Gold Price Forecast: XAU/USD eyes further downside towards $1,800, Fed Chair Powell in focus

- Gold bounces off weekly/daily low but stays pressured during three-day downtrend.

- Fears of inflation/recession weigh on prices, headlines concerning China, market’s inaction probe bears.

- US Q1 2022 PCE details, central bankers’ panel discussion at the ECB Forum will be crucial for fresh impulse.

Gold Price (XAU/USD) remains on the back foot around $1,820, despite the recent bounce from intraday low. In doing so, the yellow metal prints a three-day downtrend as traders await the week’s key data/events amid a sluggish Asian session on Wednesday.

The bullion prices refreshed their weekly bottom on breaking a short-term symmetrical triangle the previous day as market sentiment soured amid recession/inflation fears. However, cautious optimism surrounding China seems to challenge the gold sellers of late.

“China will halve to seven days its COVID-19 quarantine period for visitors from overseas, with a further three days spent at home, health authorities said on Tuesday,” per Reuters. The news also joined the latest comments from the US Deputy Commerce Secretary Don Graves who said, “A clear US response on China tariffs is coming soon,” per Bloomberg TV.

Elsewhere, a jump in the one-year US consumer inflation expectations joined hawkish Fedspeak to renew the US dollar’s safe-haven demand. The US Conference Board (CB) Consumer Confidence Index dropped for the second consecutive month in June, to 98.7 versus 100.0 expected and 103.2 in May. In doing so, the widely followed consumer sentiment gauge dropped to the lowest level since February 2021. Further details revealed that the one-year consumer inflation rate expectations climbed to 8% from May’s revised print of 7.5. It should be noted that the US trade deficit dropped to the lowest in a year, to $104.3 billion, per the latest release for May.

Amid these plays, the US 10-year Treasury yields snapped a two-day uptrend whereas Wall Street closed in the red. The S&P 500 Futures, however, print mild gains and it seems to probe the gold bears of late.

Moving on, the US Core Personal Consumption Expenditure (PCE) for Q1 2022, expected to remain unchanged at 5.1%, will precede the central bankers’ discussions at the ECB Forum to offer important insights. Should Fed Chair Jerome Powell manage to defend hawkish polic moves, the XAU/USD selling may gain extra strength.

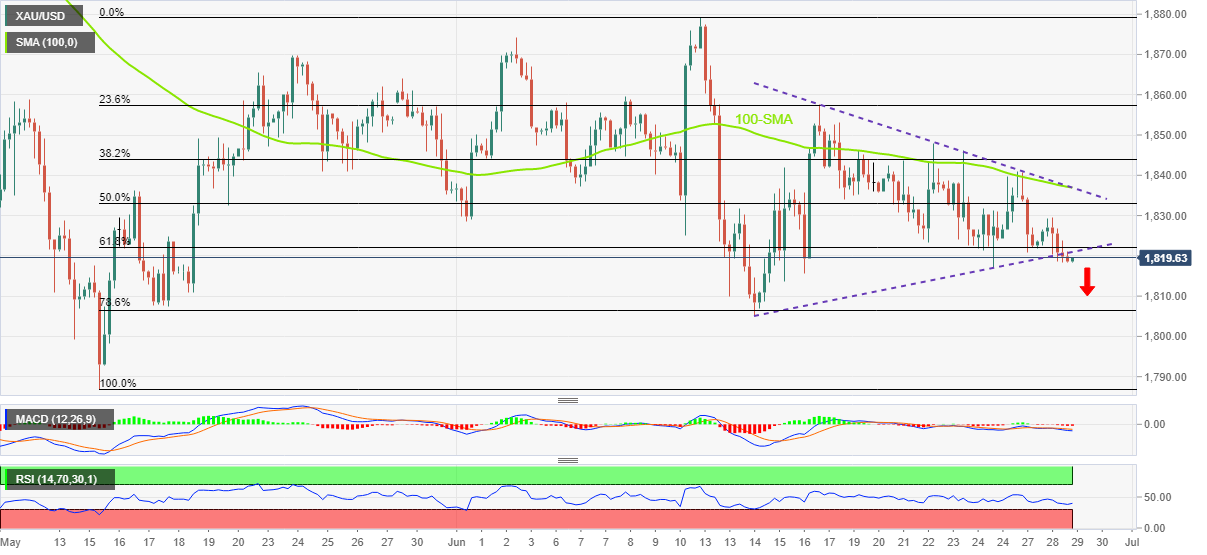

Technical analysis

Gold bears remain hopeful as a clear downside break of the two-week-old symmetrical triangle joins descending RSI (14) line (not oversold) and bearish MACD signals.

Adding to the metal’s bearish bias is a successful break of the 61.8% Fibonacci retracement (Fibo.) of May 16 to June 12 upside.

That said, the XAU/USD bears are on their way to the 78.6% Fibo. surrounding $1,805. However, the $1,800 threshold may test the further downside before directing the bullion prices towards the yearly low marked in May around $1,786.

Alternatively, the stated triangle’s support line, now resistance around $1,820, precedes the 61.8% Fibonacci retracement level near $1,823 to restrict the short-term upside of gold prices.

Following that, the weekly high near $1,830 and the 50% Fibo. level surrounding $1,835 can entertain XAU/USD bulls. However, a convergence of the 100-SMA and the aforementioned triangle’s upper line, near $1,837-38, appears the key hurdle to break for the buyers to retake control.

Gold: Four-hour chart

Trend: Further downside expected