ForexLive Americas FX wrap: Strong jobs report sparks a wild ride

Read full post at forexlive.com

Read full post at forexlive.com

Forex news for New York trade on March 5, 2021:

Markets:

- US 10-year yields down 4 bps to 1.55%

- Gold up $1 to $1698

- WTI crude up $2.44 to $66.27

- S&P 500 up 73 points to 3841

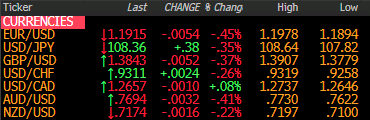

- CAD leads, EUR lags

Non-farm payrolls delivered yet another whipsaw to short-term traders. It’s clear that the playbook going in was to sell risk, sell bonds and buy the US dollar on a strong report. When it came in very strong that’s just what happened.

As a result, the US dollar jumped, yields hit new cycle highs and stocks sank. That didn’t last though. At the end of the day, a strong economy is still a strong economy and even as yields rose, it wasn’t disorderly. That led to some bottom fishing at first that picked up as yields topped.

Just as things began to rebound through, the bottom fell out again as tech stocks crumbled in part due to a 10% drop in the ARKK ETF. That briefly pulled down everything but it also reversed the rise in yields. In turn, dip buyers came again and this time it sustained in a big, slow move higher.

The moves were much bigger in equities than in FX but there were positive ticks in commodity currencies late and some USD selling. CAD was particularly strong late as oil rose above $66.

Have a great weekend.