Decentraland enters consolidation, MANA may fall below $2 before finding support

- Decentraland price trades sideways despite a strong Ichimoku bearish outlook.

- MANA’s Point and Figure chart shows opportunities for bulls and bears.

- The overall directional bias on bearish.

Decentraland price is overwhelmingly bearish on the daily Ichimoku chart. All of the requirements for an Ideal Bearish Ichimoku Breakout entry are fulfilled and have been for the past week – but no follow-through selling has occurred.

Decentraland price presents a long and short opportunity

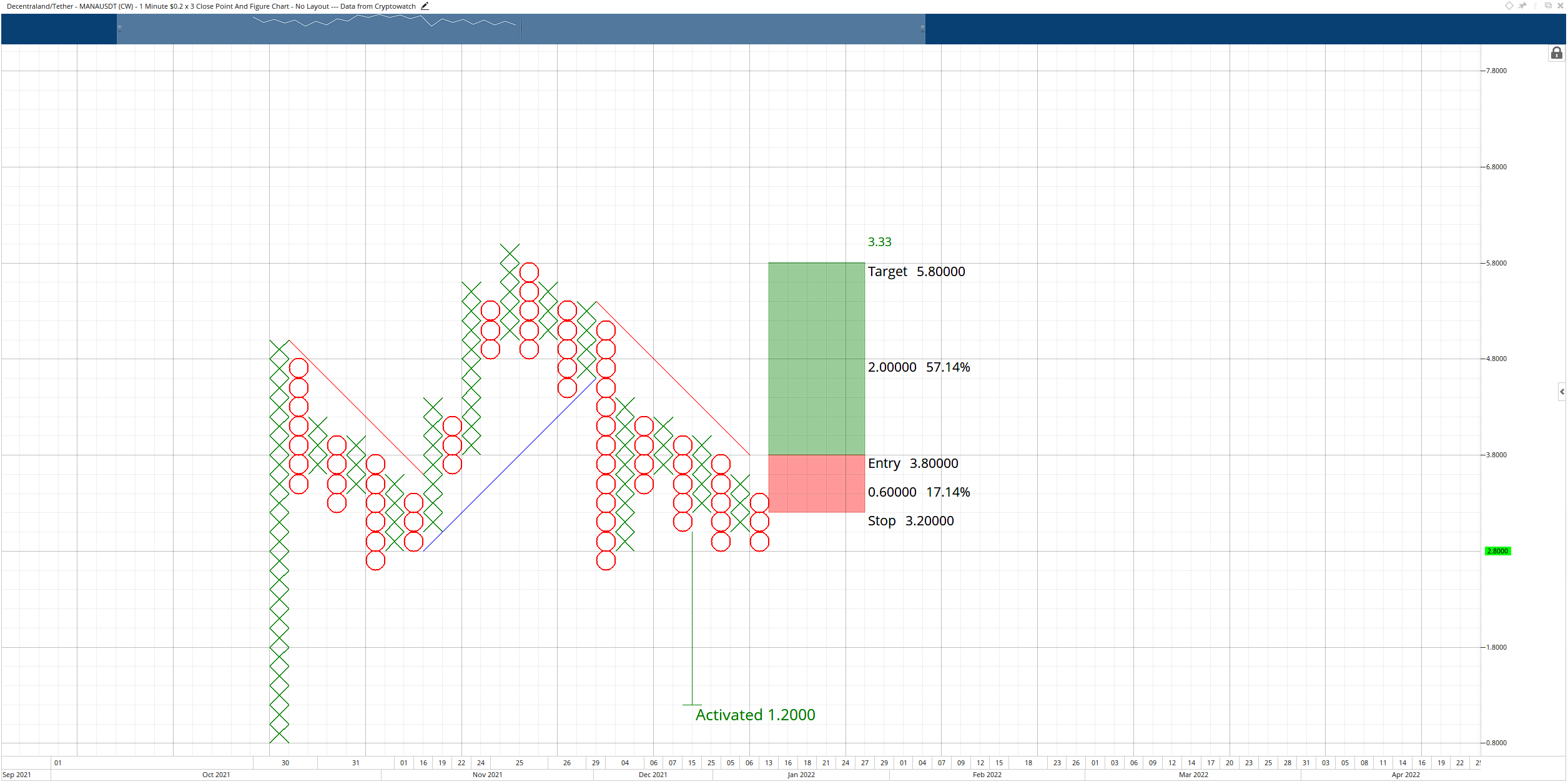

Decentralnd price action, while bearish, is not without its reasons for a bullish outlook. A hypothetical long setup with a buy stop order at $3.80, a stop loss at $3.20, and a profit target at $5.80. The trade is based on the simultaneous breakout above the upper trendline of a descending triangle and the bear market trendline. If MANA hits the entry, it converts the $0.02/3-box reversal Point and Figure chart into a bull market.

MANA/USDT $0.20/3-box Reversal Point and Figure Chart

The hypothetical long trade setup represents a 3.33:1 reward/risk with an implied profit target of 57% from the entry. However, a trailing stop of two to three boxes would help protect any profit generated after the entry is triggered. This long idea is invalidated if Decentraland price drops to $2.40

There is a fantastic setup on the short side of the market with an anticipated triple-bottom breakout. The theoretical short entry is a sell stop order at $2.60, a stop loss at $3.00, and a profit target at $1.40. The short idea is a 3:1 reward/risk with a little over a 40% gain projected from the entry. A three-box trailing stop may be too large for this trade setup, so a two-box trail would be most appropriate.

MANA/USDT $0.10/3-box Reversal Point and Figure Chart

The short idea is invalidated if the long entry triggers first.