Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin explosion eyes $40,000, crypto bull cycle intact

- Bitcoin bulls’ efforts pay up as the price spikes above $38,000 in readiness for another run-up to $40,000.

- Ethereum is on the verge of a 17% upswing after breaking above the ascending triangle pattern.

- Ripple settles for consolidation following rejection at the 50 SMA, but a breakout to $0.35 is in the offing.

The cryptocurrency market is in the middle of a recovery phase following Monday’s downslide. The total market value has crossed the $1 trillion mark, again confirming the bulls’ return.

Bitcoin is moving fast towards $40,000 after testing $30,000 earlier this week. The largest smart contract token is up 9% to exchange hands at $1,160. However, Ripple is still lagging, especially with its immediate upside capped under $0.3. Perhaps the overhead pressure comes after Grayscale dissolves the sponsored XRP Trust.

Polkadot is among the most prominent daily gainers after bringing down the resistance at $10 and brushing shoulders with $12. Other altcoins such as Chainlink, THETA, Uniswap, Zcash and SushiSwap are recording double-digit gains.

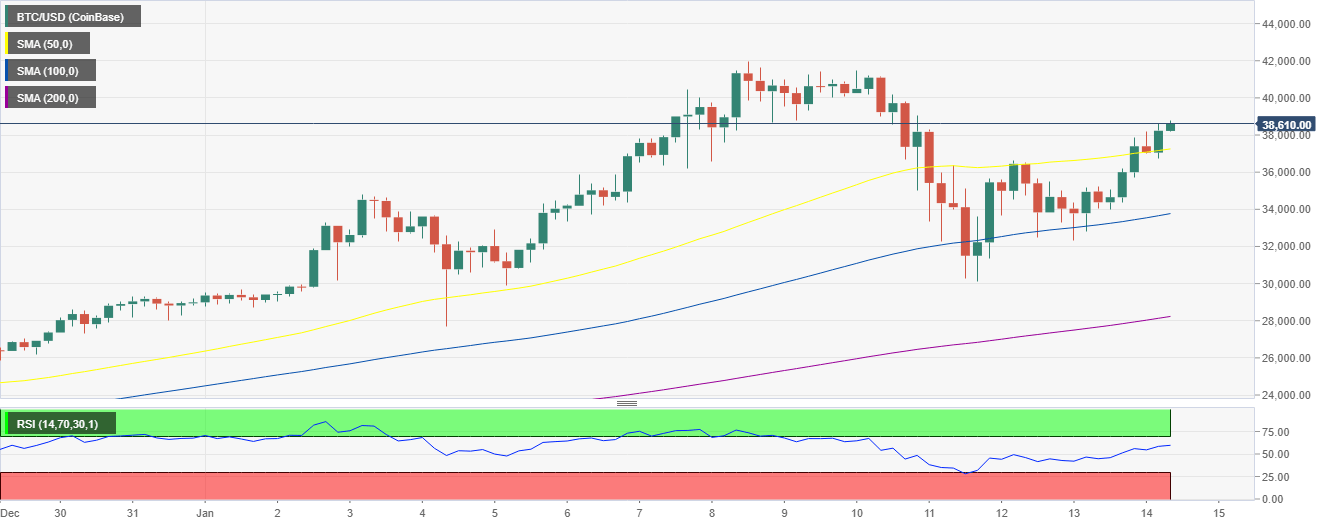

Bitcoin gradually ascends to $40,000

Bitcoin is catching momentum following the retesting of support at $32,000. As reported on Wednesday, it was unlikely the lower support at $30,000 would be rested. Simultaneously, the leg up to $40,000 was only possible if BTC/USD closed the day above $36,000.

The largest cryptocurrency has extended its price action above $38,000. The break past the 50 Simple Moving Average must have increased investors’ confidence in the uptrend. A daily close above $38,000 may see BTC explode to $40,000 and perhaps reach new record highs.

BTC/USD 4-hour chart

On the flip side, the Bitcoin bullish narrative will be thrown out the window if a correction occurs under $38,000. The 50 SMA might absorb some of the selling pressure, but some of the most formidable support levels sit at $36,000, $34,000 and $32,000. The level at $30,000 is home to BTC’s primary support.

