Articles

S&P500 Technical Analysis: Continuation goes on as the week comes to an end

12184 September 29, 2018 05:33 FXStreet Market News

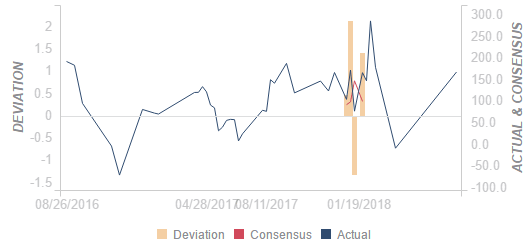

- The S&P500 is pulling back above the 2,900.00 level.

- The S&P500 is trading well above its rising and widening 50, 100 and 200-period simple moving averages suggesting a strong bullish bias. The RSI, MACD and Stochastics indicators are slightly slowing down.

- A continuation of the consolidation can lead to 2,900.00 figure and 2,877.00 January swing high.

S&P500 daily chart

-636737653716811895.png)

Spot rate: 2,915.50

Relative change: -0.03%

High: 2,919.50

Low: 2,902.25

Main trend: Bullish

Resistance 1: 2,917.00 August 29 high

Resistance 2: 2,938.00, 138.2% Fibonnacci extension (Aug-Sept, high/low)

Resistance 3: 2,950.00, 161.8% Fibonnacci extension (Aug-Sept, high/low)

Resistance 4: 3,000.00 round figure

Support 1: 2,900.00 figure

Support 2: 2,877.00 January swing high

Support 3: 2,863.75 August 7 high

Support 4: 2,853.00 August 9 low

US Dollar Index Technical Analysis: Greenback bulls challenging the 50-day simple moving average

12182 September 29, 2018 04:53 FXStreet Market News

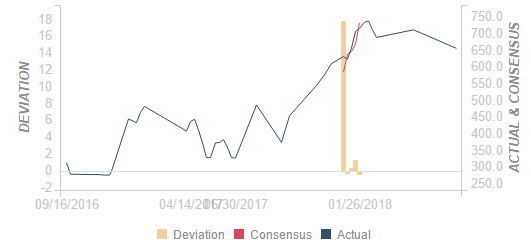

- The US Dollar Index (DXY) bulls are trying to resume the bull trend as they broke above the 100-day simple moving average.

- DXY broke above 94.43 (August 28 swing low) and is currently challenging the 50-period simple moving average. The RSI is above 50, the MACD is turning higher and the Stochastic indicator is up, suggesting bullish momentum.

- Bulls objective is to break above 95.65 July 19 high in order to reach 97.00 the current 2018 high. A bear breakout below 94.43 might invalidate the bullish bias

DXY daily chart

-636737644639225746.png)

Spot rate: 95.19

Relative change: 0.21%

High: 95.37

Low: 94.92

Trend: Neutral to bullish

Resistance 1: 95.24 July 13 high

Resistance 2: 95.52 August 6 high

Resistance 3: 95.65 July 19 high

Support 1: 95.00 figure

Support 2: 94.91 July 27 high

Support 3: 94.43-60 August 28 swing low, 100-day SMA

Support 4: 93.71 July 9 swing low

Support 5: 93.17 June 14 swing low

Support 6: 92.24 May 14 swing low

Wall Street closes the day little changed, DJIA adds more than 9% in Q3

12181 September 29, 2018 04:33 FXStreet Market News

- Financials underperform on concerns over Italian government’s proposed budget.

- Today’s data shows that personal spending and personal income both increase by 0.3% in August.

- DJIA outperforms Nasdaq Composite and S&P 500 in Q3.

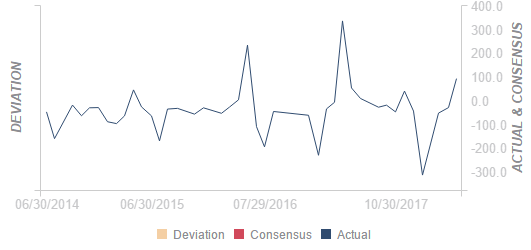

Major equity indexes in the United States started the day slightly lower and struggled to make a decisive move in either direction as investors are assessing their next move in the last day of the third quarter.

