Five big election questions

Read full post at forexlive.com

Read full post at forexlive.com

The countdown to the vote is on but so much is undecided

We’re just 15 days

away from the US election, an event which dominates conversations in the

markets, as it does in everyday life. There is so much that can happen between

now and the 3 November and we watch for this week’s third (and final)

Presidential for signs that Trump can claw back some ground in the national and

state polls. Fiscal remains the buzzword, but forget the Republicans move to

pass a $500b bill, it will not see the light of day and expectations of a new

stimulus bill have been pushed into 2021.

If the market

continues to believe a ‘Blue Wave’ (I.e. Biden in the White House, and the

DEM’s in the House and Senate) is the likely outcome then volatility and market

positioning shouldn’t shift too greatly.

That said, while

everyone has questions, here are a few that I continue to consider.

1) Contested vs

accepted. While expectations of a

contested election have receded a touch of late, it is still the dominant

question. Looking across the options landscape, I still see so much hedging of

potential drawdown in risk assets that it makes me question whether any

outcome, be it Trump or Biden, Blue wave or split Congress doesn’t actually

matter – the fact we have certainty and we know what the business landscape

looks like, could be enough to cause an unwind of contested hedges and sheer

relief that a decision will not involve the Supreme Court. Even if this relief

is short-lived remember that markets love certainty.

2) What are stimulus

expectations? The belief, at least from the optimists, is that fiscal will

continue to support, and when married with incredibly accommodative central

bank policy should drive consumption, an earnings recovery and even inflation

in 2021. This is also conditional on a vaccine being rolled out next year and

COVID-19 hospitalization rates remaining low. At this stage, there are high

expectations that if Biden can get the White House (WH) and have full control

of Congress that he’ll push through a $3.5t fiscal program in early 2021, a

fate that could have sizeable implications for inflation expectations and

markets more broadly. If Biden gets the WH but the REP’s hold the Senate, the

next most probable scenario (according to the odds), then there is little

chance the GOP will pass this size stimulus and we’ll be looking at something

closer to $1t.

Should Trump get the WH and we see a split

Congress (the DEMs seem assured of the House) then we can expect a stimulus of

$500b to $1t.

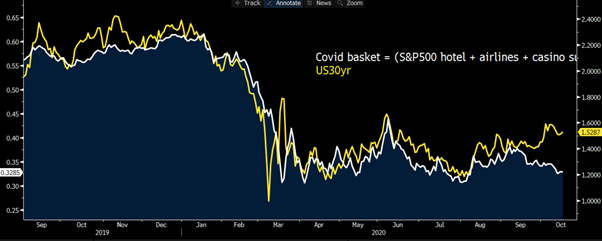

3) To what degree is

the ‘blue wave’ scenario already priced? If we look at betting

site Predicit they have a ‘blue wave’ scenario priced at 58%, with

Superforecaster at 61%. So, there is still a large degree of doubt, and this mostly

lies with the DEM’s ability to take the Senate, which seems a close call. In

terms of markets, the idea that a ‘Blue Wave’ would set off a reflationary

trend in assets can loosely be seen in the US bond market with the 30-year

Treasury pulling higher from my simple COVID basket and US 10-year yields

widening to 136bp over German bunds, although Europe also has a pressing

inflation problem.

In the rates market, we

see the first rate hike from the Fed has been brought forward over the past

month from June to March 2024, reflecting a view that the Fed may have to

tackle higher inflation if the DEM’s can push through a $3t+ stimulus in 2021.

If markets were fully reflecting a ‘Blue Wave’, I’d expect good sellers of

various 2024 Eurodollar interest rates contracts, and a repricing of the first

hike to late 2023.

In equity markets, we’ve

seen a strong outperformance from the MSCI Global Alternative Energy Index over

the MSCI Energy Sector, a reflection that Biden will try to push through a $2t

green energy bill. Elsewhere, if the market was truly fully positioned for a

‘Blue Wave’, I’d have expected small caps to outperform large caps and a more

bullish trend in cyclical sectors vs defensives and value over growth stocks.

(Blue – MSCI energy

index, white – alternative energy index), orange – Predicit chance of ‘Blue

Wave’)

4) Is a ‘Blue Wave’

really that USD negative? I’ve written about this and consensus thinking

is that this scenario would be a USD negative, as a massive fiscal stimulus

would radically increase the budget deficit and after a period where nominal

Treasuries sell-off (yields higher), we’d see the Fed respond with new measures

to keep government borrowing costs in check. This should have the effect of

lowering real (or inflation-adjusted) Treasury yields, which has been a big USD

negative. However, the other way to think about this is from the relative

attractiveness of the US as an investment destination. Perhaps the US again becomes

the most desirable place to park your capital, and we see massive capital

inflows, which has the effect of strengthening the USD?

Maybe the consensus is

seeing this wrong and this scenario is a USD positive. Could we, therefore, see

gold rising with a strong USD?

Consider Biden in the WH

and a split Congress. Gridlock means less fiscal support and therefore more

work for the Fed to bring down real rates and achieve its policy objective.

Could this be the bear case for the USD? Short USDMXN would be the trade for me

here given improved relations with key trade partners.

5) Would a Biden

government be a game-changer for US tech? Potentially, but the US tech sector is hardly underperforming on

recent news flow, and investors don’t seem worried at this stage. Much of the

DEM old guard, as well as Kamala Harris, are close to big tech, and despite

policies expressed by Bernie Sanders or Elizabeth Warren, which if implemented

would almost certainly be a game-changer, the market still feels that tech

works well in a low yield world. The market senses that life will become

problematic for US big tech, with a Biden administration eyeing their

monopolistic qualities, but whether we see a dramatic shift into value (such as

banks or materials) is yet to be seen.

Naturally, there are many more that spring to mind, such as when

we actually get an outcome or future trading relationships. However, these are

a few that are top of mind