USD/JPY bulls on the sidelines as DXY crumbles to fresh 2 1/2 year lows

- USD/JPY is currently trading at 104.48 having ranged between a low of 104.22 and 104.75.

- The pair remains higher on the day, up some 0.20% at the time of writing and despite a rejection from resistance in the DXY.

It is a mixed risk appetite mid-week following a strong start in global equities and high-beta forex which dampened demand for the greenback.

The safe-haven dollar has sunk to a fresh 2-1/2-year low each day of the week so far, including today, pressured once again by expectations of further fiscal stimulus for the United States.

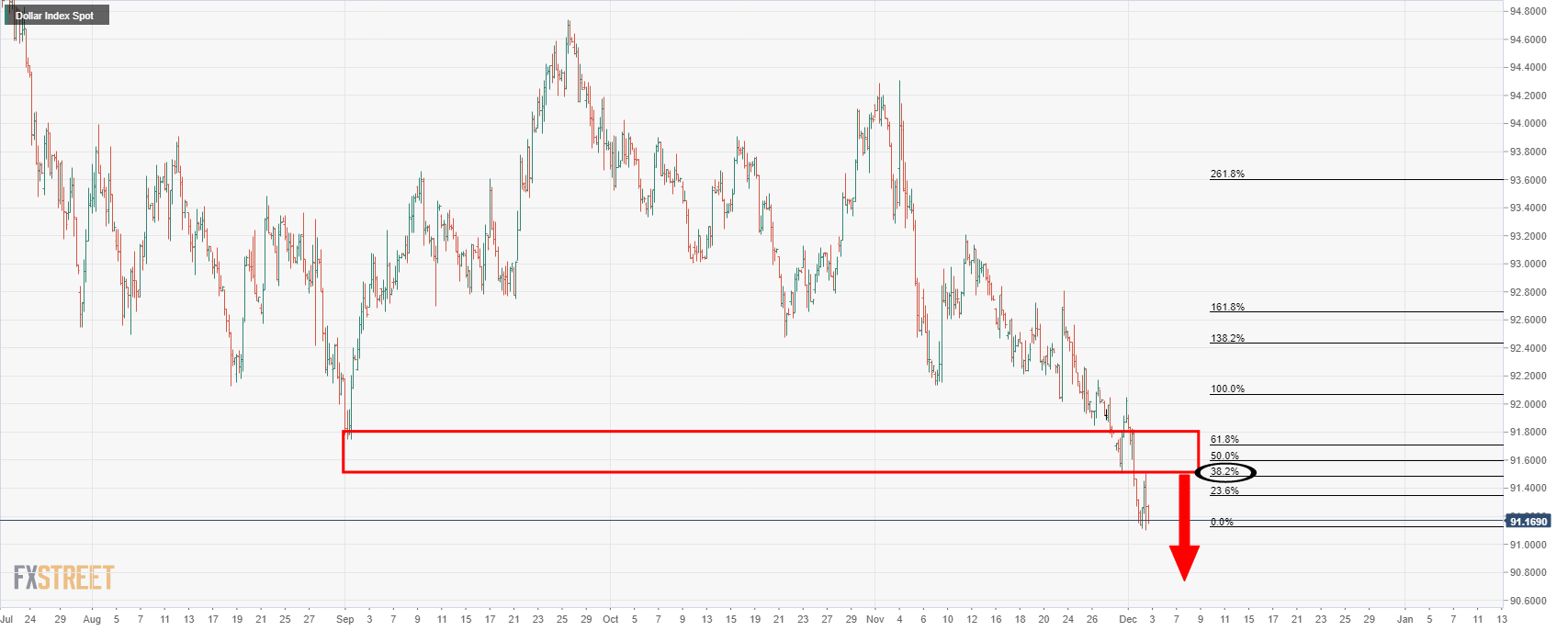

DXY 4-hour chart

Hopes of a vaccine started the week off on the front foot which counter-acted the concerns for the wide-spread contagion of the coronavirus itself.

Then, the screw turned for the dollar when prospects of a proposed bipartisan coronavirus pandemic-related economic stimulus package on Tuesday emerged.

A proposed package of $908 billion, as well as COVID-19 aid talks between US Treasury Secretary Steve Mnuchin and House of Representatives Speaker Nancy Pelosi, buoyed risk appetite.

The US dollar attempted a recovery but was met with opposition by the bears at a 38.2% daily Fibonacci retracement area from which the downside extended to the lowest low since April 2018.

On Wednesday, Mnuchin said the US President Donald Trump would sign a pandemic relief deal proposed by Senate Majority Leader Mitch McConnell.

