AUD/USD Forecast: Struggling to retain the 0.7800 threshold

AUD/USD Current Price: 0.7787

- Australian Q4 Gross Domestic Product came in at 3.1% QoQ, better than expected.

- Wall Street’s poor performance and rising US Treasury yields weighed on the pair.

- AUD/USD is neutral in the near-term, bulls can build once above 0.7840.

The AUD/USD pair trades around the 0.7800 level ahead of the Asian opening, little changed on a daily basis. During US trading hours, the pair fell to 0.7770 as the greenback got an intraday boost from rising US Treasury yields, while the aussie fell alongside equities, as Wall Street fell at the opening, later recovering and providing support to the pair.

The pair show little reaction to upbeat Australian growth figures, as the Q4 Gross Domestic Product came in at 3.1% QoQ, better than the 2.5% expected. The February Commonwealth Bank Services PMI printed at 53.4, down from 54.1 in the previous month, while the AIG Performance of Construction Index came in at 57.4 from 57.6 previously. During the upcoming Asian session, Australia will publish the final version of January Retail Sales and the Trade Balance for the same month.

AUD/USD short-term technical outlook

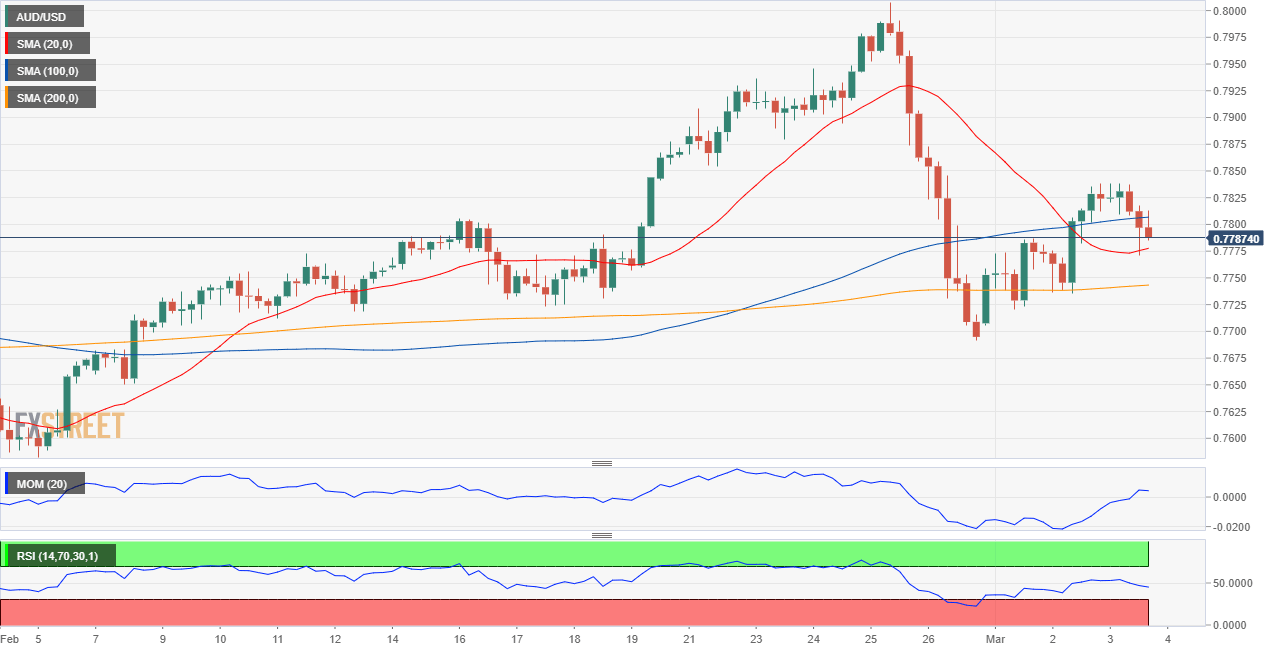

The AUD/USD pair is struggling to extend gains beyond the 0.7800 threshold, neutral in the near-term. The 4-hour chart shows that it´s trading between directionless moving averages, while the Momentum indicator retreats within positive levels, and the RSI consolidates around 47. Further gains are to be expected on a break above 0.7837, the weekly high.

Support levels: 0.7770 0.7730 0.7690

Resistance levels: 0.7840 0.7880 0.7920

View Live Chart for the AUD/USD