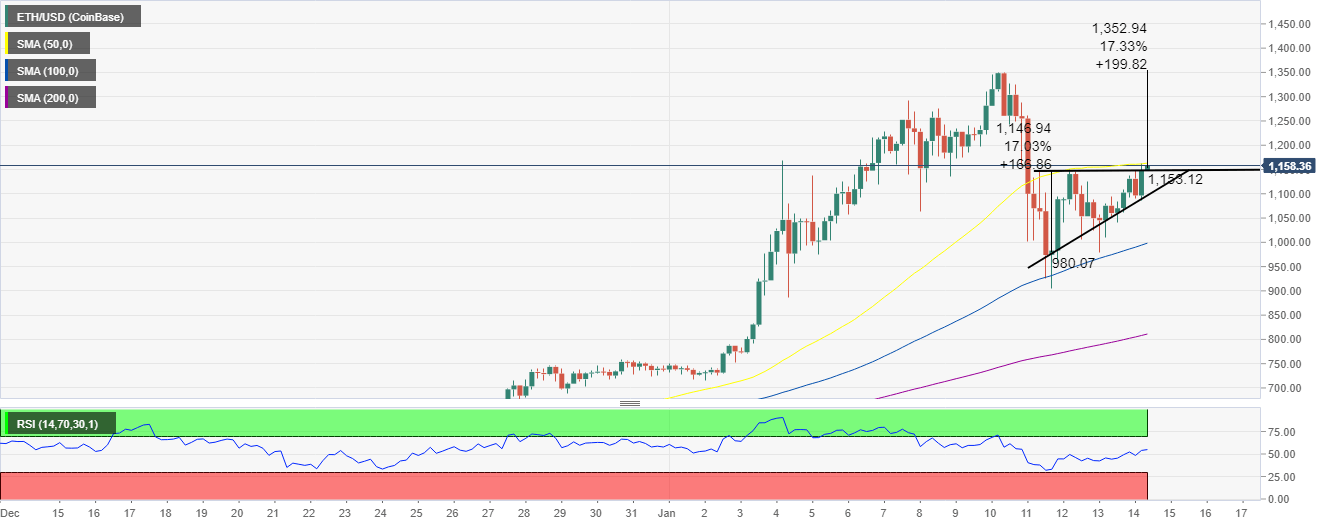

Ethereum prepares for a 17% upswing

Ethereum has just broken above the x-axis of an ascending triangle. This move is occurring after Ether took back the support at $1,100. The plunge to $900 also allowed more investors to join the bullish market.

A horizontal line can be drawn along with the swing highs, while a rising trendline developed along with the swing lows.

A recent spike in the buying pressure behind the largest altcoin allowed it to break above the overhead resistance. At the moment, ETH could shoot up nearly 17%, revisiting the recent yearly high on the ascending triangle formation.

ETH/USD 4-hour chart

On the downside, if the upswing becomes unsustainable, ETH price may retest the x-axis. Breaking under this crucial level would call for more sell orders as some investors prefer to cash out before the price dips further. Overhead pressure could see Ethereum tumble to the $1,100 and $1,000 support areas.

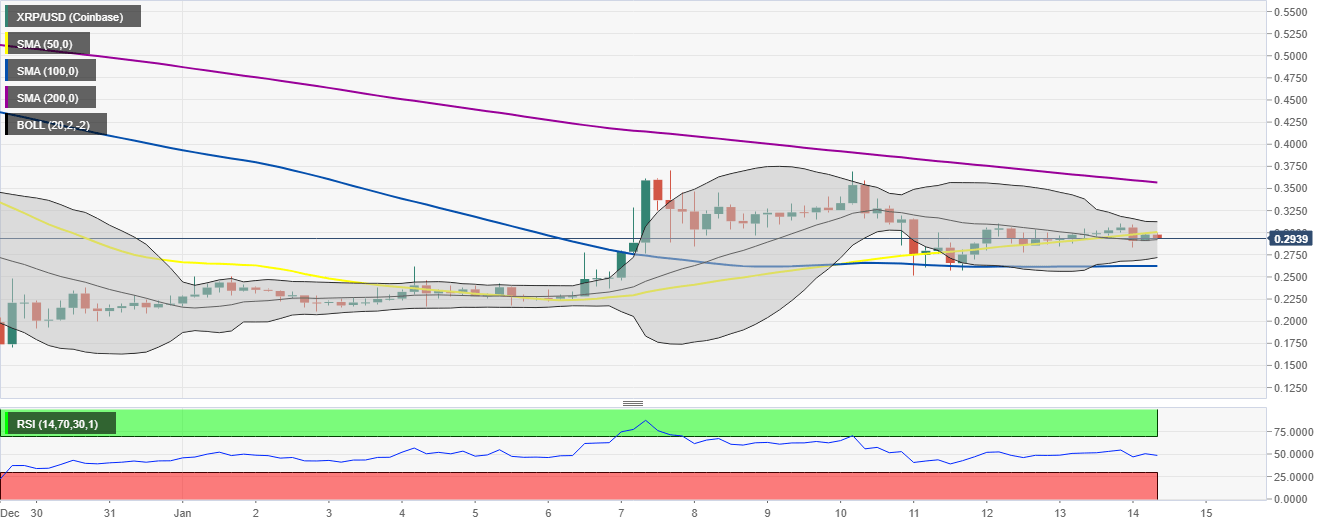

Ripple consolidation hints at a breakout to $3.5

Ripple’s upside is still capped under $0.3 as well as the 50 SMA. The cross-border token seems to be embracing another consolidation, as observed using the Bollinger bands. The middle boundary protects XRP from falling to $0.29, as explained earlier.

As the Bollinger bands constrict, XRP/USD nears its ultimate breakout. To ascertain an uptrend beyond $0.3, support at the Bollinger Bands middle boundary must hold. Buying activity is likely to rise once Ripple spikes past $0.3. The target to the upside is $0.35, but the 200 SMA may limit further price action.

XRP/USD 4-hour chart

It is worth keeping in mind that Ripple selling pressure will intensify if the 50 SMA rejects the price. More losses will come into the picture on XRP breaking under the middle boundary. The support areas likely to be tested include $0.275 and $0.25.