Articles

US: ISM Chicago PMI declines to 64.7 in September from 66.8 previous

172703 September 30, 2021 21:51 FXStreet Market News

- ISM Chicago PMI declined further in September and came in at 64.7.

- US Dollar Index remains on the defensive just below one-year tops.

The Chicago Purchasing Managers Index released by ISM-Chicago dropped to 64.7 in September from 66.8 in the previous month, indicating further deterioration in business conditions. This was worse than consensus estimates pointing to a reading of 65, though did little to provide any meaningful impetus.

Market reaction

The US Dollar extended its sideways consolidative price action below one-year tops, around mid-94.00s touched earlier this Thursday.

Full ArticleUnited States Chicago Purchasing Managers’ Index below expectations (65) in September: Actual (64.7)

172702 September 30, 2021 21:51 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Visa to accelerate crypto mainstream adoption with new ‘Universal Payments Channel’

172701 September 30, 2021 21:35 FXStreet Market News

- Visa deployed its first smart contract on Ethereum Testnet with a payment channel accepting Ether and USDC.

- The payments giant developed a conceptual protocol that enables interoperability between CBDCs for payments.

- Visa’s Universal Payments Channel (UPC) will support the exchange of CBDCs on various blockchains.

Visa is focused on cryptocurrency adoption and introduced a solution for payments using central bank digital currencies across blockchains through its concept of UPC.

Visa takes lead in enabling payments through central bank cryptocurrencies

Payments giant Visa has led the way in cryptocurrency adoption several times in 2021. Earlier this year, the company announced plans to work with local crypto companies and facilitate businesses accepting crypto payments.

The company is focused on combining reliable payment solutions with cryptocurrency payments while innovating in the industry. The American financial services firm has developed a protocol that shows how central bank digital currencies (CBDCs) on different blockchain networks could be exchanged and used for payment.

Visa’s concept of a “Universal Payments Channel” outlines the interconnection between different CBDCs and paves the way for future payments on the financial services giant.

Cuy Sheffield, Visa’s head of crypto, states,

This is a much longer-term future thinking concept around a way that Visa could potentially help become a bridge between one digital currency on one blockchain and another digital currency on another blockchain.

Interestingly, the proposed base layer for Visa’s UPC is Ethereum. Though regulation on cryptocurrencies is currently underway in most countries, centralized institutions worldwide have embraced the idea of CBDCs.

Visa is therefore creating a hub for adoption and use of CBDCs to promote the mainstream adoption of digital currencies. Cryptocurrency analysts are considering Visa’s move key to Ethereum’s institutional adoption.

Pseudonymous analyst @Pentosh1 reacted to Visa’s announcement,

Visa agrees that CBDCs and stablecoins are expected to play a significant role in the future of payments between individuals and institutions worldwide.

Visa’s whitepaper describes its UPC concept as follows,

The UPC protocol facilitates payments through an entity, called the UPC hub (or server — we use the terms interchangeably), which acts as a gateway to receive payment requests from registered sending parties and routes them to registered recipient parties.

In addition to the development in CBDC acceptance, Visa has deployed its first-ever smart contract on Ropsten, Ethereum’s testnet. The smart contract accepts ETH and USDC both. According to their head of crypto, Visa is keen on ramping up its solutions that include digital currencies and payment products in the future.

Visa aims to be a “network of blockchain networks” through its strides in crypto acceptance and adoption.

Full ArticleEUR/JPY looks offered below the 130.00 level

172700 September 30, 2021 21:35 FXStreet Market News

- EUR/JPY adds to Wednesday’s losses below 130.00.

- German flash CPI came in at 0.0 MoM and 4.1% YoY.

- Final US Q2 GDP expanded 6.7% QoQ, above estimates.

The now better tone in the Japanese safe haven drags EUR/JPY to the area of 3-day lows in the mid-129.00s on Thursday.

EUR/JPY looks to risk trends

EUR/JPY loses ground for the second session in a row on Thursday amidst the inconclusive price action in the dollar and mild gains in the Japanese safe haven.

In the bonds markets, yields of the US 10-year reference note gather extra steam and re-target the 1.55% level following mixed results from the US calendar. Indeed, final US GDP figures showed the economy expanded 6.7% during the April-June period, while weekly Claims rose by 362K WoW in the week ended on September 24.

Earlier in the session, the German labour market came in on the soft side after the Unemployment Change shrank less than expected by 30K. Still in Germany, advanced inflation figures for the month of September see the CPI rising 4.1% YoY, the highest level since 1992, and coming flat on a monthly basis.

EUR/JPY relevant levels

So far, the cross is down 0.21% at 129.53 and a surpass of 130.47 (weekly high Sep.29) would expose 130.74 (monthly high Sep.3) and then 130.75 (100-day SMA). On the downside, the next support comes at 129.50 (55-day SMA) followed by 129.39 (Fibo level) and finally 127.93 (monthly low Sep.22).

