ForexLive Americas FX news wrap: Back and forth but relatively subdued

Read full post at forexlive.com

Read full post at forexlive.com

Forex news for North American trading on October 23, 2020:

Markets:

- Gold down $2 to $1902

- US 10-year yields down 2 bps to 0.836%

- S&P 500 up 12 points to 3465 (down 0.5% on the week)

- WTI crude oil down 88-cents to $39.76

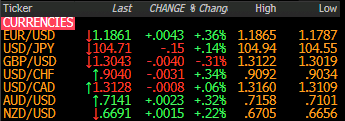

- EUR leads, GBP lags

We may have settled into a pre-election lull as it was a day of ebb and flows but not much conviction.

Sterling continues to be the mover as it gave back another big chunk of Wednesday’s rally in a fall as low as 1.3020 before bids ahead of the figure gave it a little lift late. The news that negotiations were back on led to the big lift but no one wants to ride the rollercoaster for the next three weeks. There was a big pop on a report that France was telling fishermen to quotas next year will be lower but it was quickly sold.

The euro showed some impressive resilience to more worrisome COVID numbers throughout the continent. It ended up having a nice week, which is either a sign of resilience or a sign of investors getting out of US-assets on election fears.

The loonie was soggy as oil slumped on news that Libya planned to double oil production to 1mbpd in four weeks.

The Australian dollar fared a bit better as it tracked the ebb and flows of broader sentiment. US stocks wobbled mid-day but found a footing late and AUD/USD finished the day 20 pips higher.

Have a great weekend.