AUD/USD Forecast: Bulls not giving up

AUD/USD Current Price: 0.7402

- Australian Q3 GDP at 3.3% indicated that the country is officially out of recession.

- Gold keeps recovering ground, providing support to the Australian dollar.

- AUD/USD continues to trade within familiar levels just below this year’s high.

The AUD/USD pair is modestly up for a second consecutive day, hovering around the 0.7400 level. The aussie advanced following the release of the Q3 Gross Domestic Product, which improved to 3.3%, indicating that Australia is officially out of recession. Even further, the country has not reported new coronavirus cases for three consecutive days. The pair retreated to 0.7350 as the dollar found some demand during European trading hours but resumed its advance ahead of the daily close. The AUD found additional support in a gold’s comeback, as the bright metal surged past $1,830.00 a troy ounce, setting near its daily high.

This Thursday, Australia will publish the final Commonwealth Bank Services PMI, foreseen at 54.9, and the Composite PMI, expected at 54.7. Later into the Asian session, the country will release the October Trade Balance and Home Loans for the same month.

AUD/USD short-term technical outlook

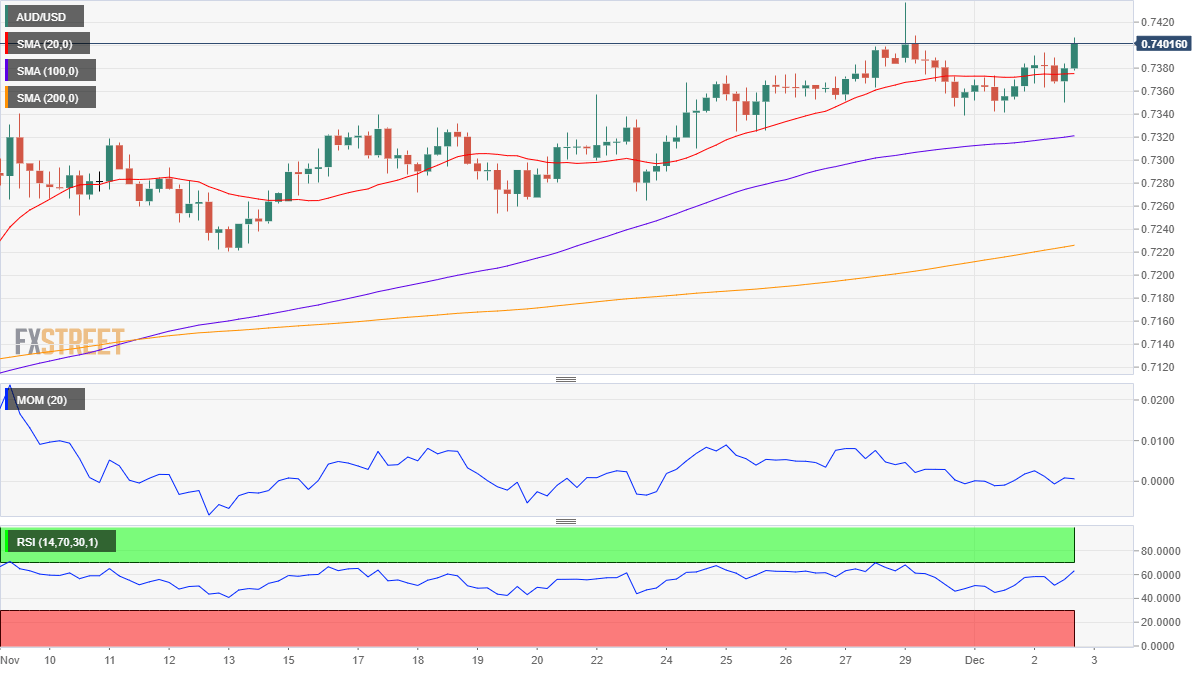

The AUD/USD pair is trading at the upper end of its latest range, still neutral in the near-term, although with increasing bullish potential. In the 4-hour chart, the pair spent the day seesawing around a flat 20 SMA to settle above it. Technical indicators recovered into positive levels but lack directional momentum. Bulls need to clear this year’s high at 0.7413 for the pair to accelerate north and approach the 0.7500 threshold.

Support levels: 0.7375 0.7330 0.7290

Resistance levels: 0.7415 0.7450 0.7490

View Live Chart for the AUD/USD