On Friday, European stocks recorded losses after Italy’s government proposed a budget deficit targeting 2.4% of the GDP for the next three years to receive heavy criticism from the EU. The risk-off mood weighed on the global market sentiment and triggered a sell-off in the financial sector amid falling US T-bond yields. “Italy is weighing on people’s minds as to where they want to be. The U.S. is the place to be, and the rest of the world – not so much,” Thomas Martin, senior portfolio manager at Global Investments in Atlanta, told Reuters, and the S&P 500 Financials Index closed the day 1.06% lower.

Meanwhile, defensive sectors such as real estate and utilities, which benefit from lower bond yields, recorded sharp gains to help keep losses limited. At the end of the say, the S&P 500 Utilities and the Real Estate indexes were up 1.5% and 1.3%, respectively.

The Dow Jones Industrial Average finished the day 0.07% higher at 26,459.05 points, the S&P 500 closed flat at 2,914.13 points, and the Nasdaq Composite Index erased 4.81 points, or 0.06%, to 2,914.13.

Major indexes’ weekly, monthly & quarterly performances (via Reuters)

- For the week, the S&P fell 0.54 pct, the Dow lost 1.07 pct, the Nasdaq gained 0.74 pct.

- For the month, the S&P rose 0.43 pct, the Dow added 1.9 pct, the Nasdaq shed 0.78 pct.

- For the quarter, the S&P rose 7.19 pct, the Dow added 9.01 pct, the Nasdaq gained 7.14 pct.

Banxico to remain on hold at 7.75% – TD Securities

12179 September 29, 2018 03:53 FXStreet Market News

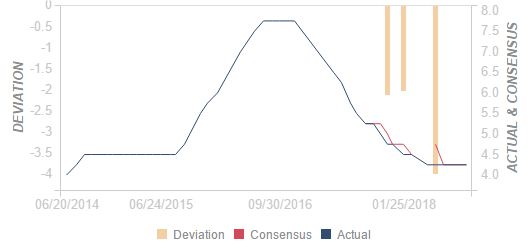

“We continue to see Banxico on hold at the upcoming meeting, but have pushed out our view for the beginning of the easing cycle to start in April of 2019,” TD Securities analysts note.

Key quotes

“While we don’t think that Banxico can afford to sound overly dovish at the current juncture, at least until inflation expectations come down, there is some chance that they begin to loosen the tether to the Fed’s policy path by altering the prominence of the focus on U.S.-Mexico policy rate differentials, and increase the importance of growth risks or the potential output gap.”

“This is of inor risk at this point however, and we expect the tone of the statement to be more in line with somewhat of an easing in forward-looking upside inflation risks. Thus a focus on less hawkishness rather than outright dovishness.”

“FX: We continue to see MXN as 8% to 10% undervalued, and continuing to offer obviously attractive carry. A positive resolution between the U.S. and Canada regarding NAFTA negotiations, currently still up in the air, could be very positive for MXN as it would remove remaining trade uncertainty.”

Oil market outlook – Rabobank

12178 September 29, 2018 03:33 FXStreet Market News

“The Brent market broke convincingly through the key $80/bbl level this past Monday and has remained firmly above throughout the trading week,” Rabobank analysts note in their latest Oil Market Outlook report.

Key quotes

“The move higher was triggered by fears of a supply shortage as the November 4th deadline for Iran oil sanctions approaches.”

“Last weekend, the Joint OPEC-non-OPEC Ministerial Monitoring Committee (JMMC) met to discuss the current state of the oil market. The meeting resulted in a commitment towards reaching 100% compliance on the original deal that began in January 2017. If the group succeeds in meeting the 100% compliance target that would imply an increase of 350kbpd from current levels. The market was clearly looking for more assurance of future supply and rallied sharply on this uncertainty.”

“The market seemed to overlook the Saudi energy minister’s explanation for not increasing production at the meeting. He noted that all current demand was being met and any increase in production would likely see those barrels end up in storage. The Saudi minister confirmed that they have 1.5mmbpd of spare capacity at the ready should it be needed. The next official OPEC meeting is scheduled for December 3rd in Vienna.”

