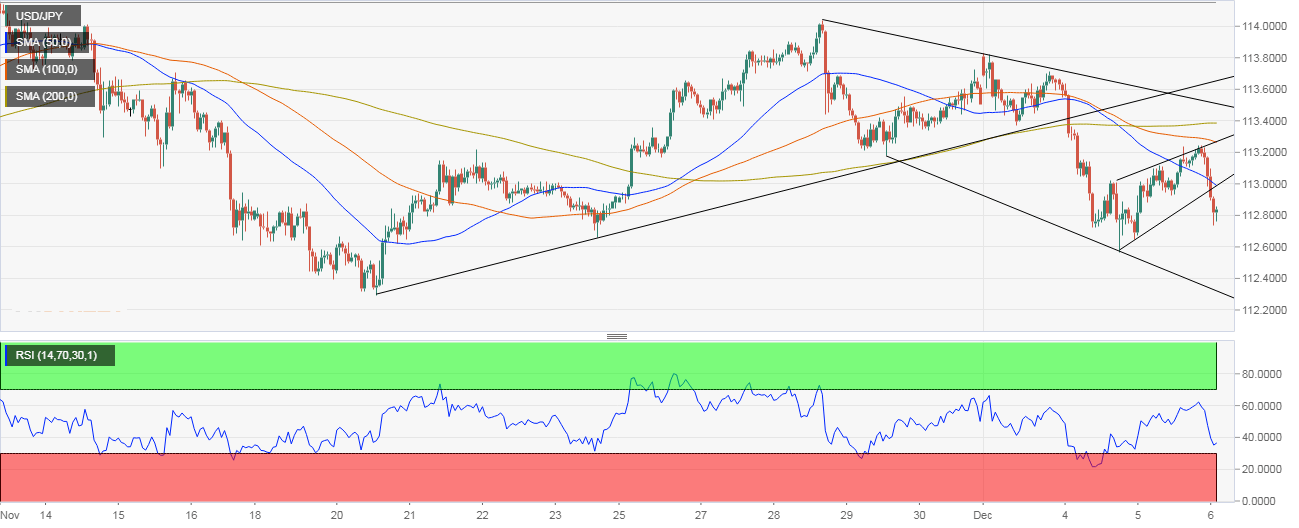

USD/JPY Technical Analysis: Bears eyeing Tuesday’s low of 112.58 after rising wedge breakdown

The USD/JPY looks set to test the support at 112.58 (Tuesday’s low), having suffered a rising wedge breakdown earlier today.

A deeper drop below that level, possibly to the 100-day moving average (MA) of 112.24, cannot be ruled out as the US treasury yield curve inversion is being read as a sign of impending economic recession.

Hourly chart

- As seen above, the pair has established a bearish falling channel, having breached the rising trendline earlier this week.

- The rising wedge breakdown seen earlier today indicates the sell-off from the Dec. 3 high of 113.71 has resumed.

- The major averages (50, 100, and 200) are located one below the other, indicating the path of least resistance is on the downside.

Trend: Bearish

USD/JPY

Overview:

Today Last Price: 112.83

Today Daily change: -39 pips

Today Daily change %: -0.344%

Today Daily Open: 113.22

Trends:

Previous Daily SMA20: 113.35

Previous Daily SMA50: 113.09

Previous Daily SMA100: 112.25

Previous Daily SMA200: 110.52

Levels:

Previous Daily High: 113.24

Previous Daily Low: 112.65

Previous Weekly High: 114.04

Previous Weekly Low: 112.88

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 113.02

Previous Daily Fibonacci 61.8%: 112.88

Previous Daily Pivot Point S1: 112.83

Previous Daily Pivot Point S2: 112.44

Previous Daily Pivot Point S3: 112.24

Previous Daily Pivot Point R1: 113.43

Previous Daily Pivot Point R2: 113.63

Previous Daily Pivot Point R3: 114.02