US jobs recovery extends, but uncertainty and volatility remain high

US initial jobless claims dropped below one million for the first time in this coronavirus crisis. Alongside a significant increase in Non-Farm Payrolls, is there room for optimism, or is the recovery slowing? Valeria Bednarik, Joseph Trevisani, and Yohay Elam debate the recent trends in the US economy and markets, including the recent bond-induced dollar action.

Yohay Elam: US initial jobless claims dropped below one million for the first time since the coronavirus crisis, the first in 21 weeks. Can this improvement be attributed to the expiry of federal unemployment benefits?

Joseph Trevisani: I believe they were extended but at a lower level by executive order?

Valeria Bednarik: I was thinking exactly that, maybe more people rushed to work as they had no more benefits, or at least, not as much as they had, and yes, but were extended just this weekend, and after benefits expired a couple of weeks ago

Yohay Elam: As far as I understand, the executive order has yet to be executed

Joseph Trevisani: Perhaps the economy is improving. Why not take the optimistic note.

Yohay Elam: Indeed, the data is for the week ending August 7, before the EO. I also think it is about the recovery more than benefits

Joseph Trevisani: Indeed

Yohay Elam: It goes hand in hand with a drop in coronavirus cases

Joseph Trevisani: Claims have been the canary in this pandemic…

Valeria Bednarik: Drop-in cases have been put on doubt by a study published yesterday. Coronavirus cases are down 19% last week from the previous two weeks averages. Yet in the same period, testing was down by 12%.

Yohay Elam: Eid the positive test rate rise?

Joseph Trevisani: PMI new orders in services were at their highest level in July on record. It would be odd if that much new or returning business did not prompt hiring.

Valeria Bednarik: Same study shows that in Texas, new cases have fallen by 10% over the last two weeks, but testing is down by 53% over the same time.

Yohay Elam: In Texas, the governor said he is not easing restrictions despite the improvement. I guess he is aware of fewer tests. PMIs have shown leaps in new orders but depressed employment components

Valeria Bednarik: The % of positive tests in Texas has doubled over the last two weeks to about 24%, according to the same report. Anyway! guess exhaustion about the ongoing situation also adds to the whole picture. We are lucky to be working but how long would you stay home doing nothing for health’s sake?

Joseph Trevisani: I believe fatalities are falling too, except in Florida.

Yohay Elam: Deaths dropped, but flattened again above 1,000 per day

Joseph Trevisani: True, I agree with the exhaustion. If claims continue to go down we might expect a strong August NFP.

Valeria Bednarik: Yeah, and guess the market will start pricing that in next week, with another batch of positive figures, and the official release will be once again a non-event.

Joseph Trevisani: One problem is the difference between reported and actual. Does that chart list the date of death or the report? they are not necessarily the same thing and can skew the result.

Yohay Elam: Next week’s initial claims are for the current week, ending August 14, which is NFP survey week

Valeria Bednarik: Yups, exactly

Yohay Elam: There are indeed issues with the data. It is clear the trend is to the downside, but the situation is still far from being under control. Dr. Deborah Birx said it is more widespread than thought, getting into rural communities

Joseph Trevisani: No doubt it is. Every serological study shows that and for some studies, the factor is 3 and 4 times.

Valeria Bednarik: Agreed, more widespread. Deaths seem stable and slowly decreasing as new contagions are younger people which has a higher rate of survival.

