S&P 500 Futures: Rejection at 3,300 exposes critical 3,251 support – Confluence Detector

S&P 500 futures met supply following rejection at the 3,300 level, undermined by the shift in the risk sentiment amid US fiscal wrangling and coronavirus concerns. With the latest leg down, the path of least resistance appears to the downside ahead of the US open and macro data.

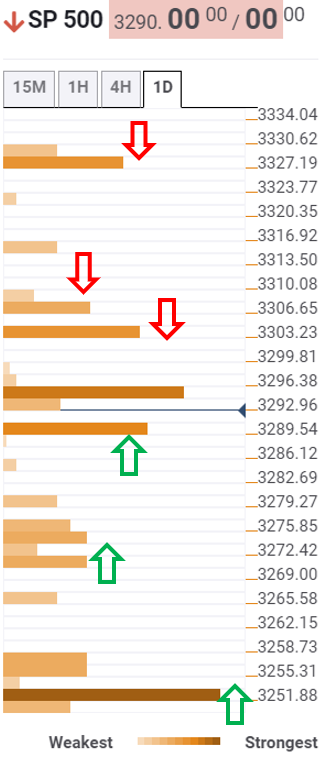

S&P 500 Futures: Key resistances and supports

The Technical Confluences Indicator shows that the S&P 500 futures is defending the 3,289 support, which the confluence of the Fibonacci 38.2% one-day, previous low four-hour and SMA50 15-minutes.

In absence of significant support levels, the US futures will directly test the 3,275/70 demand area, where the previous week high, pivot point one-week R1 and SMA10 four-hour intersect.

A failure to resist above the latter will likely expose the critical support at 3,251, the convergence of the previous year high and pivot point one-day S2.

Alternatively, the buyers could probe the 3,303 (previous day high) barrier on a break above the 3,300 level.

Further north, the hurdle awaits at $3306/08, where the previous high four-hour and pivot point one-week R2 coincide.

The next powerful resistance is aligned at 3,327, the pivot point one-month R1.

S&P 500 Chart

Here is how it looks on the tool

Confluence Detector

The Confluence Detector is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence