned resistance (1.1166) on the H4 timeframe merges remains of interest today for potential selling opportunities (green). The next downside target from this point, aside from yesterday’s low 1.1150, can be found at a Quasimodo support drawn from 1.1130.

On a wider perspective, however, buyers and sellers remain trading within the parapets of a long-standing demand zone at 1.1119-1.1295 on the weekly timeframe by way of a bearish engulfing formation. In the event a break of the aforesaid demand is observed, traders’ crosshairs will likely be fixed on the 2016 yearly opening level at 1.0873. This, according to our technical studies, is a strong possibility, given the long-term trend facing a southerly bearing since topping in early 2018.

The central focus on the daily timeframe is demand parked at 1.1075-1.1171, thanks to a rejection off long-term channel resistance taken from the high 1.1569. Although the demand is glued to the underside of the current weekly demand area, traders are encouraged to pencil in the next downside target on the daily scale in the event we push lower: a particularly interesting area of demand coming in at 1.0860-1.0954 (not visible on the screen), which happens to envelope the 2016 yearly opening level mentioned above on the weekly timeframe at 1.0873.

Areas of consideration:

Longer term, although the overall trend is facing south, this market offers a difficult short owing to demand seen on the weekly and daily timeframes.

Short-term trading, though, is likely to pop lower, at least until shaking hands with H4 Quasimodo support mentioned above at 1.1130, hence the interest in 1.1184ish: the H4 area where channel resistance (taken from the high 1.1263) and the local trend line support-turned resistance (1.1166) merges. A test of this area in the form of a H4 bearish candlestick signal, therefore, is certainly something to keep an eye on today (entry and risk can be structured according to the candlestick’s rules of engagement).

Today’s data points: FOMC Members Evans and Rosengren Speak.

