GBP/USD Forecast: Dead cat bounce, UK coronavirus curve set to pressure pound

- GBP/USD has been attempting a recovery amid some dollar weakness.

- Rising UK COVID-19 cases, lack of improvement in international relations set to send sterling down.

- Tuesday’s four-hour chart is showing a dead-cat bounce, implying further falls.

Eat out to help out – the scheme that gives Brits a boost to have a meal out on weekdays has kicked off – and the economy needs any help it can get. After depressing the coronavirus curve and settling for a localized lockdown in Leicester, the picture has changed.

Thursday’s announcement of new restrictions affecting around 4.3 million people, talk of a lockdown in London remains prevalent. Whitehall officials claim it is only a worst-case scenario, but the mere idea of slapping new limitations on one of the world’s financial capitals is weighing on the pound.

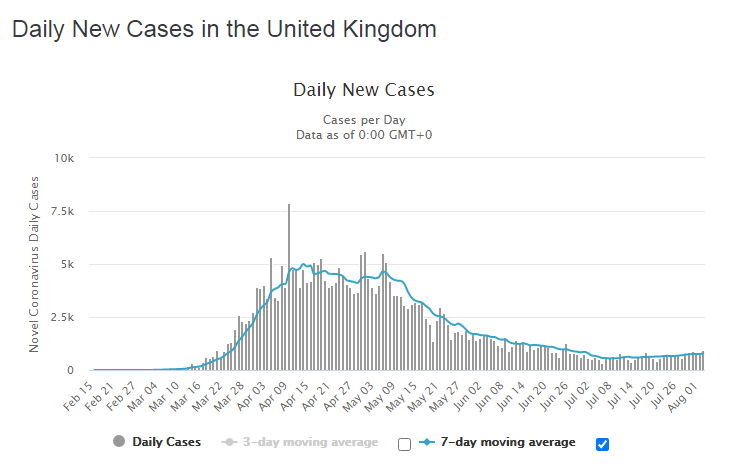

Prime Minister Boris Johnson’s comments on slowing down the reopening have come in response to the broad rise in infections:

Source: WorldInfoMeter

While coronavirus statistics dropped on Monday, investors know it is due to the “weekend effect” and that increases are due on Tuesday.

Sterling is also suffering from the lack of progress in Brexit talks, nor in trade negotiations with the US. International Trade Secretary Liz Truss is in America, for talks with Robert Lighthizer, the US Trade Representative. Expectations remain low.

Sino-American relations are also tense, with the recent row focusing on TikTok and its potential for holding sensitive information. ByteDance, the owner of the popular Chinese social media firm will likely be forced to sell TikTok, potentially to Microsoft.

The world’s largest economies are also at loggerheads over Hong Kong, where Britain has an interest as well. Any further worsening of relations between Beijing and London could weigh on the pound.

Later in the day, US factory orders for June are of interest, yet investors are already eyeing Friday’s Non-Farm Payrolls figures. While the ISM Manufacturing Purchasing Managers’ Index beat estimates, the employment component remained depressed, pointing to a weak labor market.

See US Manufacturing PMI Rebounds to 16 Month High in July:

Speculation about the NFP and an update on US COVID-19 cases and deaths have the potential to down the dollar, countering pound weakness.

All in all, both sterling and the greenback have their issues, with the dollar probably looking better at this point.

GBP/USD Technical Analysis

Pound/dollar has risen from the lows near 1.30 but failed to stage a meaningful recovery. This “dead cat bounce” pattern – as well as setting lower highs – is pointing to weakness. Moreover, GBP/USD has failed to recapture the uptrend channel that characterized it last week.

On the other hand, momentum remains positive and the currency pair is holding above the 50, 100, and 200 Simple Moving Average. Overall, the bears are in the lead, but bulls have not thrown the towel.

Resistance awaits at 1.3110, the daily high, followed by 1.3170, last week’s peak. The next lines to watch are 1.32 and 1.3270.

Support is at the daily low of 1.3050, then Monday’s trough of 1.3005. It is followed by 1.2975, 1.29, and 1.2845.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed