Articles

US Dollar Index pushes higher and targets 91.00

135015 April 30, 2021 21:29 FXStreet Market News

- DXY keeps the daily advance well in place near 91.00.

- US yields appear side-lined around the 1.65% area.

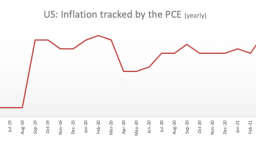

- US Core PCE rose 1.8% YoY, headline PCE up 2.3% YoY.

The greenback stays bid and flirts with the key hurdle at the 91.00 area when measured by the US Dollar Index (DXY).

US Dollar Index bid on data, month-end flows

The buying pressure remains well and sound around the dollar in the second half of the week, so far motivating the index to close the week in the positive territory for the first time after three pullbacks in a row.

Month-end flows and the offered bias in the risk complex continue to sustain the move higher in the buck, helped at the same time by the rebound in US yields.

Indeed, the recent bounce off lows in yields of the US 10-year lent support to the move higher in the dollar and put further distance from 2-month lows recorded on Thursday. Indeed, yields appreciated to the 1.70% vicinity after bottoming out around 1.53% during last week. Currently, yields remain within the consolidative theme around the 1.65% region.

In the US docket, the core PCE rose in line with forecasts 1.8% on a year to March, while headline PCE gained 2.3% from a year earlier. Further data releases saw the Personal Income expanding 21.1% MoM in March and Personal Spending gaining 4.2% on a monthly basis.

Later in the session, the Chicago PMI is due followed by the final print of the Consumer Sentiment gauged by the U-Mich index.

What to look for around USD

The April pullback in the dollar remains well and sound despite the ongoing rebound from 2-month lows in the 90.40 region. The move lower in the buck follows the broad-based retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the dollar emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made), and rising optimism on a strong global economic recovery, all morphing into a solid source of support for the riskier assets and a most likely driver of probable weakness in the dollar in the next months.

Key events in the US this week: Final April Consumer Sentiment.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families worth nearly $4 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.24% at 90.84 and a breakout of 91.42 (high Apr.21) would open the door to 91.66 (50-day SMA) and finally 91.97 (200-day SMA). On the other hand, the next support emerges at 90.42 (monthly low Apr.29) followed by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).

Full ArticleCanada Industrial Product Price (MoM) above forecasts (1.2%) in March: Actual (1.6%)

135014 April 30, 2021 21:12 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCable on the defensive after failing to break 1.40

135012 April 30, 2021 21:09 Forexlive Latest News Market News

Cable falls into month-end

Technically, it looks to have failed in another test of 1.40. This is the fifth effort to break above that level since the start of March.

Full Article

USD/CAD remains depressed near multi-year lows post-US/Canadian macro data

135011 April 30, 2021 21:09 FXStreet Market News

- USD/CAD remained depressed for the third consecutive session on Friday.

- A combination of factors might help limit any further losses, at least for now.

- Diverging BoC/Fed monetary policy stance should cap any meaningful bounce.

The USD/CAD pair witnessed some selling during the early North American session and refreshed multi-year lows, around the 1.2265 region in the last hour.

The pair, so far, has struggled to register any meaningful recovery and remained depressed for the third consecutive session on Friday. This also marked the fifth day of a negative move in the previous six, though a combination of factor helped limit any further losses.

The US dollar built on the overnight bounce from the lowest level since February 26 and strengthened across the board amid a generally softer risk tone. The global risk sentiment took a hit after the Chinese PMI indicated the slowing pace of growth in the manufacturing sector.

The data added to the market worries that the ever-increasing COVID-19 cases in some countries – India, Japan and Brazil – could derail the global economic recovery from the pandemic. This, in turn, dented investors’ confidence and drove some haven flows towards the greenback.

The USD held on to its intraday gains following the release of mostly upbeat US macro releases. The annual Core PCE Price Index accelerated to 1.8% in March from 1.4% previous. Adding to this, Personal Income surged surge 21.1%, while Personal Spending increases by 4.2% in March.

From Canada, the monthly GDP print fell short of expectations and came in to show a growth of 0.4% in February. Apart from this, a sharp fall in crude oil prices further held traders from placing bullish bets around the commodity-linked loonie and extended some support to the USD/CAD pair.

Despite the supporting factors, the pair, so far, has been struggling to register any meaningful recovery amid the divergence in monetary policies adopted by the BoC and the Fed. This, in turn, suggests that the path of least resistance for the USD/CAD pair remains to the downside.

That said, overstretched conditions on short-term charts warrant some caution before positioning for any further depreciating move. Hence, it will be prudent to wait for a modest bounce or a near-term consolidation before positioning for an extension of the well-established bearish trend.

Technical levels to watch

Full ArticleCanada Raw Material Price Index down to 2.3% in March from previous 6.6%

135010 April 30, 2021 21:09 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleChile Industrial Production (YoY) climbed from previous -3.4% to 2.9% in March

135009 April 30, 2021 21:05 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Gross Domestic Product (MoM) came in at 0.4%, below expectations (0.5%) in February

135008 April 30, 2021 21:05 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleChile Unemployment rate increased to 12.1% in March from previous 10.3%

135007 April 30, 2021 21:02 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUnited States Employment Cost Index registered at 0.9% above expectations (0.7%) in 1Q

135006 April 30, 2021 21:02 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUnited States Personal Consumption Expenditures – Price Index (MoM) above expectations (0.3%) in March: Actual (0.5%)

135005 April 30, 2021 20:56 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUnited States Personal Income (MoM) above forecasts (20.3%) in March: Actual (21.1%)

135004 April 30, 2021 20:56 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

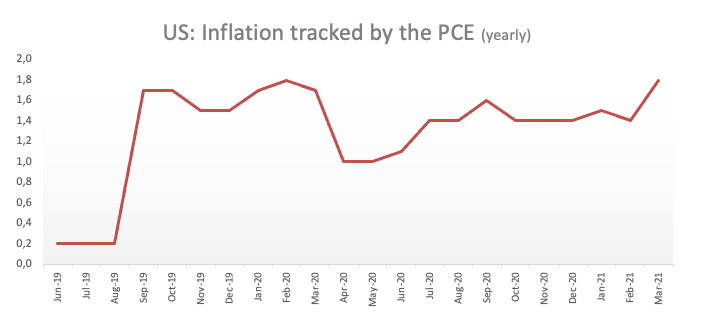

Full ArticleEUR/USD Price Analysis: Interim support emerges around 1.2050

135002 April 30, 2021 20:51 FXStreet Market News

- EUR/USD recedes further from Thursday’s monthly tops.

- Initial contention comes in at the 1.2050 zone.

EUR/USD comes under further pressure at the end of the week after recording new peaks for the month of April in the 1.2150 area on Thursday.

As the pair recedes from overbought levels, the fresh selling pressure carries the potential to re-test the 100-day SMA in the mid-1.2000s in the near-term. Further downside could see the 1.2000 support emerging on the horizon.

Above the 200-day SMA (1.1935) the stance for EUR/USD is predicted to remain constructive.