Articles

United States Pending Home Sales (MoM) below expectations (1%) in October: Actual (-1.1%)

91948 November 30, 2020 23:12 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUS October pending home sales -1.1% vs +1.0% expected

91947 November 30, 2020 23:02 Forexlive Latest News Market News

October pending home sales data:

- Prior was -2.2% (revised to -2.0%)

- Sales up 19.5% y/y vs +22.2% prior

The

year-over-year numbers tell the story in US housing. This is a small

setback in what’s been a boom and looks to be a secular trend tied to

ultra-low rates and a move out of the largest cities.

Full Article

Bitcoin price leaves another massive CME gap behind, technicals suggest it will be filled soon

91943 November 30, 2020 22:56 FXStreet Market News

- Bitcoin price is going through a recovery period after a quick dip to $16,188.

- Due to the extreme volatility in the past three days, Bitcoin has left another CME gap open.

Bitcoin is currently trading at $19,200 after a significant recovery from its low of $16,188. It seems that the flagship cryptocurrency is on its way to hit a new all-time high again. However, a notable gap on CME Bitcoin Futures might pose a threat for the bulls in the short term.

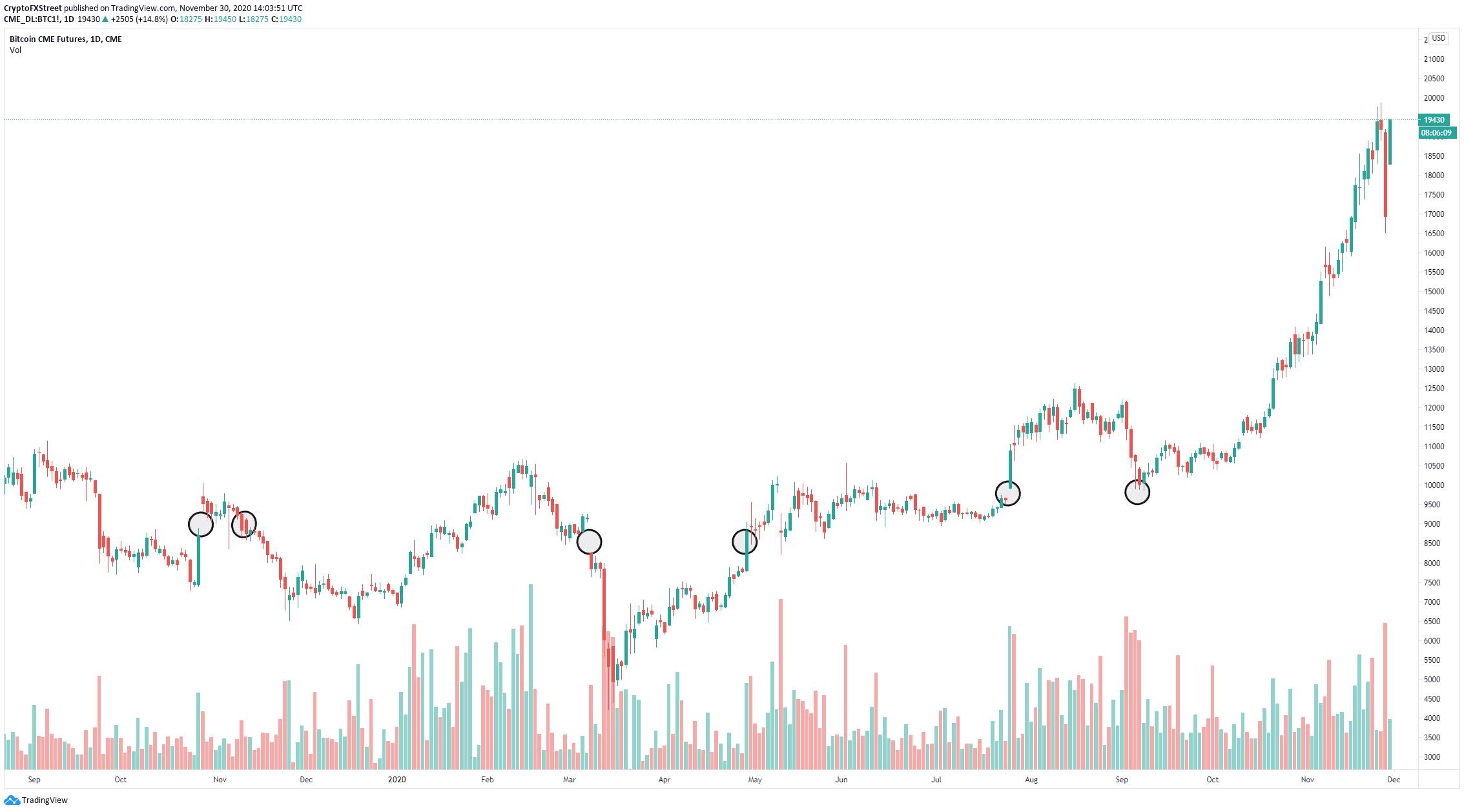

Bitcoin tends to fill CME gaps

The reliability of CME gaps being filled is good. In the past, the digital asset formed several notable gaps in October 2019, March 2020 and July 2020. All of them were filled, although the last one established on July 23, 2020, at around $9,500, was only partially filled on September 8 as Bitcoin price reached $9,850.

CME Bitcoin gaps chart

Either way, these gaps seem incredibly accurate, which means the latest gap formed between $17,295 and $18,275 is most likely bound to be filled. However, it’s important to note that most of the other gaps have taken several weeks and even months to fill eventually, which means we might not see this last gap fill until a few weeks later.