Full ArticleSurvey: OPEC Sept output rose 420K bpd to 27.31 mbpd

172698 September 30, 2021 21:21 Forexlive Latest News Market News

Reuters’ influential secondary sources survey

- Nigeria led the increase after an involuntary cut in August

- Compliance with quotas is at 114% vs 115% last month

- Output at highest since April 2020

OPEC’s quotas allowed for a 400kbpd increase in Sept and we saw more than that because of Nigerian production coming back online after August outages at the Forcados terminal. Nigeria’s output rose 170kbpd in the month.

WTI crude oil is at the lows of the week at $74.14.

Full Article

GBP/USD refreshes session tops near 1.3480 region, lacks follow-through

172697 September 30, 2021 21:21 FXStreet Market News

- GBP/USD gained some traction on Thursday and recovered a part of the overnight losses.

- The USD extended its consolidative price action and extended some support to the major.

- Mixed US economic data did little to impress traders or provide any meaningful impetus.

The GBP/USD pair edged higher through the early North American session and climbed to fresh daily tops, around the 1.3475-80 region post-US macro data.

The US dollar now seems to have entered a bullish consolidation phase and was seen oscillating in a range just below the highest level since September 2020 touched earlier this Thursday. The prevalent risk-on mood, along with a softer tone around the US Treasury bond yields held the USD bulls from placing fresh bets.

This was seen as a key factor that extended some support to the GBP/USD pair, which got a minor lift following an upward revision of the UK GDP print for the second quarter of 2021. The Office for National Statistics reported that the UK expanded by 5.5% during the April-June period as against the first estimate of a 4.8% increase.

On the other hand, the US GDP growth was also revised marginally higher to a 6.7% annualized pace from the preliminary estimate for a 6.6% rise. This, however, was overshadowed by an unexpected rise in the Weekly Initial Jobless Claims. In fact, the number of Americans filing for unemployment-related benefits jumped from 351K to 362K last week.

That said, expectations that the Fed would begin rolling back its massive pandemic-era stimulus as soon as November and raise interest rates in 2022 helped limit any deeper USD losses. Apart from this, the ongoing fuel crisis in Britain might further collaborate to keep a lid on any further gains for the GBP/USD pair, at least for the time being.

Thursday’s US economic docket also features the release of Chicago PMI, though the focus will be on Fed Chair Jerome Powell’s testimony before the Committee on Financial Services. Apart from this, the US bond yields and the broader market risk sentiment will influence the USD price dynamics and provide some impetus to the GBP/USD pair.

Technical levels to watch

Full ArticleUSD/CHF: Break above major resistance at 0.9356/69 to open up the 0.9473 peak – Credit Suisse

172696 September 30, 2021 21:12 FXStreet Market News

USD/CHF continues grinding higher and is now testing major resistance at 0.9356/69. A breakout is likely, in the view of the Credit Suisse analyst team.

First support moves higher to 0.9279

“The USD/CHF pair is now testing the important downtrend from the 2019 high and retracement resistance at 0.9356/69. We are increasingly of the view that is likely to be broken now, with the broader USD all but confirming a larger base.

“It’s worth reiterating that there is little in the way of meaningful resistance if a breakout above 0.9356/69 is seen until the .9473 high, which suggests we could see a sharp acceleration in momentum.”

“First support moves higher to 0.9279, then more importantly at 0.9246, before 0.9214 which we still look to hold to keep our bias directly higher. Below here would leave the market back in its prior range, with next support at 0.9181.”

Full ArticleAUD/USD to sink towards the 0.71 level into year-end – Rabobank

172695 September 30, 2021 21:12 FXStreet Market News

AUD/USD is finding it difficult to pull away from the 0.72 area. A dovish Reserve Bank of Australia is set to weigh on the aussie. Subsequently, economists at Rabobank expect the pair to drop to the 0.71 level.

Dovish inflation outlook is likely to restrain the AUD

“The RBA retains a dovish tone, but is pushing ahead with its previous decision to taper its QE programme from September mostly on the expectation that the economy will bounce sharply once restrictions are lifted.”

“The RBA has become surprisingly prescriptive in its view that wages will need to be growing by at least 3% to push CPI inflation sustainably into the middle of the 2% to 3% target band. This will then trigger a rise in the Cash rate. It is the Bank’s view that this will not happen before 2024. This dovish outlook is likely to restrain the AUD.”

“Despite the support from higher energy prices, we see risk of a dip to AUD/USD 0.71 on a one-to-three month view.”

Full ArticleEUR/USD Forecast: Pressure remains ahead of another round of Powell

172693 September 30, 2021 21:09 FXStreet Market News

EUR/USD Current price: 1.1587

- US Q2 Gross Domestic Product was confirmed at 6.7%, slightly better than anticipated.

- US government bond yields continue to consolidate near monthly highs.

- EUR/USD is bearish, but extreme oversold conditions hint at a possible correction.

