Articles

BoJ: No changes in the key interest rates – Deutsche Bank

14471 October 31, 2018 15:33 FXStreet Market News

Overnight, the BoJ left key interest rates and asset purchase targets unchanged while the BoJ’s quarterly outlook report indicated that inflation will remain below its 2% target at least until early 2021 and lowered the 2018 GDP growth forecast to 1.4% from 1.5%, explains the research team at Deutsche Bank.

Key Quotes

“The BoJ also added a statement in its outlook report about the need to “pay close attention to future developments” regarding risks to the financial system, while saying that the risks are not currently significant thanks to sufficient capital bases. The BoJ is also seeing the current core-CPI rising to around 1% yoy from earlier range of 0.5%-1%, which was lowered at June meeting.”

BoJ’s Kuroda: Closely watching market moves to prevent side effects from monetary policy

14469 October 31, 2018 14:53 FXStreet Market News

More comments flowing in from the BoJ Chief Kuroda, with the key headlines found below.

JGB market functioning has improved somewhat since July policy change.

JGB yields starting to respond more to move in yields overseas.

Closely watching market moves to prevent side effects from monetary policy.

440 | +2.424% | 3 Setups

14340 October 31, 2018 14:35 SwingFish Trading Room Journal AUDJPY • GBPAUD • USDSGD

Wednesday, starting out late and sleepy (had a long night finishing up some stuff)

(more…)

Australia: Headline inflation below RBA’s 2-3% target band – Rabobank

14467 October 31, 2018 14:33 FXStreet Market News

Australian CPI came in at 0.4% q-o-q headline vs. an expected 0.5%, and in y-o-y terms it was down from 2.1% to 1.9% and once again the ever-optimistic RBA finds itself with headline inflation below its 2-3% target band despite everything looking sunny, as far as it is concerned, explains the research team at Rabobank.

Key Quotes

“Moreover, the trimmed mean measure was 0.4% q-o-q and 1.8% y-o-y, down from 1.9%, and the weighted median was 0.3% and 1.7%, down from 1.9%. That’s three different servings of the same humble pie. Don’t expect any changes from the RBA, however. Their economic projections are all written by the kind of teenagers that wander off alone into haunted houses.”

Eurozone: Focus on employment and inflation data – TDS

14462 October 31, 2018 14:03 FXStreet Market News

Analysts at TD Securities point out that Euro area inflation is released, along with the unemployment data and are going to be the key economic releases for today’s session.

Key Quotes

“We expect unchanged readings for both headline (2.1% y/y, mkt: 2.1%) and core inflation (0.9% y/y, mkt: 1.0%). The unemployment rate is also out, with markets looking for an unchanged reading of 8.1%.”

Oil hits two-month low, WTI getting held over $66.00

14457 October 31, 2018 13:53 FXStreet Market News

- Oil barrels continue to float close to near-term lows as US oversupply keeps investors soothed.

- US-Iran tensions are sure to see sparks flying as sanctions come into effect in early November.

Crude oil prices are seeing continued pushes to the downside as oil investors grapple with still-rising US supplies of crude oil and massive sell-side shocks across broader markets that see investors pulling their cash out of riskier assets, including oil barrels.

US supplies of Amercian crude continue to rise as domestic demand doesn’t stand a chance of catching up to the levels of production being achieved by US producers, and WTI prices which were bumping back into multi-year highs on fear surrounding the upcoming US sanctions on Iran, are now heading steadily lower as US production numbers roll over the current supply lines. On the flip side, getting US crude barrels across the oceans to eat up missing supply when the US introduces full-scale embargoes on Iran beginning on November 4th is an incredibly difficult proposition, and with most oil users in the Middle East and elsewhere using machinery that requires Middle East oil sources, future price shocks on US-Iran troubles could be on the cards in the future.

WTI levels to watch

US oil barrels are trading near 66.50 after dipping briefly into a two-month low on Tuesday, but firm selling is keeping crude pinned to the current low end near the 66.00 handle, and the next support zone is seen at August’s swing low of 64.50, with resistance sitting at the critical 200-day moving average capping action near 67.60.

AUD to extend recovery against the EUR – Westpac

14456 October 31, 2018 13:33 FXStreet Market News

Sean Callow, Research Analyst at Westpac, explains that the AUD underperformed many currencies from late August to mid-September, as the Aussie appeared to suffer a political risk premium on the Canberra leadership change and the US-China trade war deepened with a new wave of tariffs.

Key Quotes

“AUD price action has been more constructive in recent weeks, the Aussie showing resilience to global equity turbulence. Moreover, multi-month highs for Australia’s commodity export price basket – led by iron ore and coal – implied less damage from trade wars than feared, at least in the short term.”

“Meanwhile, the euro was undermined in October by the selloff in Italian bonds as the new government proposed a looser budget than the EC demanded.”

“In coming weeks, rather than Italy, the bigger question for EUR is likely to be whether the Eurozone economic slowdown continues.”

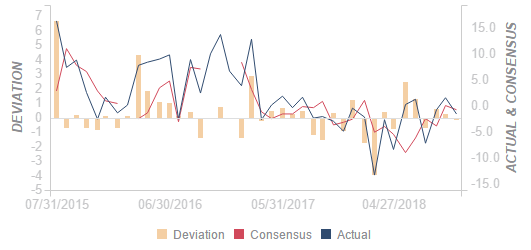

“Our Eurozone data pulse is below 30% versus 52% over 2017, while Q3 GDP growth of 0.2% was the weakest since 2014.”

“This focus on Eurozone data into the Dec ECB meeting contrasts to the RBA’s plausible projection of Australian GDP growth remaining above 3% into 2019. This should help AUD extend its recovery against the euro multi-week to AUD/EUR 0.6325/50 or EUR/AUD 1.5750/1.5800.”

China factory expansion slowest in two years, exports slump picks up speed – Reuters

14453 October 31, 2018 12:53 FXStreet Market News

According to reporting by Reuters, China’s factory growth figures declined to their slowest pace in two years, while Chinese exports are seen slipping further back as the US-China trade war continues to produce economic drag throughout the Sino region.

Key highlights

As noted by Reuters, China’s rate of factory expansion in October declined to its slowest pace in over two years, with external demand continuing to dry up as China’s government continues to try and prep their domestic economy for a protracted trade war with the United States.

Investor anxieties over China’s rapidly-dwindling growth figures are beginning to show cracks in the PMI figures for the Asian megacountry, with the official PMI rate for October coming in at just 50.2, declining from September’s 50.8 and the key indicator’s lowest reading since July of 2016.

The Chinese PMI has held above the critical 50.0 midpoint for 27 consecutive months, but a dip below that level indicates immediate expectations of a contraction in growth.

“All the numbers from China’s PMI release today confirm a broad-based decline in economic activity,” said Raymond Yeung, chief economist for China at ANZ in a client note, adding that conditions for the private sector is “much worse” than headline data suggested. “Besides an expected reserve requirement ratio (RRR) cut next January, we expect future supportive policy actions to be measured. The government’s priority is to avoid a financial blow-up.” – Reuters

NZ: Dwelling consents fell 1.5% m/m in September – ANZ

14450 October 31, 2018 12:33 FXStreet Market News

Liz Kendall, Senior Economist at ANZ, notes that the number of residential dwelling consents in New Zealand fell 1.5% m/m in September (seasonally adjusted) which included a 32% m/m boost in Canterbury consents (sa) and was offset by a 14% m/m drop in Auckland and a 0.5% m/m drop elsewhere.

Key Quotes

“The number of residential consents is down 12% in the quarter, following strong consent issuance in the June quarter. Consents have been volatile of late.”

“Looking through recent volatility, residential investment looks set to end the year on a slightly softer note, albeit a softening from historically high levels.”

“Residential consents continue to drift south in trend terms, which if sustained, will make it difficult to maintain recent high levels of building activity.”

“Demand appears strong, but may be softening at the edges with the housing market softer and waning confidence. Industry challenges and delays may also be limiting activity.”