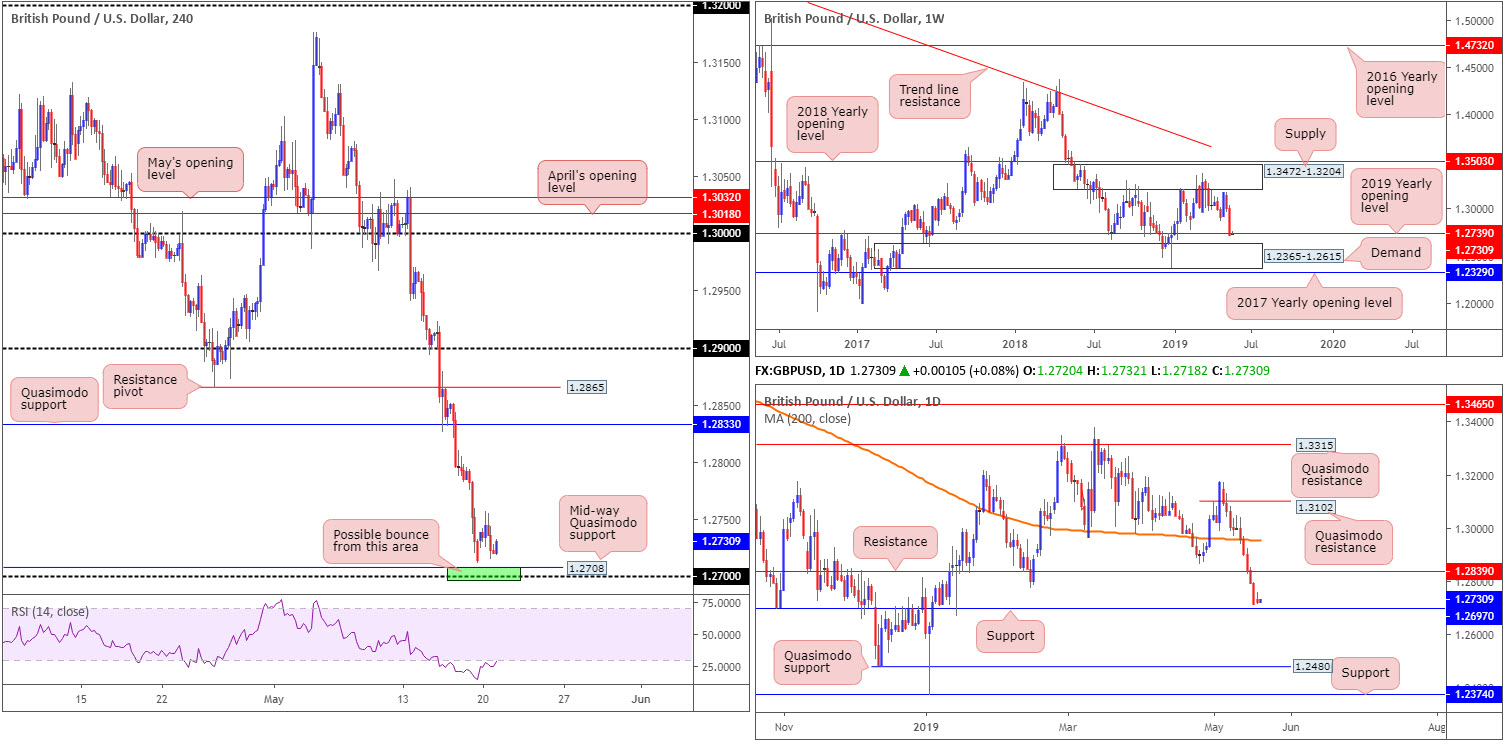

GBP/USD:

Outlook unchanged.

In similar fashion to the EUR/USD, cable also emphasised a dreary tone Monday, sporting a range of no more than 45 points as the market likely awaits its next round of developments on the Brexit front.

Last week’s action on the weekly timeframe witnessed the GBP/USD extend losses and finish down more than 250 points by the close. Moulded by way of a near-full-bodied weekly bearish candle, the unit marginally engulfed its 2019 yearly opening level at 1.2739 and now faces a possible test of demand plotted close by at 1.2365-1.2615.

Assessing the daily timeframe’s structure, five consecutive bearish daily candles pencilled their way on to the page in recent trading, each closing near its respective low. As you can see, the market ended the week closing within touching distance of a support level drawn from 1.2697, after engulfing support at 1.2839 (now acting resistance) in strong fashion. It might also be of interest to some traders to note recent movement overthrew the 200-day SMA, indicating sentiment faces a downside trajectory at present.

Price action on the H4 timeframe wrapped up Monday’s session within striking distance of a mid-way Quasimodo support level at 1.2708, closely shadowed by the 1.27 handle. Another key thing to note here is the daily support level circulates just south of 1.27 at 1.2697. Therefore, between 1.2697/1.2708, we have a potential base of support to work with (green). In the event further selling is seen, however, we could head for H4 demand pencilled in at 1.2606-1.2646 (not visible on the screen), which captures the top edge of weekly demand mentioned above at 1.2365-1.2615.

Areas of consideration:

Although the market has been incredibly bearish of late, a bounce from the green H4 support zone at 1.2697/1.2708 may still come to fruition early week. As round numbers tend to entice fakeouts, though, waiting for additional confirmation to form might be an idea. A H4 bullish candlestick signal, for example, is likely enough to attract buyers into the market. Not only does a candlestick pattern help identify buyer intent, it also provides traders entry and risk levels to work with.

Today’s data points: UK Inflation Report Hearings; FOMC Members Evans and Rosengren Speak.

