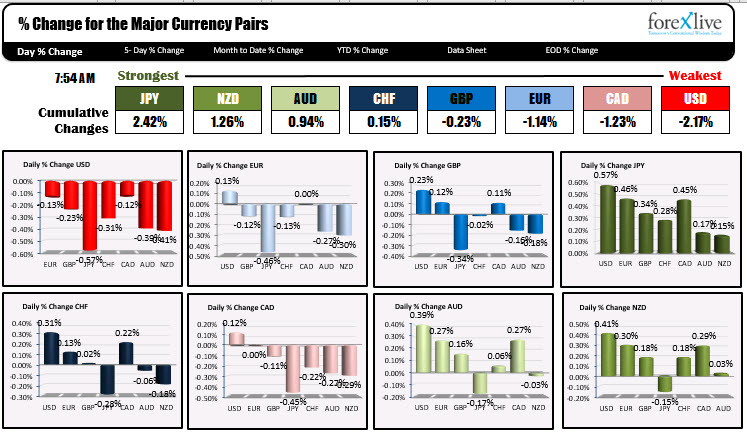

The JPY is the strongest and the USD is the weakest as NA traders enter for the day

Read full post at forexlive.com

Read full post at forexlive.com

The USD reverses lower after the rise yesterday

The JPY is the strongest and the USD is the weakest as NA traders enter for the day. The USD was one of the strongest yesterday. That trend has reversed as yields in the US move lower. The 10 year yield is down to 1.647% which is some 13 pips lower from last week’s high at 1.777%. Gold is up. Crude is down marginally. The Nasdaq is higher after two days of declines (but only marginally each day). US initial jobless claims will be released at the bottom of the hour. Feds Powell will speak on a IMF panel on the global economy at 10 AM ET. Feds Kashkari will also speak later today.

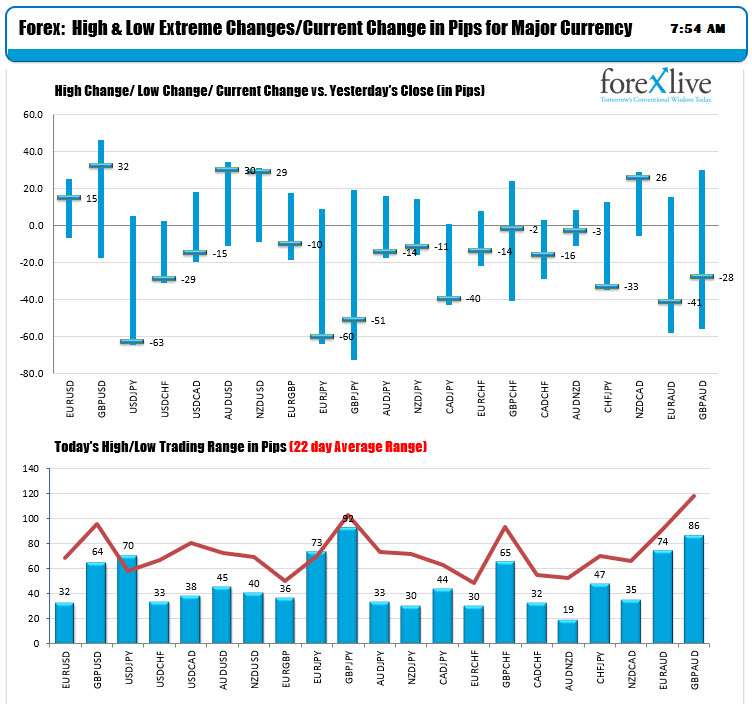

The USDJPY is trading at the session lows as is the USDCHF. The AUDUSD and NZDUSD are just off session highs at the morning snapshot of currency changes. The EURUSD is trading more near mid range with a modest 32 pip trading range. The JPY crosses are all trading lower as well as investors move into the JPY today. The EURJPY fell below its 200 hour MA today at around 129.92 tilting the bias lower. For the USDJPY, it fell back below its 200 hour MA on Tuesday, consolidated sideways yesterday and is resuming the downward bias today.

In other markets, the morning snapshot shows:

- Spot Gold, plus $10.80 or 0.62% at $1748.52.

- Spot silver is up $0.24 or 0.96% at $25.38

- WTI crude oil futures are down $0.16 or -0.25% at $59.62

- Bitcoin is of $324 or 0.58% at $56,562

In the premarket for US stocks, the futures are implying a higher opening. The gains it led by the NASDAQ index after two straight days of modest declines:

- S&P index +15.05 points. The index rose up at 6.01 point yesterday

- NASDAQ index +114.55 points. The index fell -9.538 points yesterday

- Dow industrial average is up marginally higher by 10.74 points after a 16.02 point modest gain yesterday

In the European equity markets, the major indices are mixed:

- German Dax, unchanged

- France’s CAC, +0.35%

- UK’s FTSE 100, +0.4%

- Spain’s Ibex, -0.25%

- Italy’s footsie MIB, -0.35%

In the US debt market, the yields are lower with a flatter yield curve. The 10 year yield is down the most by -2.7 basis points to 1.647% (down from 1.777 last week). The 2-10 year spread is lower by above 2 basis points to 150.06 from 152.12 basis points at the close yesterday.