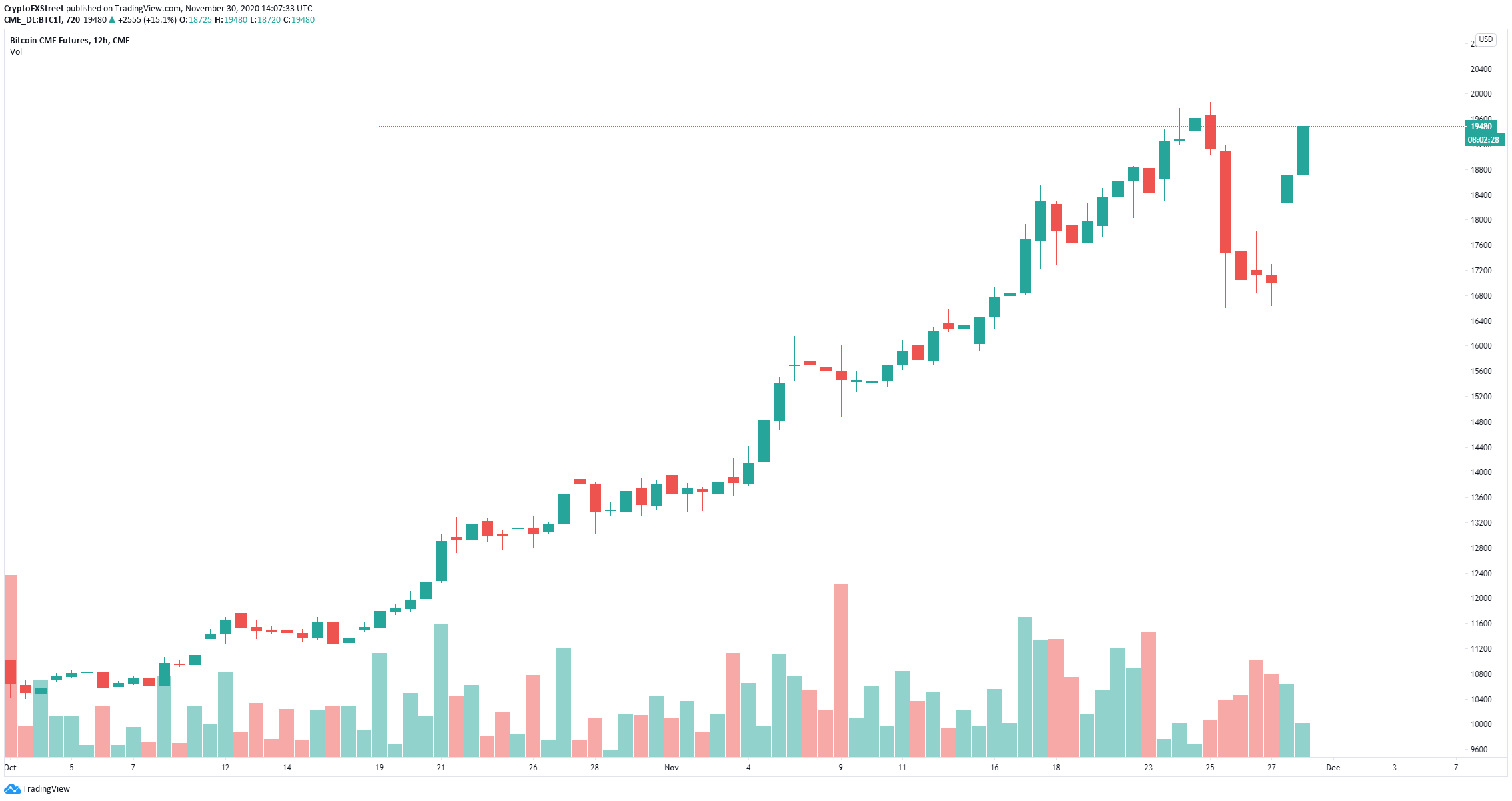

Bitcoin CME Futures 12-hour chart

Bitcoin price is up by around 10% during the weekend, leaving a massive gap on the 12-hour chart. Although gaps don’t necessarily always fill, several other bearish indicators show BTC is poised for a correction again.

