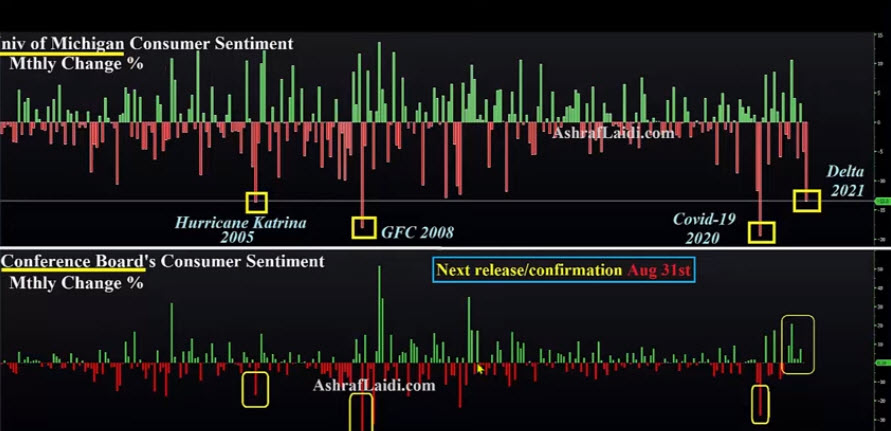

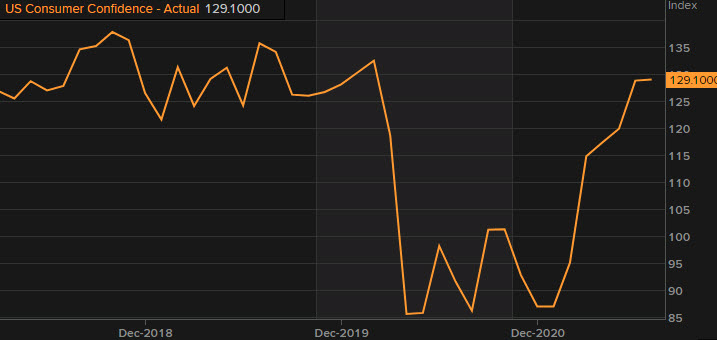

US August consumer confidence data from The Conference Board

- Prior was 129.1 (highest since the start of the pandemic)

- This is the lowest since Feb

- Estimates ranged from 110.0 to 131.0

Details:

- Expectations 91.4vs 108.4 prior

- Present situation 147.3 vs 160.3 prior

- Jobs hard to get vs 10.5 prior

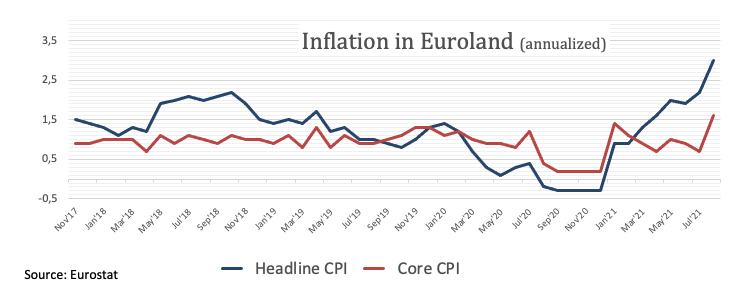

- 1 year inflation expectations % vs 6.6% prior

“Consumer confidence retreated in August to its lowest level since February 2021(95.2),” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “Concerns about the Delta variant-and, to a lesser degree, rising gas and food prices-resulted in a less favorable view of current economic conditions and short-term growth prospects. Spending intentions for homes, autos, and major appliances all cooled somewhat; however, the percentage of consumers intending to take a vacation in the next six months continued to climb. While the resurgence of COVID-19 and inflation concerns have dampened confidence, it is too soon to conclude this decline will result in consumers significantly curtailing their spending in the months ahead.”