USD/JPY Forecast: Choppy start of the week ahead of first-tier events

USD/JPY Current price: 103.80

- The market mood turned sour following the release of poor German data.

- Equities and government bond yields are down, limiting USD/JPY advances.

- USD/JPY is bullish in the near-term, but below the critical 104.40 resistance.

The American dollar is up as the sentiment is down in European trading hours after Germany published dismal data. The USD/JPY pair advances within range, now trading in the 103.80 price zone. Local indexes are in the red, erasing early gains, while US Treasury yields are also in retreat mode ahead of the US opening.

The macroeconomic calendar had nothing to offer throughout the Asian session, which helped the dollar’s rivals advance. As for the US, the country will publish the December Chicago Fed National Activity Index and the January Dallas Fed Manufacturing Business Index. Majors may continue to trade in range ahead of the US Federal Reserve decision on monetary policy and the preliminary estimate of Q4 Gross Domestic Product later this week.

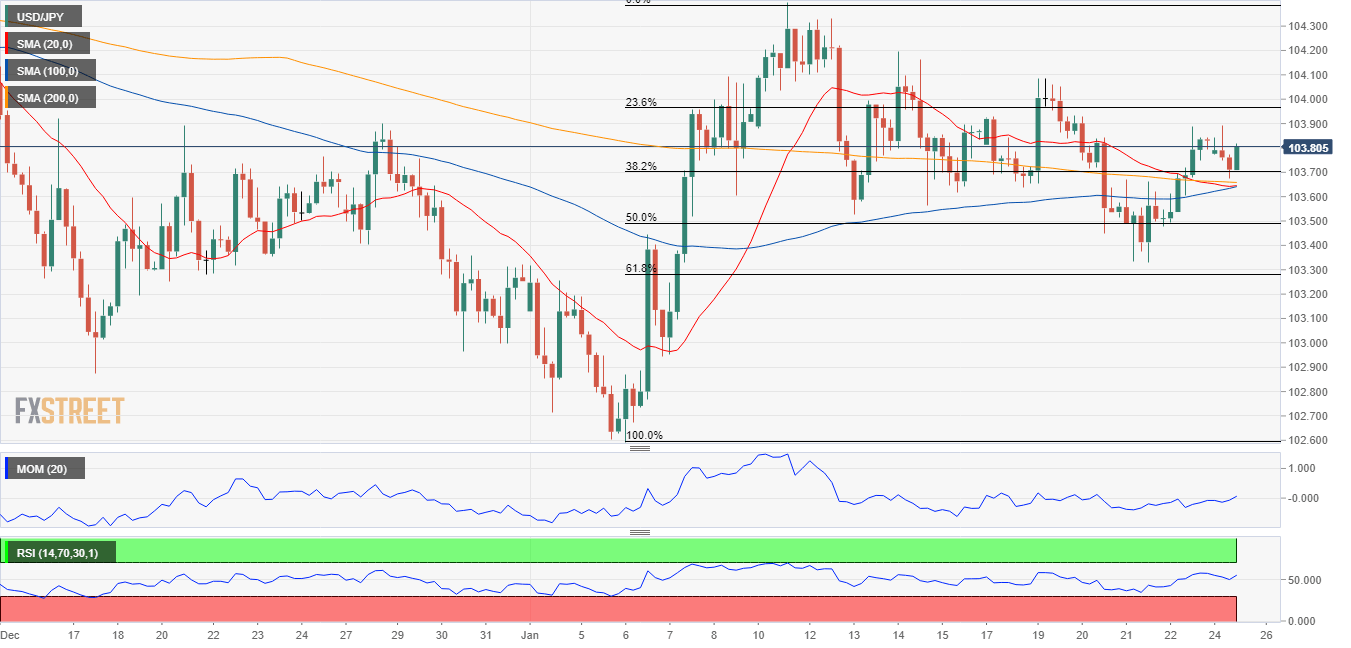

USD/JPY short-term technical outlook

The USD/JPY pair has room to advance in the near-term, trading above the 38.2% retracement of its January rally. The 4-hour chart shows that it has met buyers around congesting moving averages, all of them flat an in a 10 pips range. Technical indicators hold within positive levels, with uneven bullish strength. The next Fibonacci resistance comes at 104.00, while a daily descendant trend line coming from March 2020 comes around 104.25. The monthly high at 104.39 is the level to surpass to confirm additional gains ahead.

Support levels: 103.50 103.15 102.70

Resistance levels: 104.0 104.40 104.80

View Live Chart for the USD/JPY