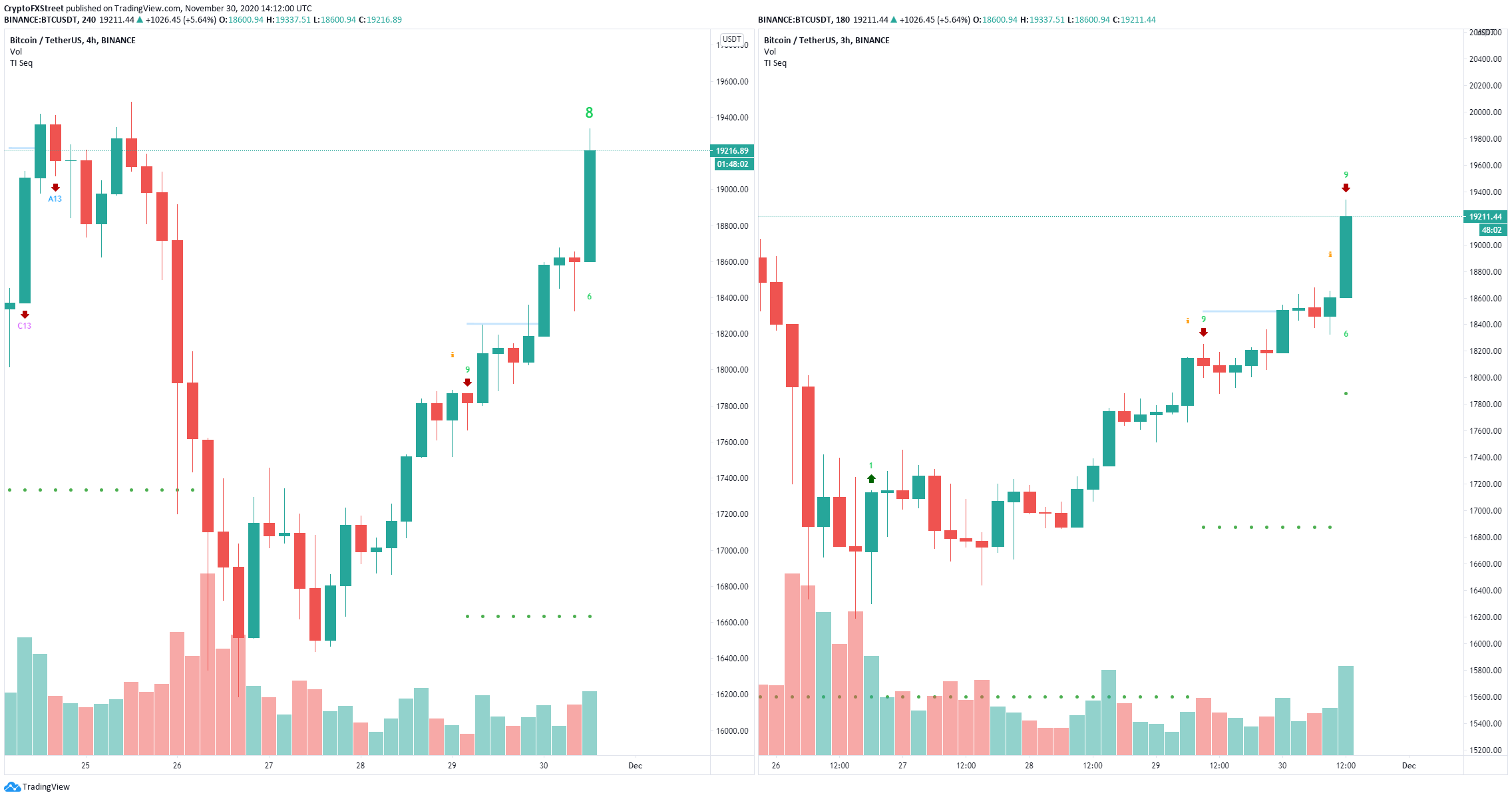

BTC/USD 3-hours and 4-hours charts

The TD Sequential indicator has presented a sell signal on the 3-hour chart, and it’s on the verge of posting another sell signal on the 4-hour chart, which suggests Bitcoin price could be bound for a short-term correction, potentially to fill the CME gap.

Nonetheless, Michael Sonnenshein, Managing Director of Grayscale, the largest Bitcoin trust fund globally, has stated that BTC remains bullish and the trust fund is “just getting started” based on the type of investors it is receiving in the past few months.

Full ArticleUnited States Chicago Purchasing Managers’ Index below expectations (59) in November: Actual (58.2)

91942 November 30, 2020 22:56 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleFed extends four emergency liquidity programs through March 31, 2021

91941 November 30, 2020 22:45 FXStreet Market News

The US Federal Reserve announced on Monday that it has extended liquidity facilities for commercial paper, money markets, primary dealers and paycheck protection program through March 31, 2021.

The Fed noted these programs are separate from credit facilities that the US Treasury has recently ordered closed on December 31.

“Liquidity facilities are continuing to support market functioning and enhancing credit,” the Fed said. “The extension of these programs was approved by the US Treasury and will help market planning through the first quarter of 2021 to aid recovery from the pandemic.”

Market reaction

The US Dollar Index showed no immediate reaction to this announcement and was last seen losing 0.2% on the day at 91.60.

Full ArticleECB still does not believe in Bitcoin as a valid means of payment