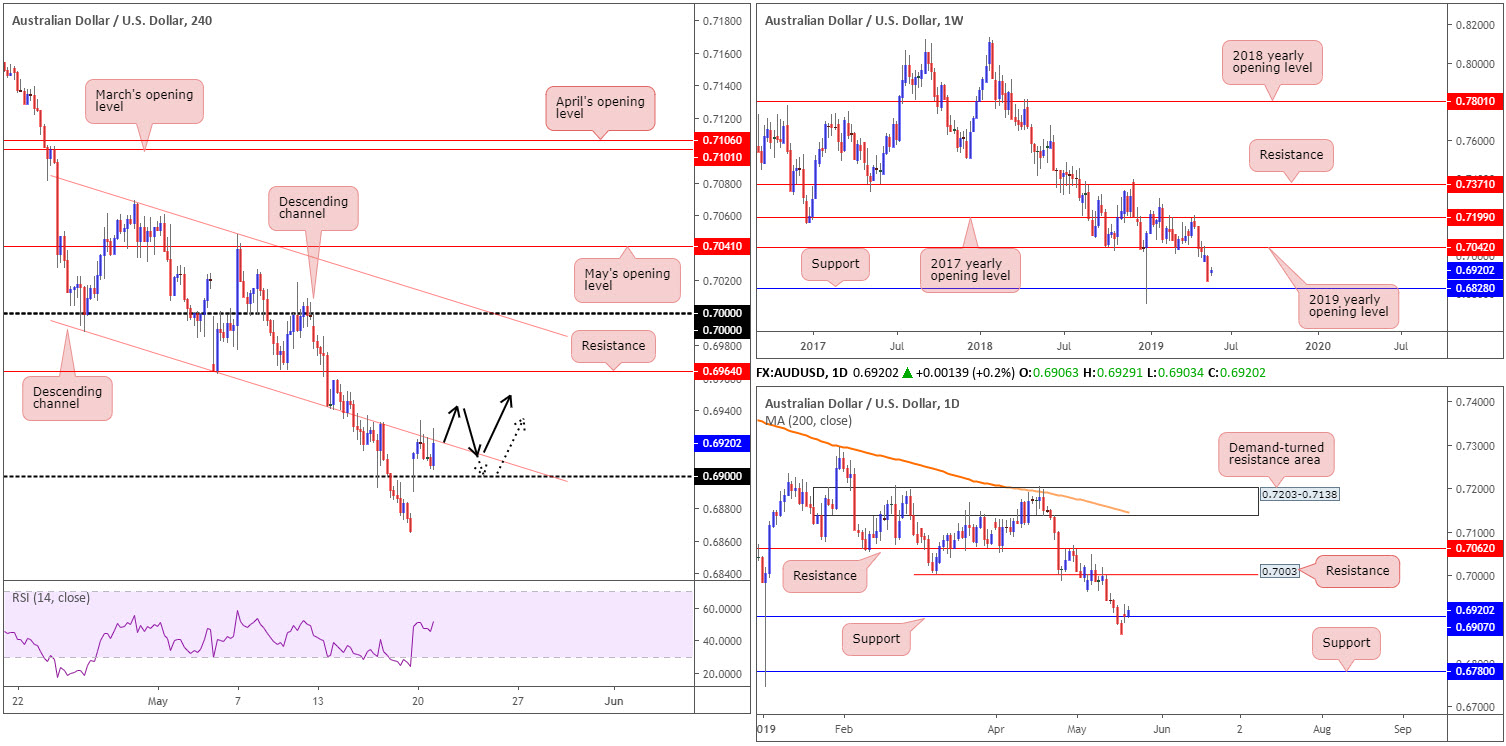

AUD/USD:

The Australian dollar found broad support vs. the majority of its major rivals at the beginning of the week, a reaction to local elections: a surprise win for the Liberal-National coalition.

Price action, however, swiftly attempted to fill the weekend gap, though encountered support off the 0.69 handle in the shape of a strong buying tail. In spite of the positive start to the week, the H4 candles are struggling to overthrow nearby resistance: a channel support-turned resistance line extended from the low 0.6988. A violation of this barrier would, according to our technical reading, likely witness an approach towards resistance pencilled in at 0.6964.

In terms of higher-timeframe structure, weekly flow remains within last week’s range. Areas to have on the watchlist on this scale are support drawn from 0.6828 and the 2019 yearly opening level at 0.7042 as resistance. Daily flow, on the other hand, shows resistance at 0.6907 (now acting support) was engulfed in recent trade, potentially setting the stage for a run towards resistance at 0.7003.

Areas of consideration:

On account of the overall technical picture, traders are somewhat cornered at present. H4 price is sandwiched between 0.69 as support and the aforementioned channel support-turned resistance. However, as daily price appears to be establishing ground above 0.6907, this could be an indication we’re likely to break above the noted H4 channel line and head for at least H4 resistance mentioned above at 0.6964.

In the event our analysis is accurate, a possible (as per the black arrows) retest of either the H4 channel line or the 0.69 level may come to fruition. For additional confirmation, traders could opt to wait and see if the H4 candles chalk up a bullish candlestick signal before pulling the trigger – think hammer or bullish engulfing pattern (entry/risk can be defined according to this structure).

Today’s data points: AUD Monetary Policy Meeting Minutes; FOMC Members Evans and Rosengren Speak.

