EToro could limit buy orders over the weekend as demand for Bitcoin and other cryptocurrencies soars

- Etoro sees an unprecedented surge in demand for BTC as price inch close to $40,000.

- Cryptocurrency trading platforms are struggling with limited liquidity amid soaring prices.

- Bitcoin is eyeing a spike to $40,000 and beyond, following a recovery above $37,000.

The cryptocurrency market is in a bull cycle, bringing extraordinary demand for Bitcoin and other digital assets. Thus, eToro, a leading trading app, anticipates a surge in the market, especially for Bitcoin over the weekend session.

Traders likely to face difficulties due to low liquidity

EToro Ltd. sites possibilities of low liquidity hampering trading activities on its platform. Demand for the cryptocurrency is high at the moment, especially with BTC grinding closer to $40,000 after a gradual recovery from $30,000. According to the email sent to the clients by the Israeli-British company:

The unprecedented demand for crypto, coupled with limited liquidity, presents challenges to our ability to support BUY orders over the weekend.

In light of this, it may be necessary for us to place limitations on crypto BUY orders over the weekend.

This communication highlights the challenges trading platforms are facing amid rising Bitcoin prices. Earlier this week, the pioneer crypto hit a higher low at $30,000 but has since rebounded, stepping above $37,000. As the weekend draws nigh, BTC could spike beyond $40,000 again and perhaps set a new record high.

EToro could limit buy orders as it sees fit to ensure that operations on the platform are not interrupted. A spokeswoman from the company said on Wednesday that it is not eToro’s wish to impose restrictions, “but the crypto markets are incredibly volatile at the moment, and the weekends present the greatest challenges.”

Bitcoin spike to $40,000 depends on one crucial level

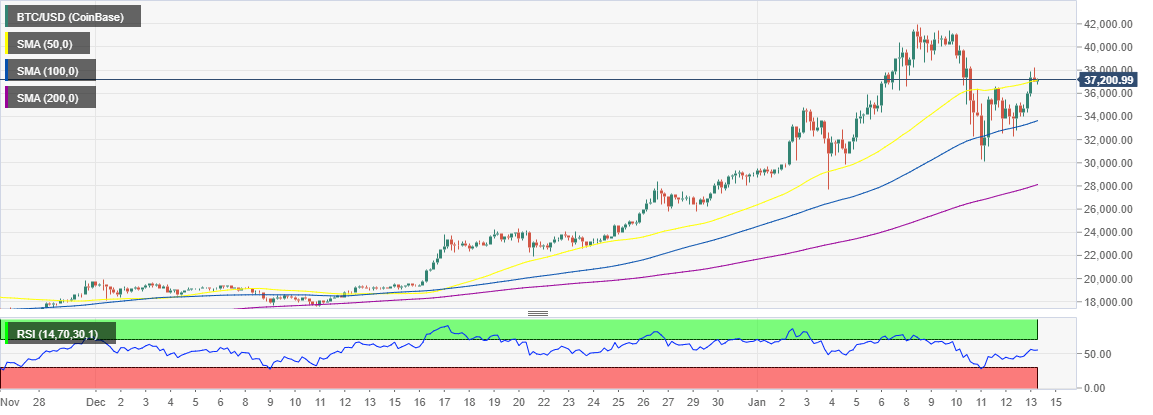

The bellwether crypto is holding above $37,000 and exchanging hands at $37,150. On the upside, the next hurdle at $38,000 has been tested but not broken. Immediately on the downside, Bitcoin is supported by the 50 Simple Moving Average on the 4-hour chart.

To finalize the leg up to $40,000, Bitcoin must defend the short term support at $37,000 as well as the 50 SMA firmly. On the other hand, the seller congestion at $38,000 must come down.

Traders can also watch the Relative Strength Index because lateral movement at the midline will signify consolidation. Simultaneously, a trend toward the overbought region will hint at a possible run-up to $40,000.

BTC/USD 4-hour chart

It is worth keeping in mind that Bitcoin is exceptionally volatile at the moment. Therefore, declines toward $30,000 cannot be ruled out. Trading under the 50 SMA and $37,000 may call for more sell orders. If enough selling volume is created, overhead pressure will rise, forcing Bitcoin onto crucial support levels at $36,000, $34,000, and $30,000.