Forexlive Americas FX news wrap: Durable goods better. Confidence lower. Stocks mixed. FX lower.

Read full post at forexlive.com

Read full post at forexlive.com

FX news for North American trading on October 27, 2020.

It was a somewhat mixed day today as markets seemed distracted as the all important US election is now a week away. Fundamentally,

- US durable goods and the various breakdowns of the number, came in better-than-expected overall. The headline number was up 1.9% vs. 0.5% estimate. The capital goods orders nondefense ex air rose by 1.0% vs. 0.5%.

- The not so great news came from the Conference Board consumer confidence much came in weaker than expected at 100.9 vs. 102.0 estimate. That was also below last month 101.3 reading.

- Back on the positive side was the Richmond Fed manufacturing index for October came in at a record level of 29 vs. 18 estimate. Back in April, an all-time record low was reached at -54. The low to high swing is quite impressive.

- House price is also came in better as low demand and the exodus out of cities into suburbia spurs on sales and prices.

In the markets, the the US stocks are closing the session with mixed results. The Dow and the S&P were the weakest and each closed near session lows. The Nasdaq index was the strongest (closing mid range):

- The Dow industrial average fell -0.8%.

- The NASDAQ index rose +0.64%.

- The S&P index closed down -0.3%.

After the close Microsoft earnings beat on the top and bottom line, but the price action after the close was mixed as market participants seem to have priced in the good numbers. Thursday is the big earning date for the quarter with Facebook, Amazon, Alphabet, Apple and Starbucks all reported earnings after the close.

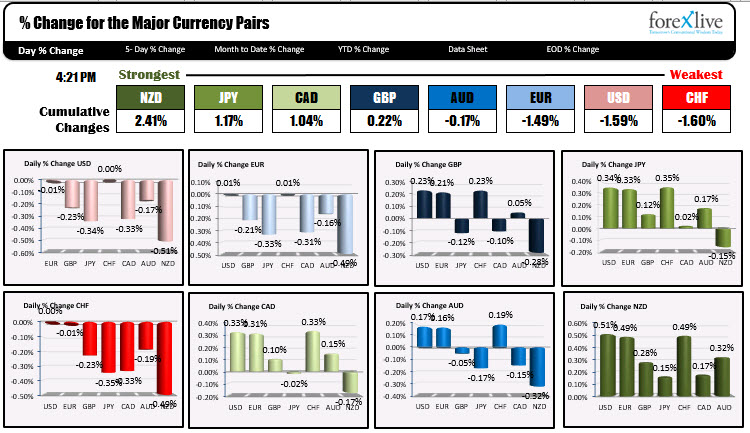

In the forex, the USD is ending the session lower but off the lows for the day. The NZD was the strongest of the majors today. Below is the rankings of the strongest to weakest currencies. The NZD, JPY and CAD were mostly higher, the CHF, USD and EUR were mostly lower. The GBP and the AUD were mixed and little changed.

Intraday, there the EURUSD and the USDCHF traded up and down. The USDJPY and NZDUSD were more trendy but in the opposite direction. The USDJPY moved lower. The NZDUSD moved higher. The GBPUSD, USDCAD, AUDUSD saw the USD move lower vs each but there was lots of up and down price action too.

- EURUSD. The EURUSD traded mostly between its 100 hour moving average above (currently at 1.1829) and it’s 200 hour moving below at 1.17978. The pair is currently trading just above the 200 hour moving average at 1.1800 into the close. That MA will be the barometer for buyers and sellers in the new trading day. Move below is more bearish. Stay above and the chop continues between the moving average levels

- GBPUSD: The GBPUSD also traded mostly between the 100 and 200 hour MAs, but is closing closer to its 100 hour moving average at 1.30636 (the price is trading at 1.3050). The lower 200 hour moving averages at 1.3009. The price did try to extend above the 100 hour moving average (it did the same yesterday) but could not sustain momentum. That helps turn the bias a bit more to the bearish side into the new trading day (as long as the price can stay below that 100 hour moving average).

- USDJPY:The USDJPY traded to below the Thursday and Wednesday lows at 104.54 and 104.469 respectively. However the low from last week (Tuesday) at 104.336 could not be reached. The low price stalled at 104.383. The current price is trading at 104.44. Short-term close risk will be eyed at 104.54. On the downside getting below the October 21 low at 104.336 would have traders looking toward the swing low from the end of July at 104.18 and the swing low from September at 103.995.