91939 November 30, 2020 22:45 FXStreet Market News

- ECB’s governor clarified the central bank’s attitude towards the digital euro.

- The regulator does not consider cryptocurrencies as a functional type of money.

The head of the European Central bank, Christine Lagarde, says that cryptocurrencies such as Bitcoin do not fulfil the functions of money due to various issues, including high volatility, low liquidity and the lack of identifiable issuer or claim.

Speaking in an exclusive interview with L’ENA hors Les Murs magazine, the central banker detailed the institution’s position towards digital euro and cryptocurrency assets.

Digital euro will complement cash

Christine Lagarde pointed out that the Central Bank wants to keep up with the financial innovations and ensure that the euro is fit for the digital era. That is why the ECB Governing Council is exploring the opportunities of creating the digital version of the single currency.

As FXStreet previously reported, the ECB published a report on a digital euro launched public consultations on the matter.

The digital euro would be regarded as a form of an existing currency that would cater to the changing needs of the population and allow the ECB to stay on top of the digitalization trend.

A digital euro would complement cash and ensure that consumers continue to have unrestricted access to central bank money in a form that meets their evolving digital payment needs, Lagarde said (translated from French).

On the reason why the regulator is yet to make a final decision on issuing its own coin, the governor emphasized that it might be useful in various scenarios in the future, including decreased cash usage.

