ForexLive European FX news wrap: Yen, dollar advance on risk-off wave

Read full post at forexlive.com

Read full post at forexlive.com

Forex news from the European trading session – 21 September 2020

Headlines:

Markets:

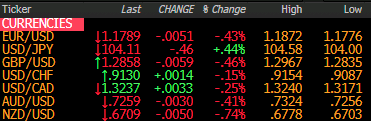

- JPY leads, NZD lags on the day

- European equities down heavily; E-minis down 1.5%

- US 10-year yields down 3.4 bps to 0.659%

- Gold down 1.1% to $1,930.45

- WTI down 1.9% to $40.32

- Bitcoin down 2.6% to $10,602

It was a quiet session in terms of headlines but market movement was certainly anything but, as we see another wave of risk aversion sweep across to start the week.

European futures pointed to a more dour start and the selling picked up upon the cash market open, with US futures also seeing losses accelerate during the session.

The DAX turned a 1% decline to a little over 3% now, with S&P 500 futures seeing a drop from around 0.5% to 1.5% as we look towards North American trading now.

The move prompted additional flows into the yen, which was the main beneficiary in the currencies space. USD/JPY slipped to a six-month low from 104.30 to 104.00.

Meanwhile, the dollar was a touch softer initially to start the day but turned things around as the risk-off mood intensified. EUR/USD fell from 1.1860 to 1.1776 while GBP/USD fell from a high of 1.2967 to 1.2835 as sellers seized near-term control.

Commodity currencies were also hit as AUD/USD fell from 0.7320 to near the lows now at 0.7256, with NZD/USD also easing from 0.6770 to near 0.6700 currently.

Renewed virus fears is weighing on banking and travel stocks in Europe, while US stocks are on edge after barely staving off a fall below the previous September low on Friday.

The risk mood is going to be the key spot to watch as we start the week, with focus also set to shift on Fed chair Powell over the next few days as well as US stimulus talk – which is going to be a key driver for the dollar as well alongside the risk mood.