Articles

EUR/JPY Price Analysis: Downside pressure alleviated above 129.60

187319 November 30, 2021 22:26 FXStreet Market News

- EUR/JPY bounces off recent lows in the 127.50 region.

- Above 129.50 the selling pressure should mitigate somewhat.

Despite the current daily rebound, the outlook for EUR/JPY still falls on the fragile side, to be optimistic.

The continuation of the downtrend remains well on the cards for the time being, although further recovery faces the initial hurdle at the 10-day SMA at 128.92. Further up comes the weekly top around 129.60 (November 24) and if cleared, then the downside pressure is expected to alleviate somewhat.

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.55.

EUR/JPY daily chart

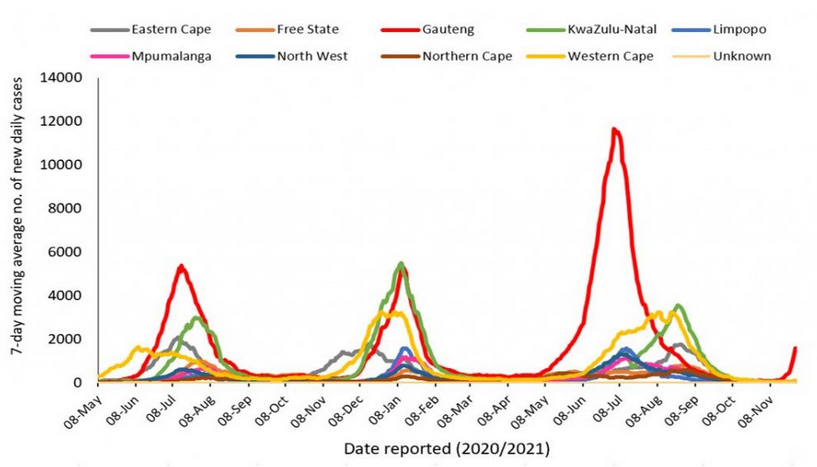

Full ArticleWhat the data is saying: Covid cases in South Africa’s omicron epicenter fell again today

187317 November 30, 2021 22:17 Forexlive Latest News Market News

Forget the talking heads, follow the data

Everyone pretends like they’re researching and following the data but when the CEO of Moderna speculates on vaccine ineffectiveness, everyone abandons the data and clings to authority.

Here’s some hard data: Covid cases in Guateng — which is the centre of South Africa’s covid outbreak — fell to 1909 on November 29 from 2308 a day earlier.

Here’s the recent progression:

- 25 Nov : 1950

- 26 Nov : 2173

- 27 Nov : 2629

- 28 Nov : 2308

- 29 Nov : 1909

In every other province in the country, the number of new cases are negligible (Western Cape is highest at 119). In terms of positivity, it’s high with 10.7% of people testing positive.

Hospital admissions:

- 25 Nov : 98

- 26 Nov : 60

- 27 Nov : 30

- 28 Nov : 17

- 29 Nov : 79

2414 people are currently admitted, 234 are in the ICU and 112 ventilated. The peak was near 20,000 last January. The population of South Africa is 53 million and around 23% are vaccinated.

Draw your own conclusions.

Full Article

USD/JPY slides further below 113.00, lowest since October 11

187316 November 30, 2021 22:17 FXStreet Market News

- A combination of factors dragged USD/JPY to the lowest level since October 11 on Tuesday.

- COVID-19 woes, the risk-off mood benefitted the safe-haven JPY and exerted heavy pressure.

- A steep decline in the US bond yields weighed on the USD and contributed to the downfall.

The USD/JPY pair maintained its heavily offered tone through the early North American session and was last seen trading around the 112.75-70 region, or the lowest level since October 11.

Following the previous day’s two-way price moves, the USD/JPY pair met with fresh supply on Tuesday and prolonged its retracement slide from a near five-year peak, around mid-115.00s touched last week. The risk-off impulse in the markets provided a strong boost to the safe-haven Japanese yen. This, along with a broad-based US dollar weakness contributed to the pair’s ongoing decline.

The global risk sentiment took a hit amid growing concerns about the potential economic fallout from the spread of the new coronavirus variant. The market worries were exacerbated further after The chief executive of drugmaker Moderna warned that existing vaccines will be much less effective at tackling Omicron than earlier strains of COVID-19.

Meanwhile, the developments surrounding the coronavirus saga pushed back market expectations about the likely timing when the Fed would begin tightening its monetary policy. In fact, the money markets now indicate a 25 bps rate hike in September 2022 as against July 2022 already priced in. This, along with the global flight to safety, triggered a steep decline in the US Treasury bond yields.

This, in turn, weighed heavily on the greenback and was seen as another factor that aggravated the bearish pressure surrounding the USD/JPY pair. Apart from this, the downfall could further be attributed to some technical selling below the 113.00 mark. Acceptance below the mentioned handle might have already set the stage for an extension of the corrective slide.

Market participants now look forward to the US economic docket, featuring the release of Chicago PMI and the Conference Board’s Consumer Confidence Index. The focus, however, will be on Fed Chair Jerome Powell’s testimony before the Senate Banking Committee, which might influence the USD. This, along with the broader market risk sentiment, should provide some impetus to the USD/JPY pair.

