Articles

S&P 500 opens modestly higher led by tech

117187 February 28, 2021 04:05 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

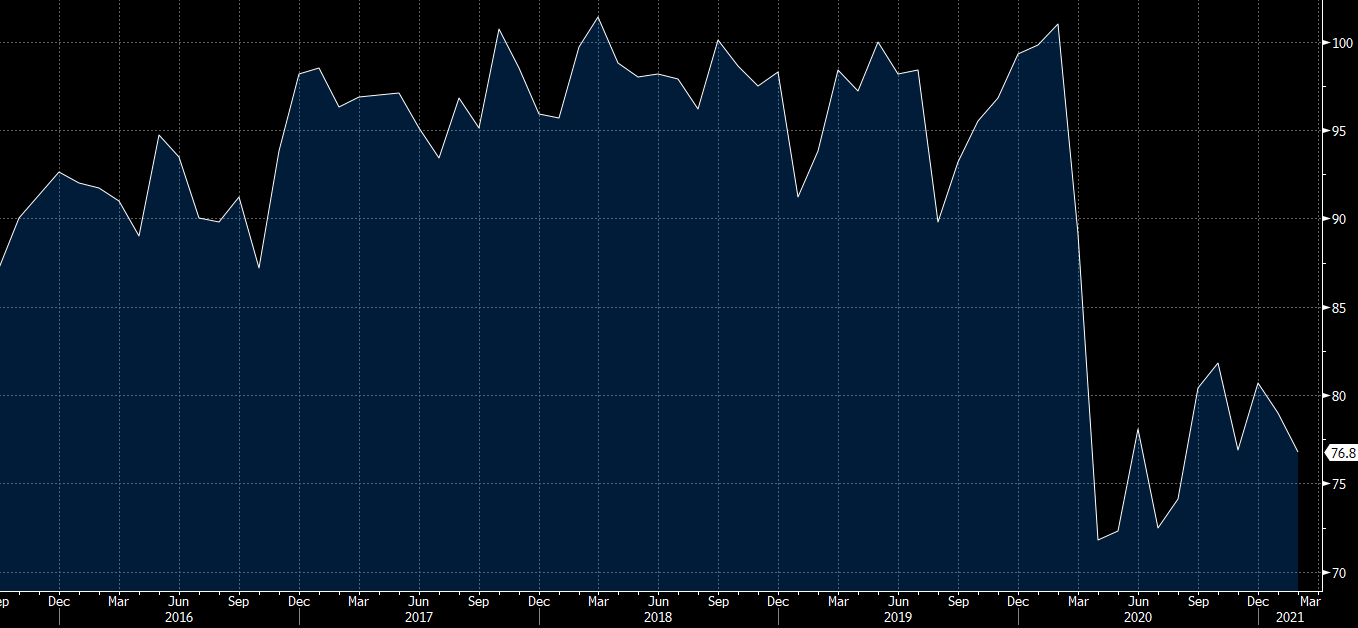

U Mich February final consumer sentiment 76.8 vs 76.5 expected

117185 February 28, 2021 03:56 Forexlive Latest News Market News

Consumer sentiment data from the University of Michigan

- Prior was 79.0

- Prelim was 76.2

- Expectations 70.7 vs 69.8 prelim

- Conditions 86.2 vs 86.2 prelim

- 1 year inflation at 3.3% vs 3.3% prelim

- 5-10 year inflation at 2.7% vs 2.7% prelim

That’s a modest beat on higher expectations but the market isn’t focused on survey data at the moment, it’s focused on bond and yields are ticking higher.

Full Article

The market is pricing a much-quicker transition to a taper and hike this time

117183 February 28, 2021 03:51 Forexlive Latest News Market News

A comparison of the financial crisis and now

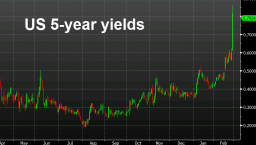

How quick will the Fed move? That’s the question underlying all the anxiety in the bond market that’s spread everywhere else. ADFter a brief bounce, US equities are lower again today and after falling to 0.73%, US 5-year yields are at 0.80%.

Here was the Fed timeline after the financial crisis:

- Taper tantrum (May 2013)

- Formal taper announcement (June 2013)

- Taper begins (Dec 2013)

- QE halted (Oct 2014)

- First hike (Dec 2015)

- Balance sheet normalization announced (June 2017)

- Normalization begins (Oct

2017)

BMO highlights that the market is increasingly pricing in a much quicker taper and transition to rate hikes this time:

At issue is that the time between the taper

tantrum and the official end of QE end was 17 months and then another 14 months

before liftoff. The market is currently pricing in effectively a 6 month-taper

to end and 6 months until first hike – or some combination that results in the

transition which took 31 months last cycle to be truncated with a year.

Certainly, it could happen – but that would imply something has changed

dramatically in the Fed’s interpretation of the balance of risks surrounding

the inflation outlook.

The counter-argument might be that a pandemic-induced recession is different from a financial crisis and that the US fiscal response has been dramatically more-powerful, with perhaps nearly $5 trillion more to come.

Full Article

US removes key stumbling block in global deal on digital tax

117182 February 28, 2021 03:49 Forexlive Latest News Market News

That’s not good news for mega-cap tech companies

That’s more bad news for mega-tech companies. The Nasdaq is down 0.6% after climbing more than 1% at the open.

Full Article

Canada April-Dec budget deficit C$248B vs C10.9B a year ago

117181 February 28, 2021 03:45 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

S&P 500 rebounds into positive territory, climbing 1.4% from the lows

117180 February 28, 2021 03:40 Forexlive Latest News Market News

Stocks back in the green

The S&P 500 fell as low as 3789 but it has rebounded to 3839. That’s a 1.4% bounce from the bottom.

The turn came in part after the ECB’s Stournaras talked about speeding up the pace of QE to counteract the rise in yields. I think that was only a small part of the turn but it highlights the chance of the Fed stepping in if the drop in yields extends.

US yields haven’t moved and remain near session highs with the US 10-year sitting right at 1.5%.

Full Article

US: Atlanta Fed’s GDPNow declines to 8.8% for Q1 after latest US data

117179 February 28, 2021 03:40 FXStreet Market News

The real gross domestic product (GDP) in the United States is expected to grow by 8.8%, down from 9.6% on February 25, in the first quarter of 2021, the Federal Reserve Bank of Atlanta’s latest GDPNow report showed on Friday.

“After this morning’s releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcast of first-quarter real gross private domestic investment growth decreased from 22.1% to 17.7%, while the nowcast of the contribution of the change in real net exports to first-quarter real GDP growth decreased from -0.78 percentage points to -0.84 percentage points,” Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen gaining 0.67% on a daily basis at 90.74.

Full ArticleUS: NY Fed’s GDP Nowcast rises to 8.7% for Q1 after this week’s data

117178 February 28, 2021 03:40 FXStreet Market News

The US economy is expected to grow by 8.7% in the first quarter of 2021, the Federal Reserve Bank of New York’s latest Nowcasting Report showed on Friday.

“News from this week’s data releases increased the nowcast for 2021:Q1 by 0.4 percentage point,” the publication read. “Positive surprises from personal consumption expenditures and disposable personal income data drove most of the increase.”

Market reaction

This report failed to provide a boost to market sentiment. As of writing, the S&P 500 was virtually unchanged on the day at 3,829.

Full ArticleCommodity currencies hit fresh lows on broad USD bid

117176 February 28, 2021 03:35 Forexlive Latest News Market News

Treasury yields near the highs of the day

US equities are bouncing but other markets aren’t buying it.

The commodity currencies are at the lows of the day, with USD/CAD breaking 1.27 and AUD/USD nearing 0.7700.

The moves come as a broad USD bid develops. US 5-year yields are now up 0.2 bps on the day at 0.82% and just off the session high of 0.83%.

AUD/USD is now down nearly 2% in an emphatic rejection of 80-cents.

Full Article

NZD/USD’s sharp reversal continues but pair finds support at 0.7250

117175 February 28, 2021 03:35 FXStreet Market News

- NZD/USD has sold off more than 200 pips from Thursday’s highs above 0.7450.

- But the pair is finding support in the 0.7250 area amid some technical confluences.