”For months, McConnell has been pushing for a $500 billion approach that Democrats rejected as insufficient. The plan includes $332.7 billion in new loans or grants to small businesses, according to a document provided to Reuters,” Reuters said.

US data in focus

Meanwhile, US jobs will be a focus for the start of this month with the highly anticipated Nonfarm, Payrolls slated for the end of the week.

”Payrolls have been rising rapidly by pre-COVID standards, but the pace has been slowing.

It probably slowed again. Related indicators have sent mixed signals, but new COVID restrictions appear to be taking a toll.

Downward momentum will probably continue before vaccines provide a lift. We see a high likelihood of contraction in the December report,” analysts at TD Securities explained.

In the mean-time, data showing slower US private hiring last month drove some safe-haven buying of the dollar.

Private payrolls in the ADP National Employment Report increased by 307,000 jobs in November, lower than economists’ forecasts of a 410,000 rise in new jobs.

In domestic news for the yen, the Bank of Japan’s deputy governor signalled that the central bank is ready to extend pandemic-response programs, saying it would “take additional easing steps without hesitation as needed.”

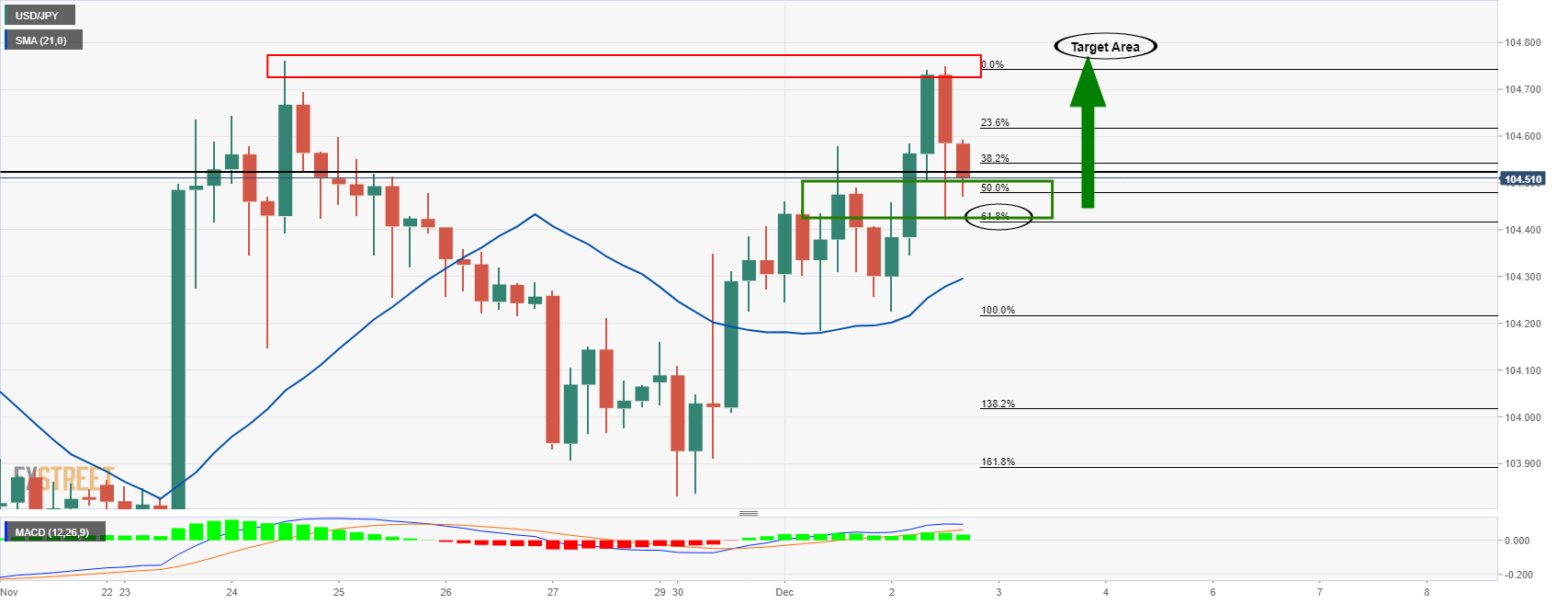

USD/JPY technical analysis

In USD/JPY’s 4-hour cart the price has fallen back into a liquidity pool which would be expected to hold and potentially offer an upside extension opportunity to the bulls.

The price is in bullish territory above the 21-moving average with MADC above the zero-line.

However, with the dollar on such thin ice, it would be prudent to monitor the lower time frames and not to expect too much from USD/JPY in the near future.

The DXY, after all, is in its own bearish development, trending lower below important resistance structure.

A continuation of the current resumption of the bearish trajectory could result in a downside extension.