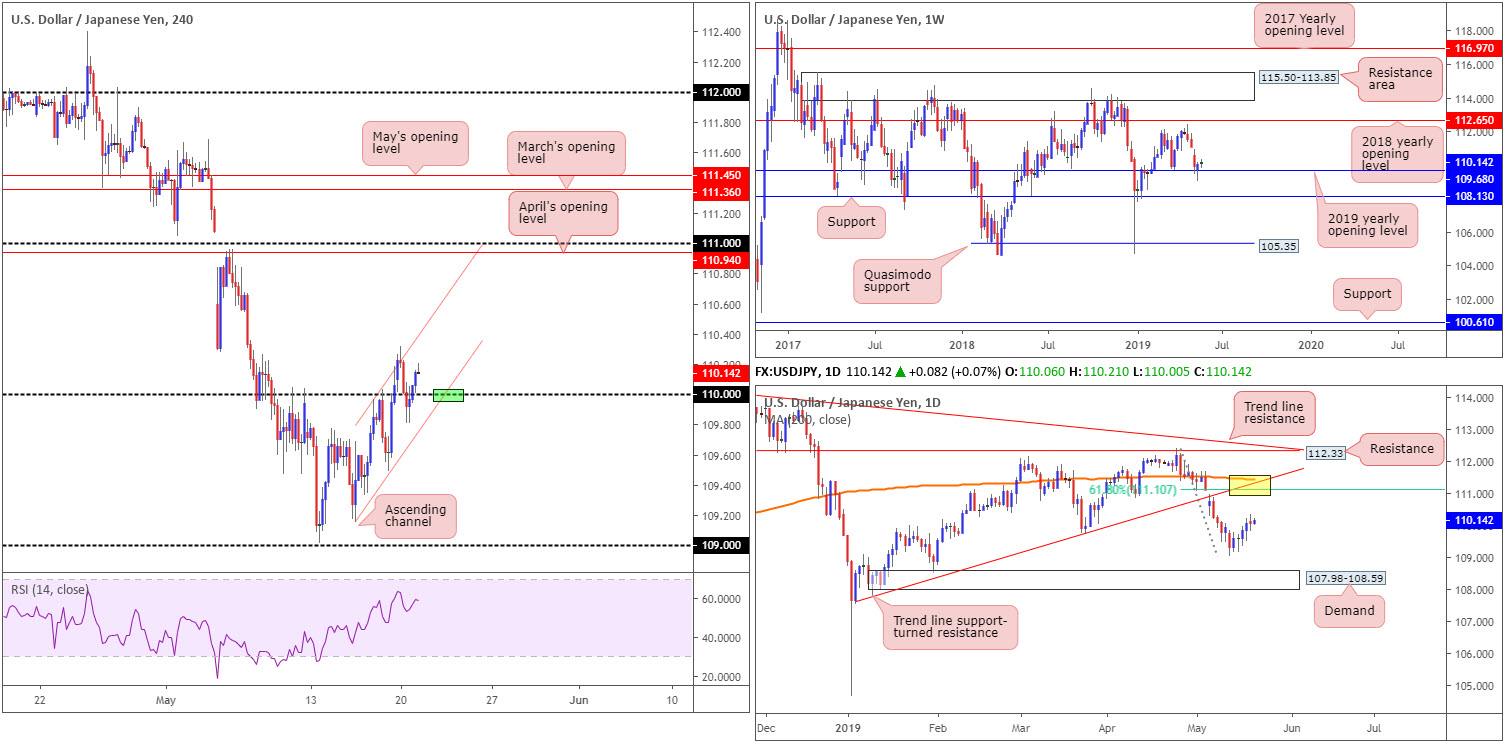

USD/JPY:

Since Wednesday last week, the USD/JPY’s H4 candles have been compressing within an ascending channel formation (109.15/109.96). Of late, price action also conquered the 110 handle to the upside and looks poised to continue exploring higher ground, targeting April’s opening level at 110.94, followed closely by 111.

The story on the weekly timeframe has price action rebounding off its 2019 yearly opening level at 109.68 in the mould of a reasonably attractive hammer pattern. Continued bidding could ultimately witness the pair knock on the door of its 2018 yearly opening level at 112.65, whereas a move to the downside has support on the radar at 108.13.

Leaving daily demand at 107.98-108.59 unchallenged, price action on the daily timeframe appears poised to approach a 61.8% Fibonacci resistance at 111.10. What gives this Fib level extra credibility is a merging trend line support-turned resistance etched from the low 107.77 and the 200-day SMA (yellow). Therefore, for traders looking to buy the recently formed hammer pattern on the weekly timeframe, it might be worth noting possible resistance could form from the 111.10ish region.

Areas of consideration:

In order to become buyers above 110 on the H4 timeframe, one option is to wait and see if the H4 candles retest the number, preferably at the point it merges with H4 channel support highlighted above (green).

Traders might also want to consider waiting and seeing if the H4 candles formulate a bullish candlestick signal off the psychological boundary. This helps confirm buyer intent and also gives credence to higher-timeframe direction. Upon a successful rejection off 110, a long on the close of the selected candle is an idea, with a protective stop-loss order plotted beneath its lower shadow.

Today’s data points: FOMC Members Evans and Rosengren Speak.