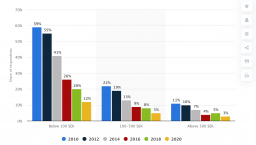

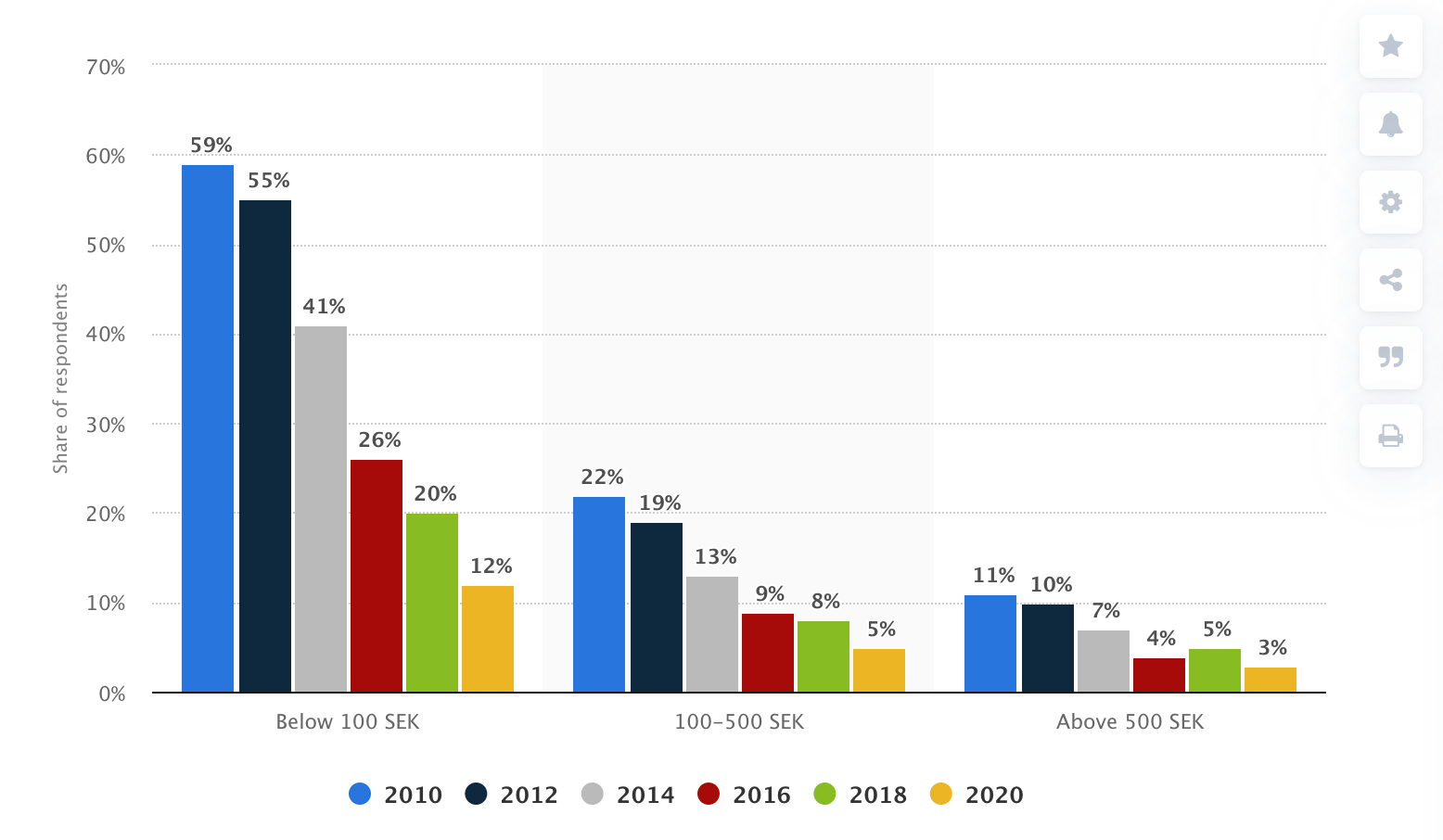

While Eurozone is still in love with cash, many countries moved towards cashless societies for years. For example, in Sweden, the percentage of cash usage for payments below 100 SEK dropped from 59% in 2010 to 21% in 2020.

Cash usage in Sweden, data provided by Statista

Similar trends are visible in large Asian economies, including China, where the government is one pace away from launching the digital version of yuan.

The process gathered pace during the COVID-19 pandemic. Thus, according to the research conducted by Boston Consulting Group (BCG), the share of cash payments dropped drastically across the globe: in the United Kindom, retail users reduced their cash payments by 62%, in Canada by 59% and in Australia by 53%.

Cryptocurrencies are not welcome

Meanwhile, speaking about digital currencies, based on the distributed ledger technologies, Christine Lagarde said that they are not as functional as traditional money. She presented a long list of risks that prevent cryptocurrencies from fulfilling the functions of a reliable medium of exchange.

Thus the ECB’s Governor pointed out that the main risk is that they rely too much on the technology.

The main risk lies in relying purely on technology and the flawed concept of there being no identifiable issuer or claim. This also means that users cannot rely on crypto-assets maintaining a stable value: they are highly volatile, illiquid, and speculative, and so do not fulfill all the functions of money (translated from French).

