USD/MXN Price Analysis: Bias still points to the upside despite the recovery of the Mexican peso

- Improvement in risk sentiment helps emerging-market assets, including MXN.

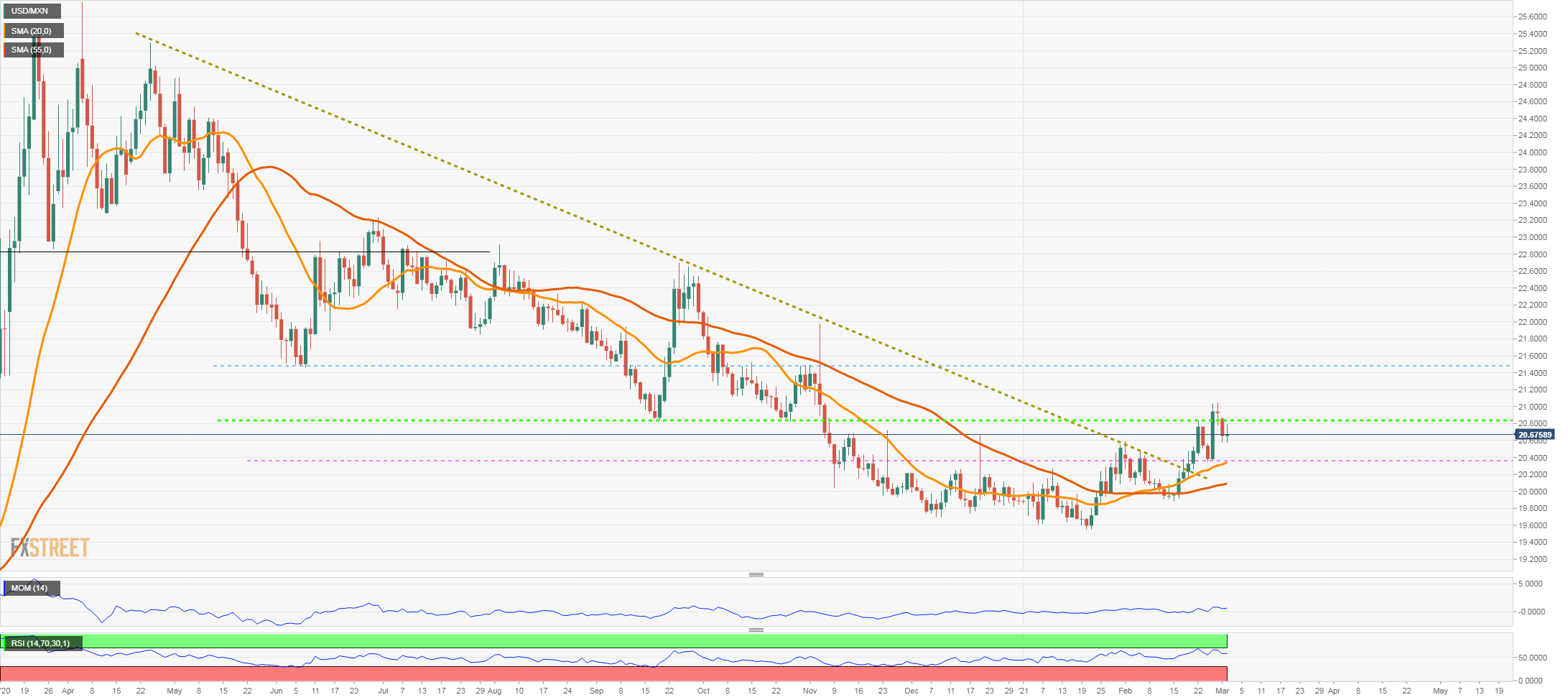

- Bias in USD/MXN points to the upside, faces resistance at 21.00.

The USD/MXN is trading around 20.65, moving sideways in the short-term. The improvement in risk sentiment kept the upside limited on Tuesday. At the same time, a precaution tone is still.

The main short-term outlook is USD/MXN still favors the upside. The key resistance stands at 20.75 that protects the key 21.00 level. A daily close above 21.00 would open the doors to more gains.

While above the 20.30/35 support, the momentum will continue to favor the upside. A break lower would point to further strength in the Mexican peso that should lead to a test of the 20.00/19.90 area.

The outlook continues to favor the US dollar that is facing resistance at 21.00. Higher equity prices in Wall Street should keep the USD/MXN away from 21.00. If stocks start to decline again, then a rally above 21.00 looks likely.