Gold Price Analysis: XAU/USD rallies to test descending trend-line hurdle, around $1860 level

- Gold caught some aggressive bids in the last hour and rallied to fresh session tops.

- Mixed oscillators warrant some caution before placing any aggressive bullish bets.

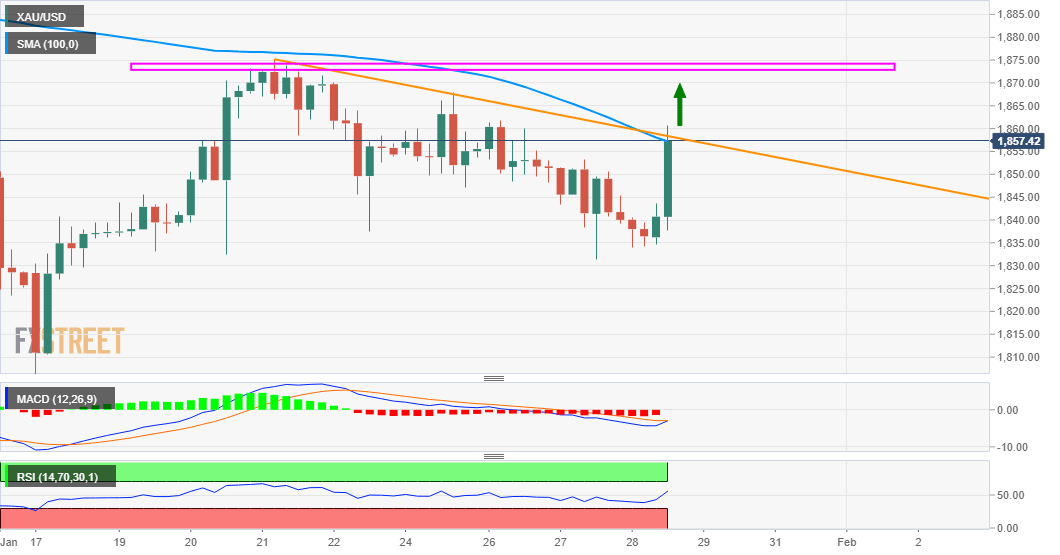

Gold witnessed a dramatic turnaround during the early North American session and rallied over $20 in the last hour. The commodity jumped to fresh daily tops, around the $1860 region, with bulls now looking to build on the momentum beyond a one-week-old descending trend-line resistance.

The emergence of some heavy selling around the US dollar was seen as one of the key factors that prompted some short-covering around the dollar-denominated commodity. That said, a dramatic positive turnaround in the equity markets could cap any further gains for the safe-haven XAU/USD.

Moreover, neutral oscillators on the daily chart and slightly overbought RSI on the 1-hourly chart further warrant some caution for aggressive bullish traders. This makes it prudent to wait for some strong follow-through buying before positioning for any further appreciating move.

Hence, any subsequent positive move is likely to confront stiff resistance near weekly tops, around the $1868-70 supply zone. A sustained move beyond will be seen as a fresh trigger for bullish traders and assist the XAU/USD to reclaim the $1900 mark for the first time since January 8.

On the flip side, the $1848-47 region now seems to protect the immediate downside. This is closely followed by support near the $1840 area and weekly swing lows, around the $1830 region. Failure to defend the mentioned levels might turn the XAU/USD vulnerable to slide further.

The downward trajectory might then drag the yellow metal back towards challenging monthly lows, around the $1800 mark touched last week.