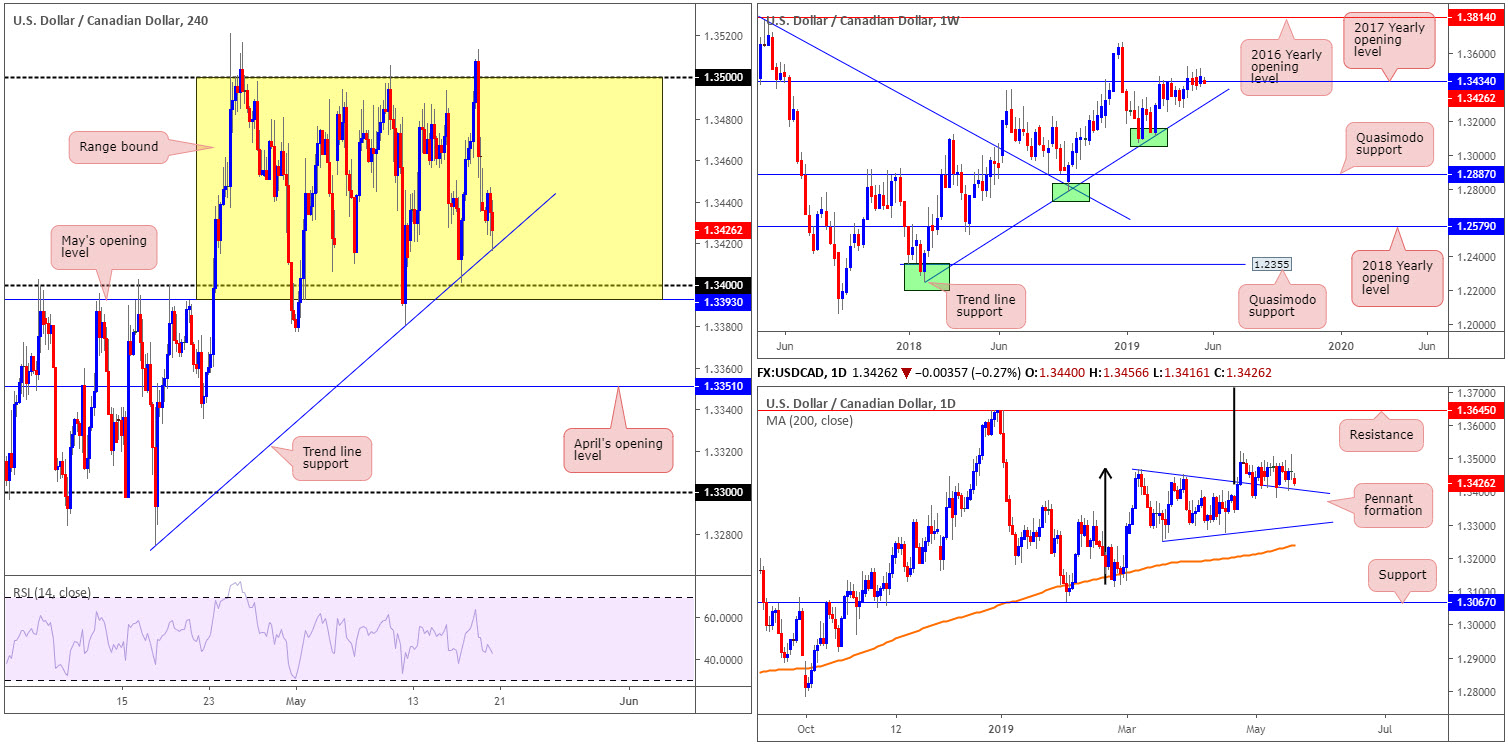

USD/CAD:

Outlook unchanged.

The US dollar kicked off the week on negative footing, opening 20 points lower vs. its Canadian counterpart. Despite somewhat of a lively start, the pair had a difficult time setting its next short-term direction amid a lifeless economic calendar and Canadian banks closing in observance of Victoria Day.

Since the latter part of April, the H4 candles have been busy carving out a 100-point+ range between May’s opening level at 1.3393 and the round number 1.35. However, within the confines of this zone, it may interest some traders to note price action is currently rebounding from a trend line support extended from the low 1.3274.

On a wider context, longer-term flows broke out above the 2017 yearly opening level at 1.3434 on the weekly timeframe, though has so far failed to breed much follow-through momentum. Areas outside of this level to be aware of fall in around the 2018 yearly high of 1.3664, and a trend line support etched from the low 1.2247.

A closer reading of price action shows the daily candles continue to feed off support drawn from the top edge of a pennant pattern (1.3467). Although the traditional price target (calculated by taking the distance from the beginning of the preceding move and adding it to the breakout price) remains on the chart at 1.3768 (black arrows), the next upside target from a structural standpoint falls in around resistance at 1.3645.

Areas of consideration:

In light of yesterday’s lacklustre performance, the research team’s outlook echoes thoughts put forward in Monday’s briefing.

