USD/CAD rangebound above 1.2920s despite crude oil markets gains

- USD/CAD trades flat on the day around 1.2930 despite strong crude oil prices.

- Crude oil market gains have been spurred by news that OPEC+ are making headway towards a deal.

USD/CAD trades flat on the day, despite a solid rise in crude oil prices. Though the pair managed to eke out fresh multi-year lows below 1.2920 this morning, support in the 1.2920s has largely held and prices are now seemingly rangebound between the 1.2930s and 1.2950s.

CAD fails to rally in tandem with crude oil

Recent reports that OPEC+ has made headway towards a deal gave oil markets a reason to cheer. Front-month WTI contracts are up more than $1 on the day (or over 2.5%) and have rallied into the upper $45.00s per barrel. Markets hope that the cartel will agree on a three-month extension to their current supply cuts of just under 8M barrels per day, which are currently scheduled to end in January. The positive OPEC+ news overshadowing bearish EIA crude oil inventory numbers, which showed headline crude oil stocks drawing 0.679M, less than the expected draw of 2.358M.

However, CAD has broadly failed to pick up in tandem with crude oil prices. Soft Labour Productivity data for Q3 might be weighing on the loonie a tad, with productivity dropping 10.3% in the third quarter following a 10.5% surge in Q2. Lockdowns and the impact of the pandemic do of course distort the data, so it is difficult to see how much of this deterioration in productivity will persist into Q4 and beyond.

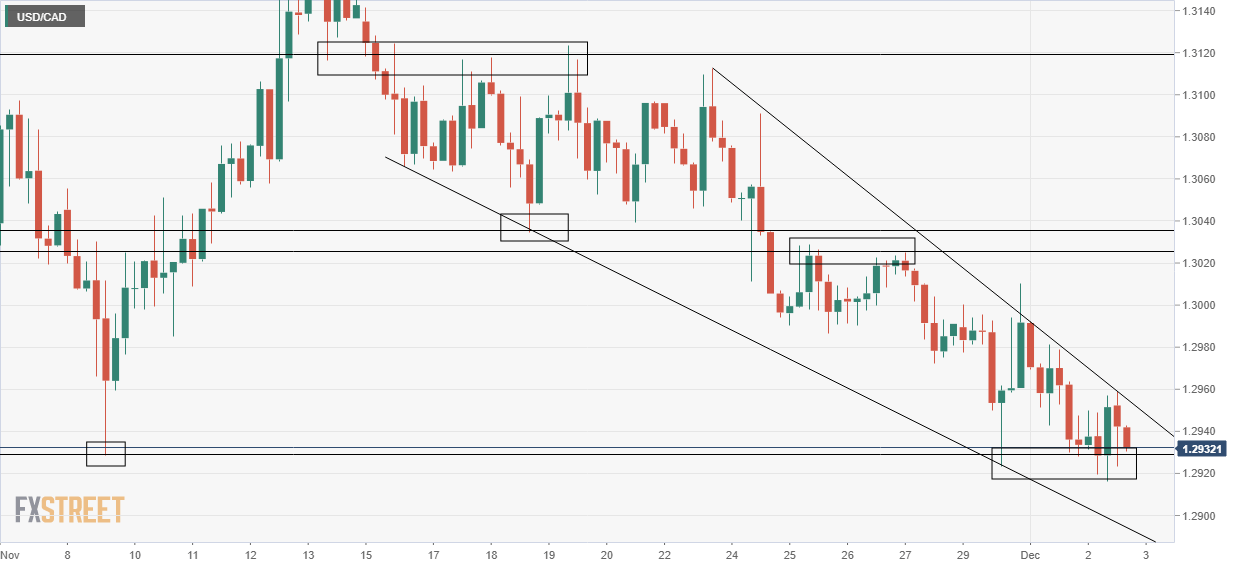

USD/CAD continues south within bearish wedge

Though USD/CAD is yet to break significantly to the south of the key support area in the 1.2920s (the 9 November low), its near-term bias remains towards further downside given that the pair is trading within a bearish wedge. The trendline support of this wedge links the 16, 18 and 30 November lows, while the trendline resistance of this wedge links the 23, 24 and 30 November highs, as well as Tuesday’s and Wednesday’s highs.

Should a convincing break of the 1.2920 area ensue, the most immediate area of support would be the psychological 1.2900 level. Below that, the next area of support goes right back to October 2018 low which sits just below the psychological 1.2800 level. Thus, if USD/CAD can crack below 1.2900, it will have a relatively open run at 1.2800.

To the upside, a break to the north of USD/CAD’s bearish wedge would open up the door to a test of the 30 November high at just above the psychological 1.3000 level, as well as resistance around the 1.3030s (the 25 November high and 18 November low).

USD/CAD four hour chart