US Third Quarter GDP Preview: Must what goes down, come up?

- GDP growth forecast to set a record at 35% annualized.

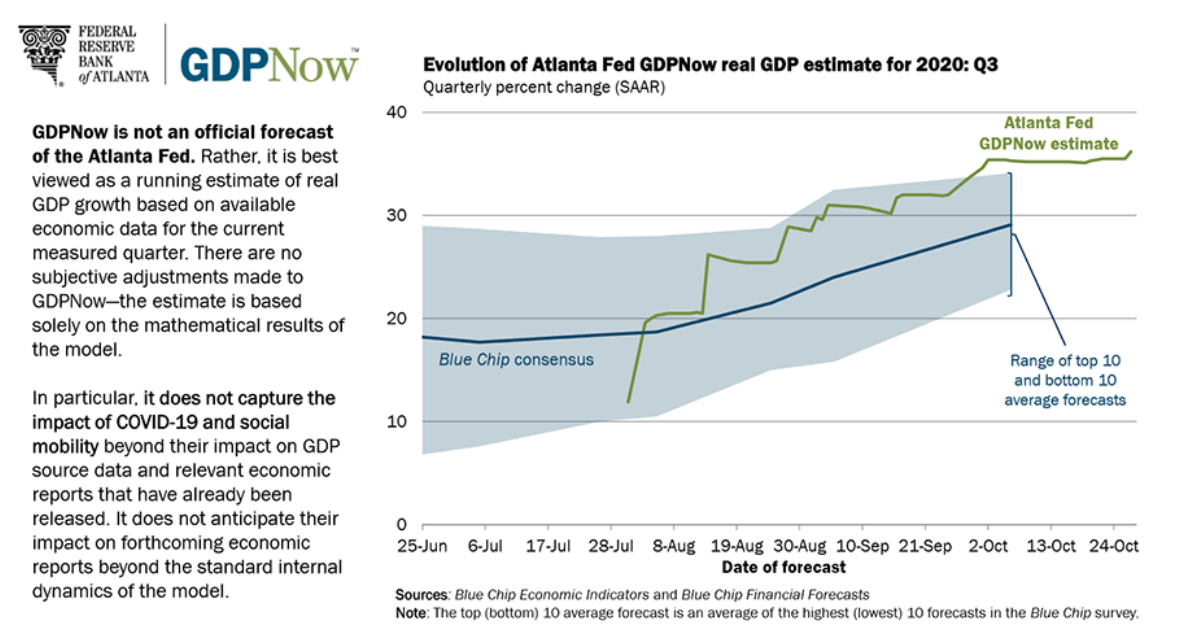

- Atlanta Fed GDPNow estimate is 36.2%, its highest for Q3.

- New York Fed’s Nowcast estimate is 13.75%.

- Market have priced a sharp increase in GDP.

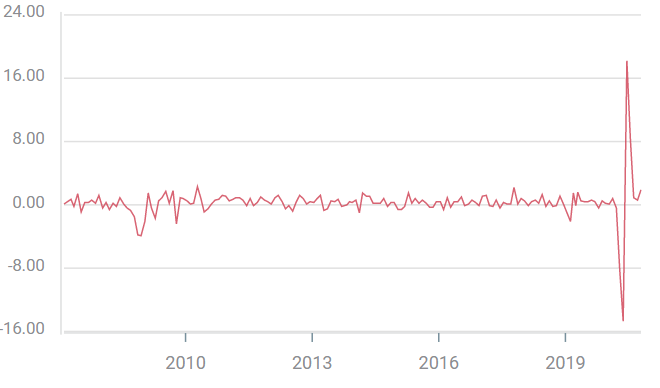

American economic growth raced ahead in the third quarter after the pandemic lockdown in March and April caused the largest GDP drop in history.

Expansion is expected to reach an annual rate of 35% last quarter after it collapsed at 31.4% in April, May and June.

The closure of much of the US economy under government orders produced a catastrophic fall in employment, 22 million American lost their jobs in the shutdown months and through September just over 50% have returned to work. In the last two weeks of March over 10 million people filed for unemployment benefits and, seven months later on October 16 the weekly filing was still 767,000.

Retail Sales plunged 22.9% in the closure months, spending in the GDP component Control Group fell 9.2%. Durable Goods Orders for long-lasting consumer and business items plummeted 35% and Nondefense Capital Goods, the business investment proxy, dropped 7.9%.

Retail Sales

Pandemic recovery

Surprisingly the recovery in Retail Sales, the Control Group and Durable Goods Orders has replaced or surpassed the declines suffered in the shutdowns despite the continuing high levels of unemployment and job losses.

Retail Sales have gained 30% in the five months through September. Including the shutdown months of March and April the seven month average is a remarkable 1.01% monthly increase. The Control Group receipts are 18.1% higher in the same period with a 1.27% monthly average. Either performance would credit a healthy consumer and labor market, in the midst of COVID-19 it is remarkable.

Durable Goods have climbed 36.7% in the five months from May to September which gives just a 1.7% surplus for the pandemic or a 0.24% average monthly increase. Nondefense Capital Goods the business investment analog is up 11.4% post-shutdown or a respectable 0.5% monthly rise.

GDP Projections

Consumer spending is about 70% of US economic activity.

The rapid expected recovery in GDP has been driven by the equally sharp return of consumer and business spending. The surprise has been the level and continuation of the consumer renaissance in the face of 7.9% unemployment and the much higher underemployment rate of 12.8%.

Jobless benefits from Washington and the states have helped to maintain consumption but with the next stimulus bill stalled in election politics, the ability of consumers to maintain these essentially normal levels of spending will come under strain if another relief program is not passed.

The Atlanta Fed’s GDPNow model estimates that GDP expanded at 36.2% in the third quarter, and the New York Fed’s Nowcast program has a much lower forecast at 13.75%. The consensus view from the Reuters Survey of economists is 35%.

Atlanta Fed GDPNow

Conclusion and markets

Conclusion and markets

Although a strong recovery in the third quarter is priced into the markets there is considerable range in many forecasts. The highly unusual economic events of the last seven months supply a vivid degree of uncertainty and markets are susceptible to any variation from the forecast.

Equities and the credit markets will respond in a linear fashion as GDP deviates from the forecast.

The dollar has been performing a limited safety role over the past several weeks, falling as perceived risk declines and climbing as risk rises. That dynamic should remain for US GDP. The stronger the US economy is in the third quarter the better for the globe and the less demand for the dollar safety trade. A weaker-than-expected GDP should prompt some modest immigration to the dollar.