1.34/May’s opening level at 1.3393 is an area of interest on the H4 timeframe for possible longs. Not only does the base represent the lower edge of the current H4 range, it is also further reinforced by the top edge of the daily pennant formation highlighted above. For conservative traders, waiting for a H4 bullish candlestick to print from this region will help identify buyer intent and also serve as a structure to base entry and risk levels from.

In the event we fail to reach 1.34 and turn higher, nonetheless, the market may eventually observe a H4 close form above 1.35. Should this occur, traders have the choice of either buying the breakout candle and placing stop-loss orders beneath its tail, or waiting and seeing if a retest scenario takes shape and entering on the back of the rejection candle’s structure (the more conservative approach). The next upside target on the H4 scale can be seen around 1.3570 (not seen on the screen), though according to the higher timeframes we could be heading much higher.

Today’s data points: FOMC Members Evans and Rosengren Speak.

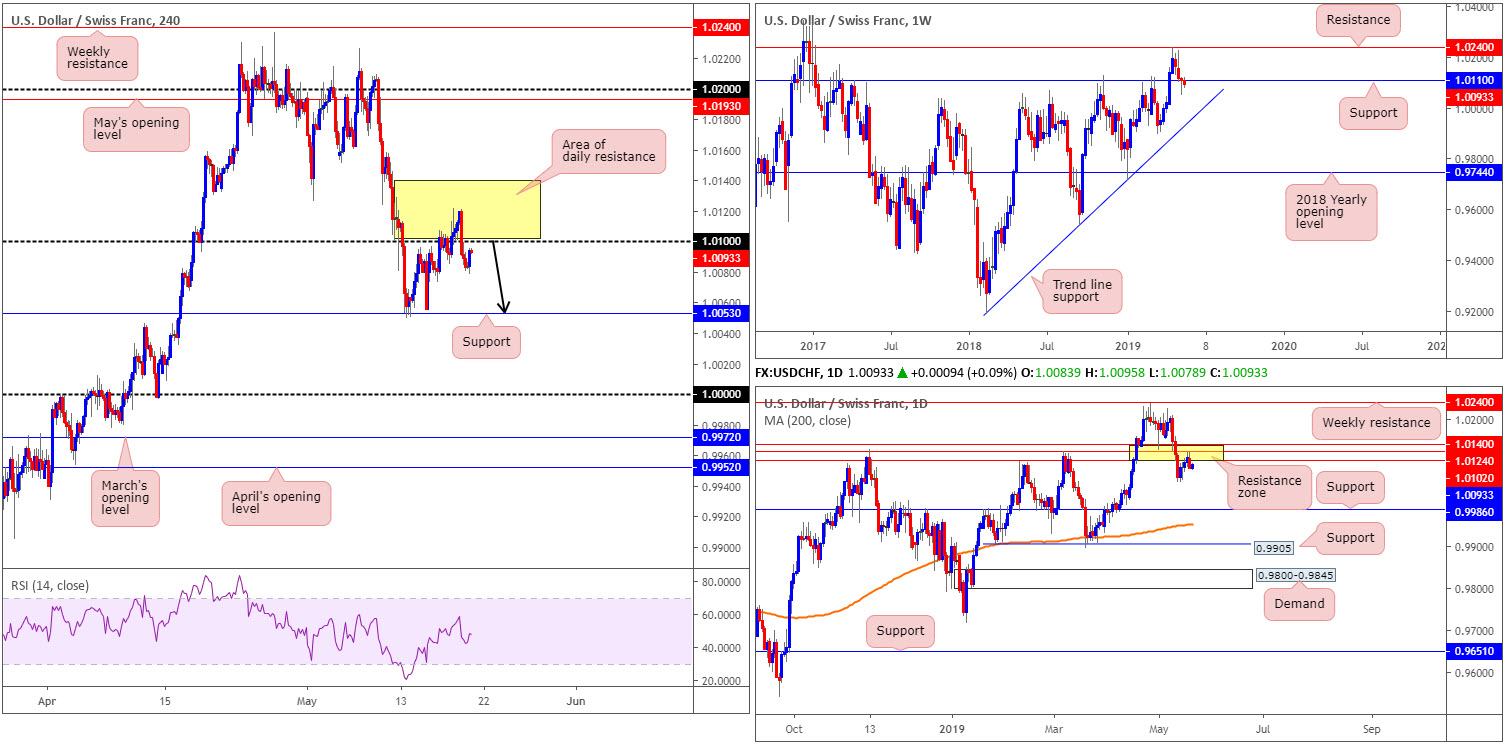

USD/CHF:

The Swiss franc was among the top performers Monday.

The USD/CHF, despite rising for four consecutive sessions, closed lower in recent trade, down 0.25%. Seeing the H4 candles reclaim 1.01 should not come as a surprise, considering buyers failed to prove themselves above this figure, along with a robust daily resistance zone between 1.0102/1.0140 visible overhead.