“Technicals: $80/bbl has flipped from resistance to support but look for a potential flush if the market gets below there. The 9-day RSI is at 72 suggesting we are overbought in the short term. The upper Bollinger band sits right below $82.”

Canada: Jobs data to attract the most attention – NBF

12177 September 29, 2018 03:03 FXStreet Market News

According to analysts at the National Bank of Canada, next week, the key economic report will be on Friday with job market numbers.

Key Quotes:

“The LFS has painted a rather morose picture of the Canadian labour market lately. Indeed, the reported 51.6K jobs lost in August brought this year’s cumulative employment change back into negative territory at -14.6K. Such a poor number is hard to reconcile with the rather upbeat economic data published recently. Adding to the confusion, the SEPH survey, a poll of establishments, continues to show strong job gains this year (+203K). There’s a limit to the extent to which the SEPH and the LFS can diverge. After all, the two surveys are supposed to give an assessment of the same labour market.”

“We expect a good showing for the LFS in September (+25K), one that would at least bring total job creation in 2018 back into positive territory. If that scenario unfolds, the unemployment rate could stay put at 6.0%.”

“We’ll also get data on August’s merchandise trade balance. Both energy and non-energy exports may have shrunk in the month, hampered by lower prices. The resulting negative impact on the overall trade balance may have been compounded by a rebound of imports following a weak print in July. All told, the Canadian goods trade deficit could have widened to C$1.5 billion.”

“Markit’s manufacturing PMI for September will also be released this week.”

EUR/CHF: Likely to be affected by the Italian budget noise – ING

12175 September 29, 2018 02:53 FXStreet Market News

Strategist at ING, consider that the current political situation in Europe with Brexit and the Italian budget drama will likely keep the Swiss franc bid. The see EUR/CHF moving between 1.1180 and 1.1380 next week.

Key Quotes:

“Messy European politics – both Italy budget risks and Brexit noise at the Tory party conference – will likely keep the Swiss franc, a European haven, bid over the coming week. While we did see EUR/CHF move above 1.14 on a trade war haven unwind, the pair fell sharply below 1.13 on the back of the budget-related Italian asset sell-off on Friday.”

“It’s difficult not to see further Italian budget noise here weighing on EUR/CHF – especially ahead of potential downgrades by rating agencies and budget clashes with the European Commission in October. The risks, however, is that we could see the Swiss national bank intervening on any sharp moves below the 1.12-1.13 level.”

“On the Swiss franc side, the key data point to note next week is September CPI due Friday, where consensus expects +0.2% MoM increase (+1.1% YoY). Although Swiss data rarely tends to have much of a sustained impact on the currency, especially during times when the focus for FX markets is on European politics.”

US week ahead: ISM, NFP and Fed speeches – Danske Bank

12173 September 29, 2018 02:33 FXStreet Market News

Analysts at Danske Bank take a look at next week key events in the US, among them is the official employment report on Friday. They see that non-farm payrolls are likely to show healthy gains along with another uptick in wage growth.

Key Quotes:

“In the US, we have a busy week ahead of us after this week was quieter with the FOMC meeting as the most important event. The many scheduled Fed speeches this week will most likely not change the Fed being on autopilot until 3% is reached.”

“The most important release this week is the jobs report for September on Friday. We estimate non-farm payrolls rose around the current trend of 190,000. As employment has risen for so long, the most important part of the jobs report is the average hourly earnings, as they have risen faster than the recent trend over the past four months and the annual growth rate is at 2.9% y/y, which is a cycle high. It seems like the tighter labour market is beginning to put upward pressure on wage growth. We estimate average hourly earnings to have risen to +0.25% m/m in September, which would lead to a decline in the annual growth rate to 2.7% y/y. Average hourly earnings are quite volatile, so it does not change our interpretation that wage growth is increasing gradually.”

“ISM manufacturing is due out on Monday. Overall, ISM manufacturing has been too high compared to reality for a couple of years and, in our view, is a poor indicator at the moment. We estimate the ISM index fell to 60 from 61.3.”