GBP/USD Forecast: No follow-through beyond 1.3800

GBP/USD Current price: 1.3781

- Concerns related to the AstraZeneca vaccine keep undermining sterling.

- UK reopening plans could be altered by a delay in UK’s vaccination.

- GBP/USD advanced on the broad dollar’s weakness, but bulls are still reluctant.

The GBP/USD pair peaked at 1.3808 at the beginning of the day but turned south and bottomed at 1.3750. There was no particular catalyst behind such a decline but persistent concerns surrounding the AstraZeneca coronavirus vaccine. The UK is considering not using it in people under 30 years, which may delay the country’s reopening plans. Additionally, soft GBP figures released on Tuesday supported the idea of a slower economic comeback in the country.

Broad dollar’s weakness saved the day for GBP/USD, which bounced back during the American afternoon to settle a handful of pips below the 1.3800 threshold. The UK won’t publish relevant macroeconomic data this Thursday.

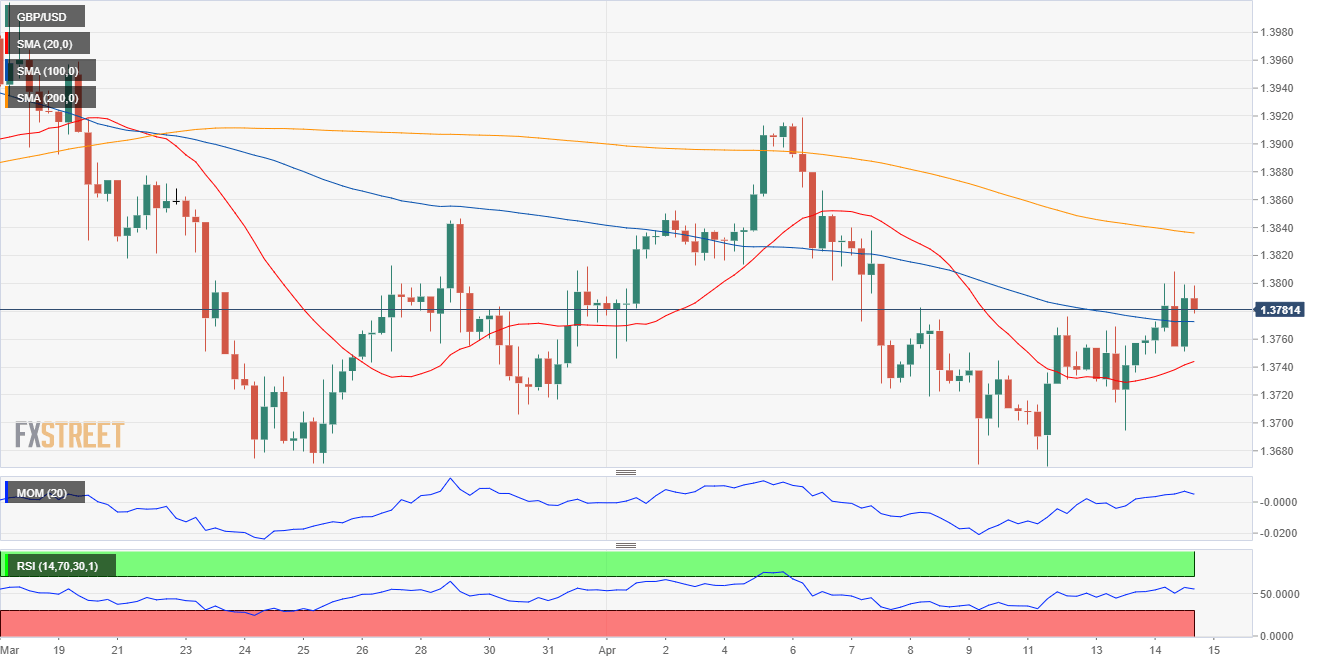

GBP/USD short-term technical outlook

The GBP/USD pair has managed to post a daily advance, although it is still unable to storm through the 1.3800 level. The 4-hour chart shows that the pair ended the day above a bearish 100 SMA, while the 20 SMA advances below it. However, the Momentum indicator eases within positive levels while the RSI is directionless around 54. Overall, the risk seems skewed to the upside, but the pair needs to clear the immediate resistance level at 1.3815 to have better chances of rising.

Support levels: 1.3750 1.3700 1.3665

Resistance levels: 1.3815 1.3860 1.3905

View Live Chart for the GBP/USD