The EUR/USD pair remains on the backfoot, accelerating its slide below the 1.1600 figure. So far, the pair has set a fresh 2021 low of 1.1567, as demand for the American currency in a tumultuous scenario persists. Stocks remain under pressure while government bond yields consolidate gains, with the yield on the 10-year US Treasury note holding above 1.50%.

European data failed to impress, adding pressure on the shared currency. German inflation remained path in September according to preliminary estimates, below the 0.1% expected. The unemployment change in the country resulted at -30K, also missing the market’s expectations.

US data was mixed, as Initial Jobless Claims were once again up, printing at 363K in the week ended September 24. The Gross Domestic Product was confirmed at 6.7% in Q2, slightly better than anticipated. Finally, core Personal Consumption Expenditures prices met expectations with 6.1%. US Federal Reserve Chair Jerome Powell will testify again with US Treasury Secretary Janet Yellen before Congress.

EUR/USD short-term technical outlook

The EUR/USD pair trades in the 1.1580 price zone, oversold but bearish in the near term. The 4-hour chart shows that technical indicators have resumed their declines and keep heading south despite being at extreme levels, while the 20 SMA further fell below the longer ones and above the current level. Further declines could be expected on a break below 1.1560, although chances of a corrective advance increased.

Support levels: 1.1560 1.1520 1.1485

Resistance levels: 1.1640 1.1680 1.1725

View Live Chart for the EUR/USD

Full ArticleRussia Central Bank Reserves $ fell from previous $619.8B to $617.9B

172692 September 30, 2021 21:09 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Power prices in southern Europe are at utterly crippling levels

172688 September 30, 2021 21:05 Forexlive Latest News Market News

These prices are at levels that can bring down industry

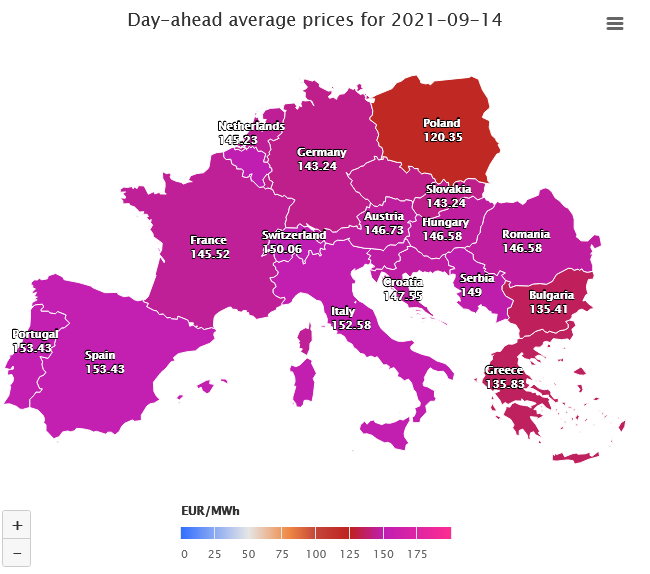

Here were prices on September 13 and they were hitting records then:

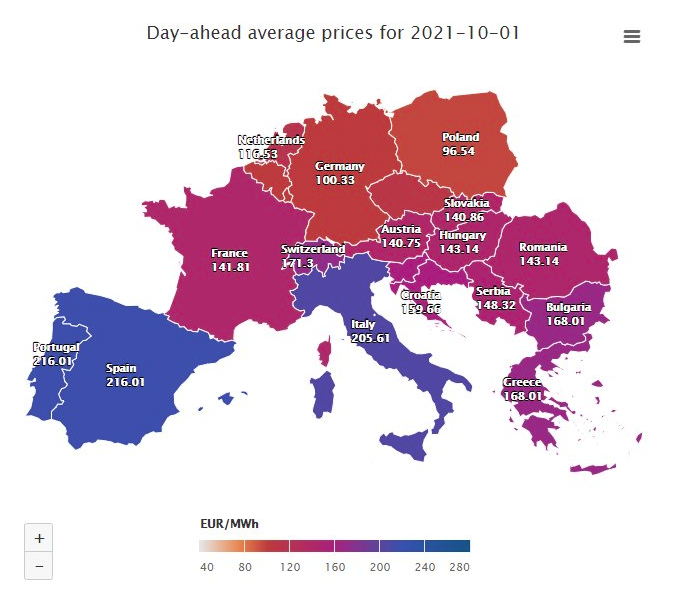

Here they are today at Energy Live. They had to change the scale! There’s some improvement in Germany and northern Europe but in the south, those numbers are at levels where some industries can’t keep the lights on.

Meanwhlie, European natural gas prices continue to hit stratospheric levels. Here’s TTF:

Asian gas prices are even higher than that.

Full Article

India Infrastructure Output (YoY) climbed from previous 9.4% to 11.6% in August

172687 September 30, 2021 21:05 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.