- ING thinks NZD will outperform AUD going forward given a less dovish RBNZ.

Friday is seeing another sharp drop in NZD/USD. At present, the currency trades around 1.6% or nearly 120 pips lower on the day and has slumped all the way from Asia Pacific highs in the 0.7370s to current levels around the 0.7250 mark. That means the pair has reversed more than 200 pips from Thursday’s early European session highs of above the 0.7450 mark.

0.7250 is a key area of support for NZD/USD, hence why it seems to be finding some support here for the moment; the area corresponds with the late January to early/mid-February highs and also the pair’s 21-day moving average or DMA (which currently resides at 0.72408. A breakthrough this region will open the door to a test of the 0.7200 level, which coincides pretty much bang on with the pair’s 50DMA, as well as an uptrend linking the 21 December 2020, 28 January and 17 February lows.

Driving the day

Fridays drop comes amid a US dollar that is bid against most of its G10 peers, possibly as a result of month end flows, and is especially bid versus the antipodes. While NZD/USD is down about 1.6% on the day, AUD/USD’s losses are closer to 2.0%. New Zealand trade numbers, released at the start of Thursday’s Asia Pacific session, were broadly ignored, but dovish remarks from the Governor of the RBNZ, who reiterated that more monetary stimulus might be needed might be contributing to NZD’s decline; given recent changes to the RBNZ’s remit, however, most analysts see such rhetoric as more bark than bite, given the bank will struggle to ease policy any further without creating further unwanted upwards pressure on housing prices (see below).

NZD to outperform AUD going forward, says ING

Following the New Zealand government’s decision to amend the Reserve Bank of New Zealand’s remit to take into account house prices when setting monetary policy sets the stage for NZD outperformance versus the Aussie dollar on the back of central bank divergence.

One of the New Zealand government’s key policy aims has been to make housing much more affordable, an aim that has been crushed by the RBNZ’s response to the Covid-19 pandemic; the RBNZ axed rates to 0.25% and started an NZD 60B QE programme and the low rate environment the YoY rate of median house price growth to 3.5%, its highest level in more than a decade.

The RBNZ has recently opted to tighten loan-to-value ratio (LVR) restrictions on mortgage lending in an effort to dampen housing demand. Note that such a policy makes it harder to lower-income New Zealand citizens to get on the housing ladder as they must now save up a significantly greater amount to afford the house deposit, in a way flying in the face of the government’s aim to make housing more accessible to all.

Despite tougher LVR restrictions, the change to the central bank’s remit effectively rules out negative rates, thinks ING, before caveating that negative rates were already unlikely to be implemented given the New Zealand economy’s relative strength (compared to other developed market peers, anyway) and the fact that the country has kept the pandemic broadly contained.

Moreover, ING thinks that the new remit will create pressure on the RBNZ to start hiking interest rates before other developed market central banks, given that the combination of ultra-low interest rates plus the expected strong economic rebound in the coming months is likely to generate further upside in house prices. 25bps of tightening is now priced in for 2022 and ING “suspect that speculation for an even earlier or a more substantial policy normalisation cycle will continue mounting for the rest of the year.”

“From an FX perspective” concludes the bank, “higher chances of a tightening in New Zealand before other major economies bodes well for NZD prospects… (and) we continue to expect the monetary policy divergence between New Zealand and Australia to remain wide and favour NZD over AUD.”

Full ArticleECB’s Stournaras: ECB should accelerate PEPP purchases

117174 February 28, 2021 03:35 FXStreet Market News

European Central Bank (ECB) policymaker Yannis Stournaras said on Friday that the ECB should accelerate the purchases within the Pandemic Emergency Purchase Programme (PEPP), as reported by Reuters.

Additional takeaways

“There’s no fundamental justification for a tightening of nominal bond yields at the long end.”

“Governing council should instruct board at March 11 meeting to fight unwarranted tightening of financing conditions.”

“There is currently an unwarranted tightening of bond yields.”

Market reaction

The shared currency remains under strong bearish pressure following these remarks. As of writing, the EUR/USD pair was down 0.62% on a daily basis at 1.2101.

Full ArticleEuropean equity close: UK stocks tumble in a rough day everywhere

117173 February 28, 2021 03:33 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article