WTI in fresh 2019 peaks beyond $57.00

- Prices of the WTI climbs further north of the $57.00 mark.

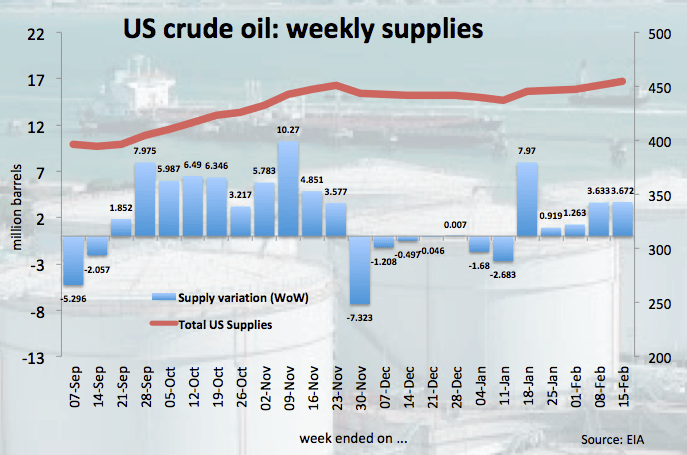

- EIA reported US supplies rose by nearly 3.7 mb last week.

- Baker Hughes’ oil rig count next of relevance later in the day.

Prices of the barrel of the WTI keep the upbeat tone so far this week and are now trading in fresh 2019 tops near the $57.30 mark.

WTI looks to data, trade

The barrel of West Texas Intermediate has been inching higher in recent sessions on the back of rising hopes on a US-China trade agreement. In this regard, President Trump is expected to meet Chinese Vice Premier later today following this week’s talks.

The recent progress in trade talks has motivated oil traders to ignore another weekly build in US crude oil supplies, this time by nearly 3.7 M barrels, as reported by the EIA on Thursday.

Later in the session, driller Baker Hughes will publish its weekly report on US oil rig count.

What to look for around WTI

Hopes of a US-China trade deal have lent extra oxygen to crude oil prices in past sessions and this should remain a key driver in the very near term. On the broader picture, the ongoing OPEC+ agreement to curb oil production, US sanctions against Venezuelan and Iranian oil exports and the so-called ‘Saudi Put’ are seen propping up the upbeat sentiment in crude prices.

WTI significant levels

At the moment the barrel of WTI is gaining 1.06% at $57.09 facing the next hurdle at $57.25 (2019 high Feb.22) seconded by $58.00 (high Nov.16 2018) and then $59.63 (50% Fibo retracement of the October-December drop). On the downside, a break below $55.22 (10-day SMA) would aim for $54.32 (21-day SMA) and finally $51.15 (low Feb.11).