Technical levels to watch

Full ArticleUS Dollar Index Price Analysis: Pullback could see 95.50 retested

187315 November 30, 2021 22:17 FXStreet Market News

- DXY resumes the leg lower and breaks below 96.00.

- Next on the downside appears the 95.50 region.

DXY fades Monday’s decent bullish attempt and refocuses instead on the area well below 96.00 on Tuesday.

The next significant support comes at 95.51 (November 18), which is also reinforced by the 20-day SMA, today at 95.45.

In the meantime, while above the 2-month support line (off September’s low) near 94.10, extra gains in DXY remain well on the table. In addition, the broader constructive stance remains underpinned by the 200-day SMA at 92.47.

DXY daily chart

FOMC Chairman Powell testifies before Senate Banking Committee live stream – November 30

187314 November 30, 2021 22:12 FXStreet Market News

FOMC Chairman Jerome Powell will be testifying before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen on Tuesday, November 30, at 1500 GMT.

The hearing is entitled “CARES Act Oversight of Treasury and the Federal Reserve: Building a Resilient Economy.”

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System’s principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Full ArticleEUR/USD Forecast: Fears hit the greenback

187312 November 30, 2021 22:12 FXStreet Market News

EUR/USD Current price: 1.1369

- Coronavirus vaccine and drug cocktails seem to lose effectiveness against the new variant.

- European inflation soared to a record high of 4.9% YoY, according to preliminary estimates.

- EUR/USD is bullish in the near term, faces strong Fibonacci resistance at 1.1380.

Risk aversion took over financial markets to the detriment of the greenback. The EUR/USD pair broke higher and peaked at 1.1372 amid mounting concerns about the Omicron coronavirus variant. Moderna’s CEO said that he believes the vaccine effectiveness would probably drop with the new strain, although he said he’s not sure by how much. Also, and according to preliminary estimates, antibody drugs’ cocktails seem to lose effectiveness against this new strain.

European countries continue to take desperate measures to contain the spread of the virus. Greece has made vaccination legally mandatory for those aged 60 and older, while borders’ closures are taking place globally. It’s unclear the extent of the effects on economic growth at the time being, yet this new situation is meant to delay the comeback.

Demand for safety pushed government bond yields to their lowest in almost a month, with the yield on the 10-year Treasury note down to 1.419%. Adding fuel to the fire, EU inflation surged to a record high of 4.9% YoY in November, according to preliminary estimates. The core reading printed at 2.6%, much higher than the previous 2%, piling pressure on the European Central Bank to start trimming facilities.

The US macroeconomic calendar includes the November Chicago Purchasing Managers’ Index and US Federal Reserve chief Jerome Powell’s testimony on the CARES Act before the Senate Banking Committee. The text has already been released, and it shows that Powell will say that factors pushing inflation upward are expected to linger “well into next year.”

EUR/USD short-term technical outlook

The EUR/USD pair trades near the mentioned high, a few pips below the 38.2% retracement of the November slump at 1.1378. The near term picture hints at further gains, particularly if the pair manages to break above the mentioned Fibonacci resistance level. The 4-hour chart shows that it is currently struggling around a bearish 100 SMA, while the 20 SMA maintains its bullish slope below the current level. Technical indicators have reached overbought conditions, holding on to intraday gains and hinting at prevalent buying interest.

Support levels: 1.1305 1.1260 1.1210

Resistance levels: 1.1380 1.1425 1.1470

View Live Chart for the EUR/USD

Full ArticleOPEC November oil output rose 220K bpd

187311 November 30, 2021 22:09 Forexlive Latest News Market News

Reuters secondary sources survey

- OPEC had pledged to increase production by 400k bpd

- Total production was 27.74 mbpd

- Compliance with cuts up to 120% from 118%

Saudi Arabia and Iraq boosted output in line with the agreement along with Kuwait, the UAE and Algeria.

Output fell in Libya due to pipeline maintenance while it fell in Angola to a record low, perhaps owing to tanker schedules.

Full Article

United States Redbook Index (YoY) climbed from previous 15.4% to 21.9% in November 26

187310 November 30, 2021 22:09 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

US: House Price Index rises 0.9% in September to 354.6 from 351.5 in August

187309 November 30, 2021 22:09 FXStreet Market News

According to the latest data from the Federal Housing Finance Agency, the monthly House Price Index rose to 354.6 in September from 351.5 in August, a 0.9% MoM rise. That took the YoY rate of house price increase to 17.7% on the month.

The S&P/Case-Shiller Home Price Index, released by Standard & Poor’s, showed prices rising at a YoY rate of 19.1% in September, slightly below the expected pace of 19.3% and a tad down from August’s YoY rate of 19.6%.

Market Reaction

FX markets have not responded to the latest US house price numbers.

Full ArticleUS Sept FHFA house price index +17.7% y/y vs +18.5% prior

187308 November 30, 2021 22:05 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

United States Housing Price Index (MoM) down to 0.9% in September from previous 1%

187307 November 30, 2021 22:05 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

BoE’s Mann: Premature to talk about timing of rate hikes, much less how much

187306 November 30, 2021 22:05 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Full Article