Further selling from current price has H4 support at 1.0053 in sight, eventually followed by 1.0000 (parity). Further rejection off the said daily resistance zone, nonetheless, has last Tuesday’s low at 1.0050 in sight, followed then by a possible run towards support fashioned at 0.9986.

It might also be worth sharing a note on the weekly timeframe. The buck’s retreat from the 2019 high 1.0236 set towards the end of May continued last week, though downside momentum decreased considerably and formed a nice-looking hammer formation off support at 1.0110. For that reason, there are likely some buyers entering this market, though likely hampered by the collection of daily resistance highlighted above. A failure of the aforementioned weekly support positions trend line support (etched from the low 0.9187) in the firing range.

Areas of consideration:

As we’ve formulated a H4 close beneath 1.01, a retest to the underside of this number is likely of interest to some traders, targeting H4 support at 1.0053 as the initial port of call. Ultimately, it is down to the individual trader to decide whether a short here is worthy of the risk. Conservative traders may opt for additional confirmation to take shape, be it a candlestick signal, an MA crossover or even lower-timeframe confirming structure: support-turned resistance retest. This not only helps identify seller intent, it’ll also help provide traders with entry and risk levels to work with.

Today’s data points: FOMC Members Evans and Rosengren Speak.

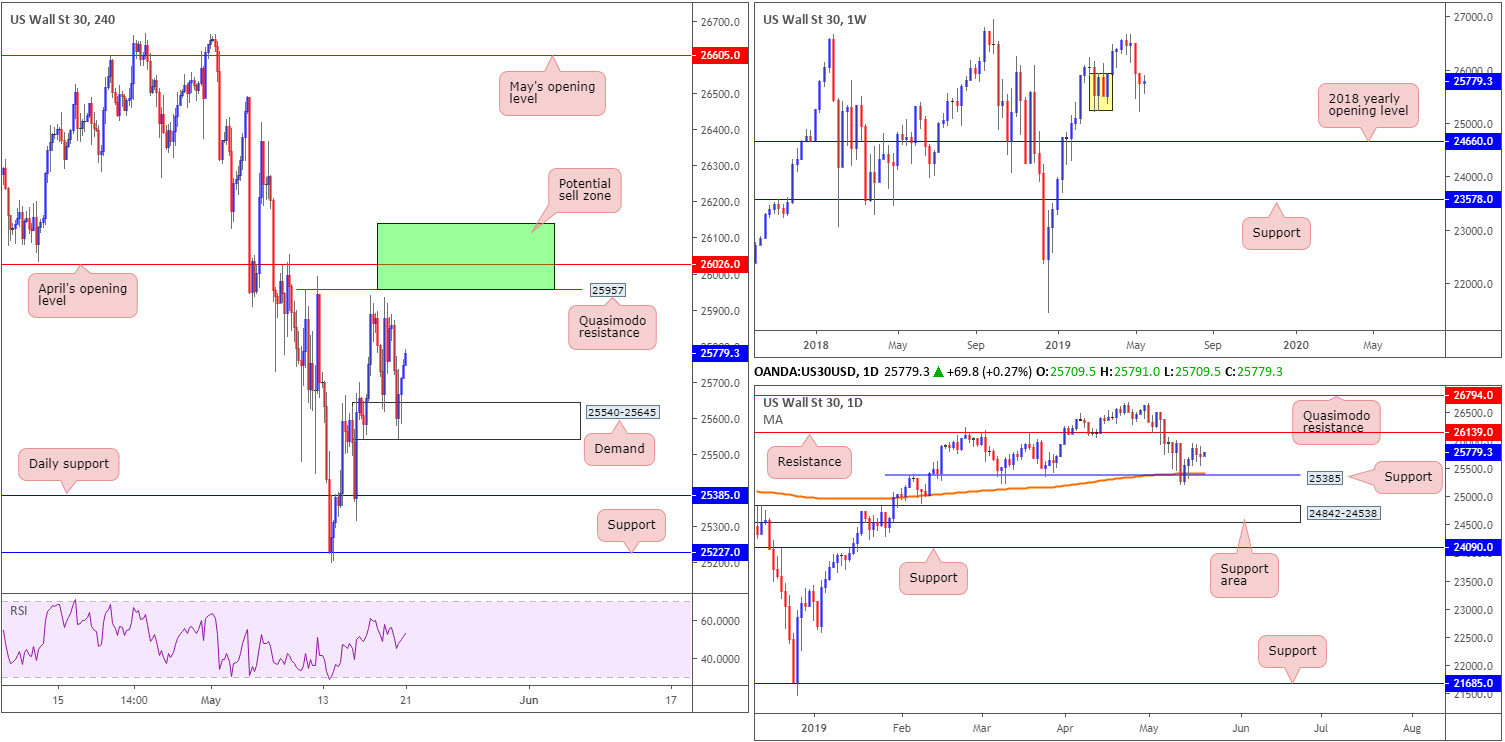

Dow Jones Industrial Average:

Outlook unchanged.