While stablecoins solve some of the issues typical of crypto-assets, their wide adoption on a global scale could threaten most countries’ financial stability and monetary sovereignty if an issuer did not guarantee a fixed value on it.

Apart from that, stablecoin’s mass adoption can lead to run off banks and impact banks’ operations and the transmission of monetary policy.

Full ArticleEUR/USD: The 1.20 level is just around the corner

91937 November 30, 2020 22:45 FXStreet Market News

- EUR/USD keeps its march north unabated on Monday.

- Dollar-selling keeps bolstering the upside in the pair.

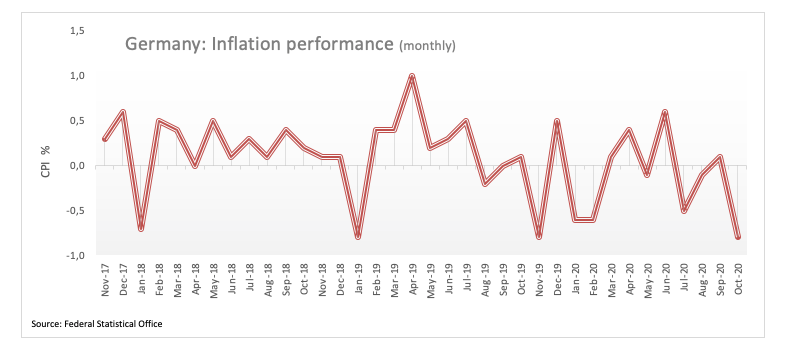

- German flash CPI came in short of expectations in November.

The buying interest around the shared currency stays well and sound and pushes EUR/USD closer to the psychological hurdle at 1.20 the figure on Monday.

EUR/USD now looks to the 2020 high

EUR/USD navigates just pips away from the psychological 1.20 barrier at the beginning of the week.

The firm upside momentum around the pair remains propped up by the unremitting selling pressure hurting the dollar in spite of omnipresent concerns over the advance of the coronavirus pandemic.

In fact, investors keep favouring the “glass half-full” view and look past the ongoing pandemic, anticipating at the same time a “V”-shaped recovery in the global economy. This upbeat sentiment has been gathering extra pace after US President-elect Joe Biden nominated ex-Fed J.Yellen to be Treasury Secretary.

In the data space, German advanced inflation figures showed consumer prices tracked by the CPI are expected to have contracted 0.8% MoM in November and 0.3% on a yearly basis.

What to look for around EUR

EUR/USD’s rally moves closer to the 1.20 yardstick and opens the door to a probable test of the so far 2020 peaks near 1.2020, always against the backdrop of a favourable atmosphere for the risk complex. In the very near-term, EUR/USD appears supported by prospects of a strong recovery in the region along with the increasing likelihood of extra stimulus in the US. Risks to this positive view emerge from the potential political effervescence around the EU Recovery Fund and increasing chances of further ECB easing to be announced as soon as at the December meeting.

EUR/USD levels to watch

At the moment, the pair is gaining 0.30% at 1.1997 and a break above 1.2000 (psychological level) would target 1.2011 (2020 high Sep.1) en route to 1.2032 (23.6% Fibo of the 2017-2018 rally). On the flip side, immediate contention emerges at 1.1800 (low Nov.23) followed by 1.1745 (weekly low Nov.11) and finally 1.1709 (Fibo level of the 2017-2018 rally).

Full ArticleAUD/USD trades in tight range below 0.7400 ahead of mid-tier US data

91936 November 30, 2020 22:45 FXStreet Market News

- AUD/USD consolidates last week’s gains below 0.7400 on Monday.

- US Dollar Index continues to edge lower at the start of the week.

- Investors await mid-tier macroeconomic data releases from the US.

After closing the previous week in the positive territory, the AUD/USD pair rose to its highest level since September 1st at 0.7408 in the early trading hours of the Asian session on Monday. However, the pair struggled to preserve its bullish momentum and seems to have gone into a consolidation phase near 0.7380.

DXY extends last week’s slide

The data from China showed on Monday that the economic activity in the manufacturing and service sectors expanded at a robust pace in November and helped the China-proxy AUD gather strength at the start of the week.

