Crypto.com continues to look weak, CRO could fall another 20%

- Crypto.com price remains under considerable pressure after Thursday’s selling.

- Muted to zero recovery during the Friday trading session.

- A deeper retracement may be ahead for CRO.

Crypto.com price action looked extremely bullish and optimistic on Tuesday and Wednesday, closing more than 10% higher. Thursday, however, saw persistent selling pressure, with the close of the day equalling the low. Friday’s price action has been remarkably flat, but the directional bias remains bearish.

Crypto.com price straddles final support structure before dropping to $0.37

Crypto.com price action is flirting with the idea of driving lower. Participating during the Friday trading session has been very low, with little movement in the overall price range traded. On Thursday, the rejection against the Tenkan-Sen yielded a close below the Wednesday open, signaling a very bearish event. However, bears have not followed through.

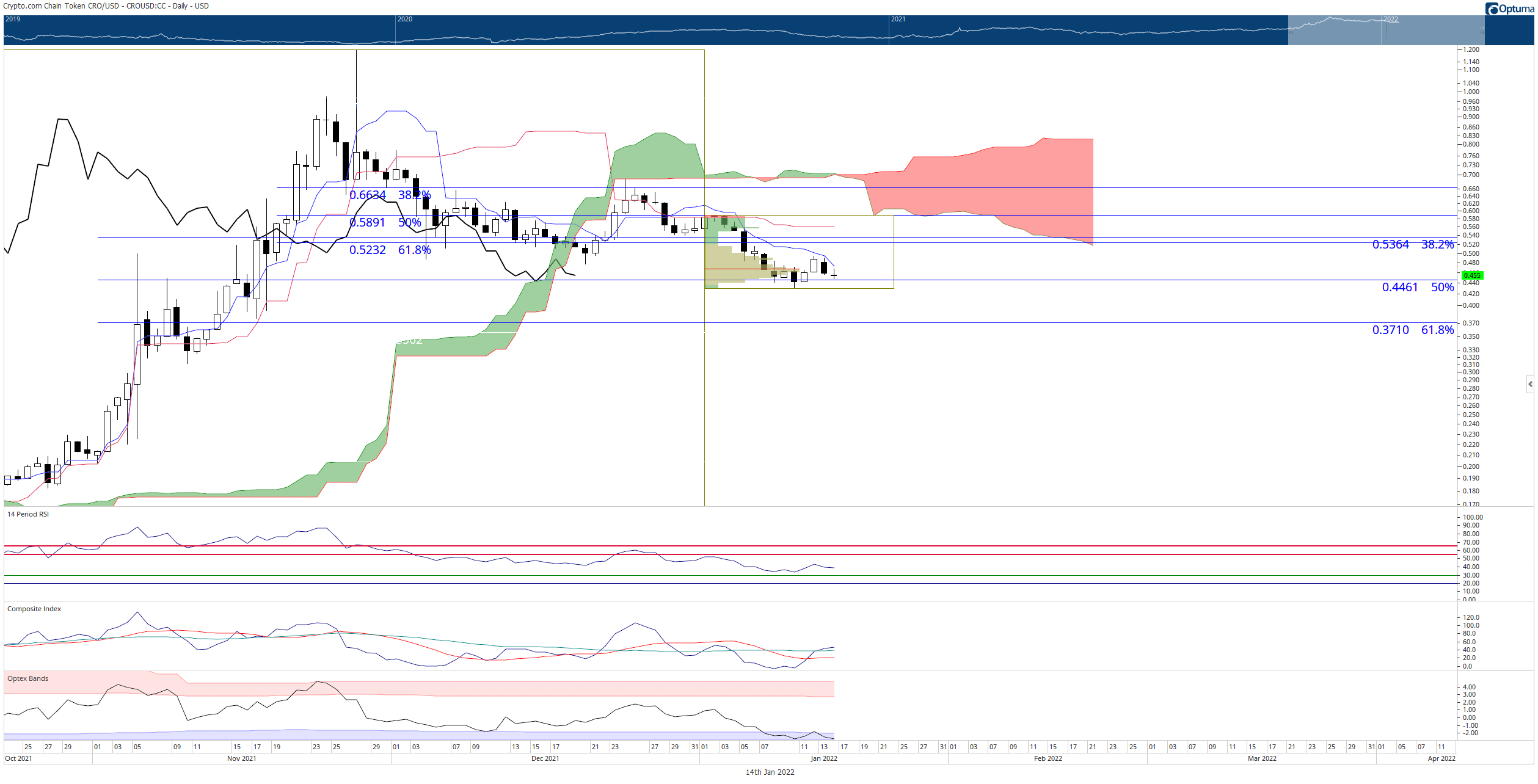

The 50% Fibonacci retracement at $0.445 continues to be the primary support zone for CRO price. Failure to hold support at $0.445 would likely push Crypto.com down to $0.37, where a high volume node and the 61.8% Fibonacci retracement exist. The Relative Strength Index and Composite Index oscillators support a downside move, but the Optex Bands oscillator does not. The Optex Bands oscillator is at extreme oversold conditions – but that is the only oversold variable present.

From a bullish perspective, buyers could eliminate any near-term bearish outlook by pushing Crypto.com price to a close at $0.53. In that scenario, CRO would be above the 38.2% Fibonacci retracement and the Tenkan-Sen. More important, the Chikou Span would be positioned above the candlesticks.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

A clear and undeniable uptrend could only occur when Crypto.com price moves to a daily close above the Cloud – the lowest price level that CRO would need to reach is $0.72 – a long way away from the present value area.