US equities turned south Monday amid on-going conflict between the Chinese media giant Huawei and the US government. The Dow Jones Industrial Average ended lower by 0.33%; the S&P 500 concluded the session down by 0.67 and the tech-heavy Nasdaq settled at -1.69%.

Despite the negative start to the week, the overall technical structure of the DJIA remains unchanged.

Weekly flow shows demand marked in yellow at 25217-25927, although unlikely to be considered a strong area on this timeframe owing to limited momentum produced from the base, remains in the fold. However, traders may also want to acknowledge weekly price finished the week in the form of a hammer candlestick pattern. In the event this entices buyers into the market, we could be looking at a run towards the 26668 April 22 high, while a move to the downside has the 2018 yearly opening level to target at 24660.

Last week observed the index shake hands with notable support at 25385 on the daily timeframe, which happened to intersect with the 200-day SMA. Technically, this provided a platform for buyers to enter the market, with the next upside point of interest falling in at resistance fixed from 26139.

H4 flow has the candles rebounding from demand at 25540-25645, poised to possibly run towards a Quasimodo resistance at 25957, trailed closely by April’s opening level at 26026. Beyond the current demand, the research team also has daily support mentioned above at 25385 sited on the chart.

Areas of consideration:

While there is scope for a push higher on the weekly timeframe, daily price has resistance plotted within touching distance at 26139. On top of this, we also have short-term resistance on the H4 timeframe between 26026 and 25957. This resistance makes the current weekly hammer formation a problematic long, according to our technical studies.

On account of the above, the green area plotted on the H4 timeframe between 26139 (the daily resistance level) and 25957 (the collection of H4 resistances) is a zone worthy of attention this week for shorts. An ideal scenario would be for the H4 candles to chalk up a notable bearish candlestick configuration. Entry can be applied according to the candlestick’s rules, though stop-loss placement may be either above the daily resistance at 26139 (conservative) or above the upper shadow of the candlestick signal (aggressive).

Today’s data points: FOMC Members Evans and Rosengren Speak.

XAU/USD (GOLD):

Outlook unchanged.

Up until now, the price of gold, in $ terms, offered little in terms of market movement, ranging no more than $5. For that reason, technically anyway, Monday’s outlook remains in focus.

Kicking things off from the weekly timeframe, the 2018 yearly opening level at 1302.5 was aggressively challenged last week and held almost to the point. Selling from this angle brought price action back beneath its 2019 yearly opening level at 1282.2 and produced a bearish shooting star pattern. This, by and of itself, has likely garnered the attention of candlestick traders and could play a part in weighing on the market this week towards support coming in at 1260.8.

Sited just north of the weekly support level mentioned above at 1260.8 is a daily support area seen at 1272.5-1261.5. The zone boasts a reasonably solid history and merges with a trend line support taken from the low 1160.3. What’s also notable from a technical perspective is the 200-day SMA appears poised to converge with the said support zone in the near future.

Closer analysis on the H4 timeframe exhibits limited support until reaching demand (green arrow) at 1268.1-1272.3, followed closely by support at 1266.1. Note the current H4 demand area also resides around the top edge of the daily support area at 1272.5-1261.5. Should price turn higher before probing lower, resistance surfaces at May’s opening level drawn from 1282.6 (merges closely with the 2019 yearly opening level mentioned above on the weekly timeframe at 1282.2).

Areas of consideration:

The H4 supply at 1288.9-1284.8, positioned directly above May’s opening level at 1282.6 (and the 2019 yearly opening level on the weekly timeframe at 1282.2) is an area sellers potentially have interest in this week. This is due to the stop-loss orders likely accumulating above May’s opening level, thus providing strong liquidity to sell into.

The H4 demand marked with a green arrow at 1268.1-1272.3 is also a point of interest for longs this week, owing to its connection to the top base of the daily support area at 1272.5-1261.5.

Both areas, according to our technical reading, house considerable strength and are likely to hold should a test (under normal market conditions) be observed. However, for the more conservative traders, they may wish to wait and see how H4 action behaves before pulling the trigger. While this may sacrifice the ‘better’ entry, it’s offset by having additional confluence backing the trade, and therefore a higher probability of moving in favour.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.