Joseph Trevisani: Perhaps the economy has turned an important corner here

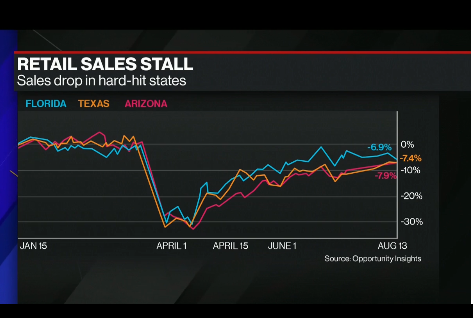

Yohay Elam: Maybe in New York, but not in hard-hit states

Joseph Trevisani: Well, as for NYC, I’ll let you know when we return in three weeks

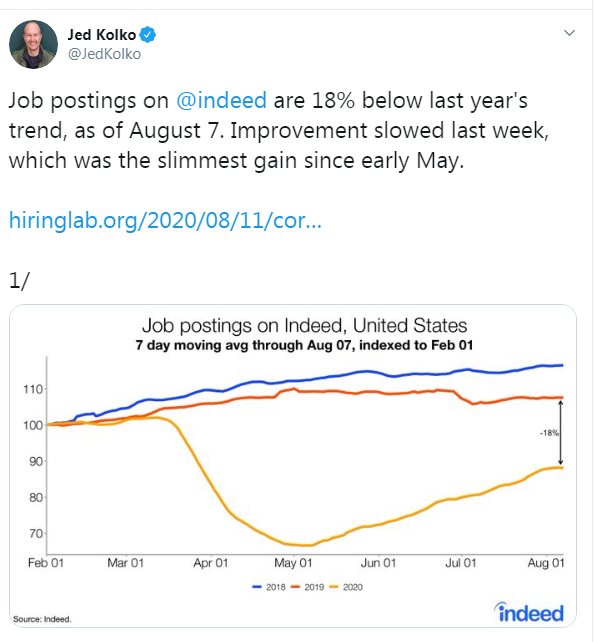

Yohay Elam: A tweet by Jed Kolko, Chief Economist at Indeed

Joseph Trevisani: I am not so sure about the stall. CPI was much stronger in July than expected. You need demand for that to be true.

Yohay Elam: For me, it’s still the bounce from the deep lows, but losing steam. The swoosh in the Nike logo is flattening

Valeria Bednarik: Yes

Joseph Trevisani: Indeed, the job market may not represent the national market. Remember the last ADP report.

Yohay Elam: ADP is undoubtedly off the rocker, but the trend of a slowdown in job restoration was seen in July’s NFP

Joseph Trevisani: Yes, I would think they have done their report serious damage with the misses and then the revisions.

Yohay Elam: ADP hired a top-notch economist a few years ago and he improved their figures, but have proved susceptible to the virus. Eric Rosengren of the Boston Fed said that temporary job losses may turn permanent

Valeria Bednarik: I already mentioned this, but the world is losing roughly 500 million jobs within this pandemic

Joseph Trevisani: I am sure many already have, small businesses have failed, in urban areas with no foot traffic like NYC, how can they survive?

Yohay Elam: Half a billion, hard to grasp

Joseph Trevisani: There is also an opportunity in this as well, though it may take some time for it to show

Valeria Bednarik: Of course, every crisis is an opportunity, but not for all.

Joseph Trevisani: This week’s improvement in claims was 20%, a nice round number, well 19.1%.

Valeria Bednarik: Still, the US needs to recover what? some 50% of the jobs lost in March and April right?

Yohay Elam: 58%. 42% were restored

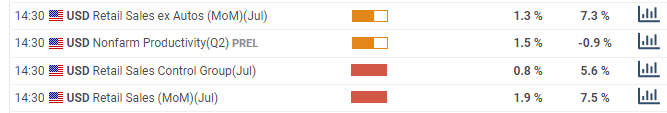

Joseph Trevisani: Yes, 42% back so far. Tomorrow’s retail sales are forecasted to drop sharply, I have my doubts

Yohay Elam: Around 70% of the US economy is centered on consumption if I’m not mistaken

Valeria Bednarik: Woha… quite a number

Joseph Trevisani: Yes. that is the usual figure

Yohay Elam: That should be a big market mover, but so many other figures have failed to move currencies. And then came this yield roller coaster out of nowhere

Joseph Trevisani: In May and June, overall retail sales doubled forecasts 25.7% vs 13%

Yohay Elam: Small increases are expected for July’s retail sales

Joseph Trevisani: Quite a rise in the 10-year.