In the meantime, the greenback struggled to find demand on Monday and the US Dollar Index (DXY) slumped to its lowest level in more than 30 months at 91.55. Although the DXY staged a rebound and rose above 91.70 during the European session, it turned south ahead of mid-tier data releases from the US and allowed AUD/USD to limit its losses.

October Pending Home Sales, the ISM Chicago PMI and the Dallas Fed Manufacturing Business Index will be featured in the US economic docket. Meanwhile, Wall Street’s main indexes remain on track to start the day modestly lower and a cautious market mood could cause AUD/USD to start edging lower.

On Tuesday, the AiG Performance of Manufacturing Index and the Commonwealth Bank Manufacturing PMI will be released from Australia.

Technical levels to watch for

Full ArticleBiden’s team confirms that Yellen will be nominated Treasury Secretary

91935 November 30, 2020 22:35 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

WTI rebounds from lows, stays close to $46.00 ahead of OPEC+

91933 November 30, 2020 22:26 FXStreet Market News

- Prices of the WTI keeps the buying interest unchanged near $46.00.

- The 2-day OPEC+ meeting kicks in on Monday.

- Vaccine hopes keep sustaining the demand for crude oil.

Prices of the barrel of the WTI add to Friday’s gains and managed to bounce off earlier lows in the $44.50 region.

WTI focused on OPEC+, data

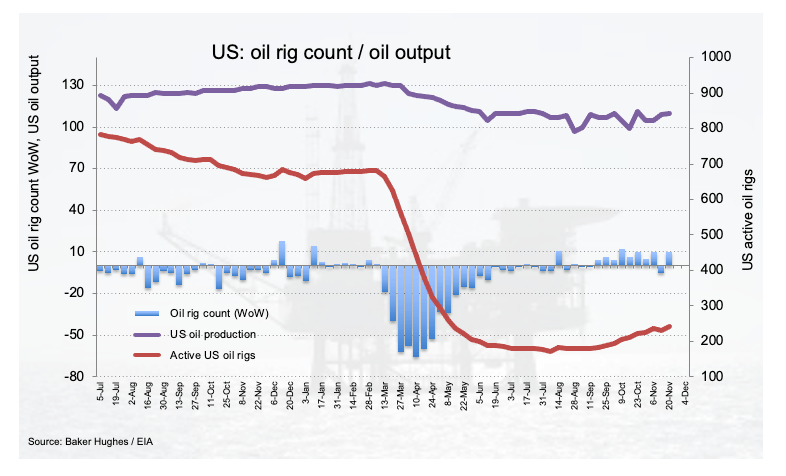

The barrel of the American reference for the sweet light crude oil keeps the upbeat momentum on Monday, as traders anticipate the OPEC+ will delay its planned oil output increments by three months (originally scheduled to start in January 2021).

In the meantime, investors continue to look past the pandemic and sustain the current change of heart around the commodity on firm prospects of higher demand in the months to come as well as rising probability of extra stimulus under the Biden’s administration.

On the data front, driller Baker Hughes reported on Thursday that US oil rig count went up by 10 during the previous week, taking the total US active oil rigs to 241. Later in the week, the usual weekly reports on US crude oil inventories by the API and the EIA are due on Tuesday and Wednesday, respectively.

WTI significant levels

At the moment the barrel of WTI is up 0.04% at $45.56 and faces the next hurdle at $46.24 (monthly high Nov.25) seconded by $48.39 (monthly high Mar.4) and finally $54.45 (monthly high Feb.20). On the other hand, a breach of $43.04 (high Nov.11) would aim to $40.12 (weekly low Nov.16) and then $37.09 (low Nov.6).

Full ArticleCable nears the November highs on dollar selling and Brexit optimism

91931 November 30, 2020 22:12 Forexlive Latest News Market News

Cable on the move

The US dollar is slumping as New York trading hits it stride after a long weekend. At the same time, optimism about a Brexit deal continues to build.

After a few whipsaws earlier, cable has moved decisively higher and is up 60 pips on the day to 1.3375.

The technicals are going to take over in the short-term because of offers ahead of resistance at the November high of 1.3398 (call it 1.34) and stops above. If that gives way, I wouldn’t expect much to stand in the way of a return to the September spike high of 1.3482

Full Article

Belgium Gross Domestic Product (QoQ): 11.4% (3Q) vs 10.7%

91930 November 30, 2020 22:12 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full Article