Valeria Bednarik: Could have doubled forecast but are still below pre-pandemic levels. That’s the mark that should turn non-events into events

Joseph Trevisani: Yes, but I think there is cause for optimism on the sales in July. No here, I disagree. Pre-pandemic comparisons are for economists, not markets.

Yohay Elam: Why?

Joseph Trevisani: I think markets care where we are going and how fast, not in where we were in January. Markets price the future, not the past

Valeria Bednarik: But today, markets care about when economies are going to return to normal when there will a chance of actual growth, and such a chance won’t come when we are just recovering March/April slumps

Yohay Elam: Markets are also moving on where investors see the value and where they don’t. Bond yields are poor, real estate uncertain, and all the money sloshing around goes to markets. There is no alternative

Valeria Bednarik: Real estate is a mid-term opportunity

Yohay Elam: Vaccine hopes may be real, albeit not the Russian version…

Joseph Trevisani: There is the bond market, 10-year rates are up sharply this month. There is a great deal of profit in these bond levels. It might not take much for a serious bond selloff.

Valeria Bednarik: Yeah, vaccine hopes are real. About bonds, the 10-year note yield is at around 0.66%, it was above 2.0% in February. Even if we have a sell-off, we are still heading into pre-pandemic “normal”

Yohay Elam: It was above 3% not that long ago, seems far now

Valeria Bednarik: Also. Just come to my mind that we get used to things too quickly. The market cheered the lastest yields’ bounce, which anyway, stand at record lows

Yohay Elam: Higher yields allow the Fed to enact Yield Curve Control. More bond buying, better for stocks, one of many lines of thought. If yields continue higher, will the dollar follow once again? Or was this week’s action just a summer blip?

Joseph Trevisani: I think the Fed would be gals to revert to a more normal policy if possible. Y2C, as I like to call it, it a drastic policy. It assumes the Fed knows better than the markets. A dubious proposition only to be used in dire circumstances. Glad to revert

Yohay Elam: The Fed’s inflation forecasts in the past decade have shown it doesn’t know everything…

Joseph Trevisani: You are being kind

Valeria Bednarik: Ha!

Joseph Trevisani: My view is that the Fed knew well that their forecasts were ‘optimistic’ but since price stability is one of their mandates and they have defined it as 2%, they had no choice. At no time in the decade after the financial was inflation one of their top, but they are obliged to pay its rhetorical homage.

Yohay Elam: They raised rates to stay ahead of the inflation curve and now they want to see the white in inflation’s eyes before considering raising rates. Powell makes Yellen look like a fierce hawk

Joseph Trevisani: It’s just that the Fed has far greater issues than whether inflation is at 2%. As long as prices are not threatening to deflate. and besides what the Fed would do to counter low inflation, it is already doing

Yohay Elam: So, if jobs are picking up and inflation remains low, what’s next for the dollar?

Joseph Trevisani: Claims point the way but we will need more substantial data for the dollar to recover, retail sales, NFP, and consumer confidence. In the meantime, watch Treasury yields.

Valeria Bednarik: Guess I have to agree with that. No time for a bullish dollar

Joseph Trevisani: Not yet at any rate. Historically the US recovers faster. We shall see if tht remains true?

Valeria Bednarik: Yups, wait-and-see now

Yohay Elam: Yep, agreed. So many unknowns at this point, the trend of the virus, fiscal support, relevant not only for the US

Valeria Bednarik: Uncertainty keeps as busy. Can you imagine how boring it would be if we had all the answers?

Joseph Trevisani: Utopia is always boring.

Yohay Elam: Last year we had lots of uncertainties without volatility. This year, even EUR/USD is moving…

Valeria Bednarik: Point there, no doubts