Base Camp: #1 some fundamental stuff

In post basic experience creating an edge will give you the greatest leverage, keep it simple, there is little need to complicate things; test(back/forward) until you find a system you enjoy using and has worked over at least 200 trades. Once you feel confident regarding the odds being in your favor, paper trade it until your confidence in your system increases. Start small and increase your lot size as your confidence increases, I would suggest .5%-2% of your account. Keep in mind emotions are the primary catalyst of your ability to trade in the markets.

If you are emotionally compromised your dog died, you found out your BF/GF left you, etc…DON’T TRADE.

Write down your emotions be certain to include what happened, for me, I kept a journal which included trades, wins, losses and what I was feeling at the time. Watch yourself if you are tempted to move stops etc. Do not go live unless you are able to execute your strategy flawlessly. Now when I say flawlessly I don’t mean win after win, I mean it was a good trade because you stuck by your parameters, you didn’t allow emotions have total control your actions. A good trade can still be a losing trade which will be explained later on.

In order to be a consistently successful trader you must think differently from the 90% of traders. Oftentimes we hold beliefs that do not support our goals and hence the low percentage of successful traders. As a trader who previously struggled and was frustrated with my results I can attest that changing your way of thinking and beliefs is some of the most tricky and subtle tasks you can imagine and changing a trader who has experienced loss into a winner is the epitome for a trading mentor/consultant. Fear not! Through the series of articles posted there will be a mixture of trading experiments I have conducted along with strategies to test, philosophical posts about trading in general & insight into how to improve both as an individual and trader.

This is what you need to do to educate yourself in order to be a winning trader. I am at wit’s end reading posts, articles, Tweets and the like of complicated strategies and fear-based advice given to new traders like yourself.

Philosophy

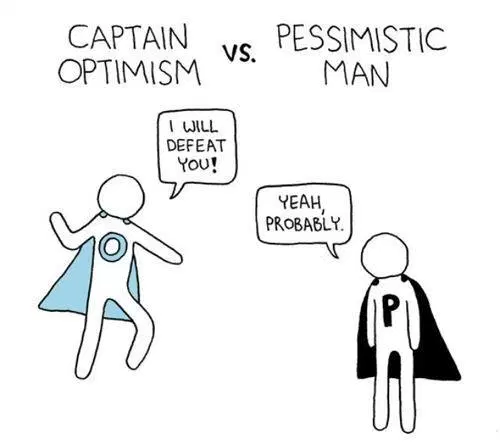

This leads us to what has to be the most painful lesson ever inflicted on the optimistic nature of the human species: the tactics that an individual uses to achieve her dreams and goals in everyday life do not work in trading; in fact, they are one of the main reasons for a traderÂ’s failure. The determination, courage, positive thinking, and resoluteness that have made people a success in one area of their life simply set them up for slaughter in the markets. It is these types of traders who obstinately hold on to a losing position, adding to it on the way down, using positive thinking techniques to visualize this fiasco eventually turning into a winning trade. I donÂ’t care how many Tony Robbins tapes the employees of Enron listen to; itÂ’s not going to get their stock back up to $90 a share. The trader who is unaware of this phenomenon is set up for failure from the very beginning. This doesnÂ’t mean that a person shouldnÂ’t be positive about her ability to eventually become a successful trader. Far from it. However, a trader will be much better off assuming that every trade she takes is going to become a successful trader. Far from it. This way, she learns to focus on protecting her downside and minimizing her risk. The upside can take care of itself, thank you very much. ItÂ’s the downside that can easily get out of hand. Be positive on life, but pessimistic on your next trade.

RISK MANAGEMENT

If you go back and reread the article on babypips you’ll be surprised to see that they offered ABSOLUTELY no insight into how to go about risk management. In short, the article is very poorly done, in its defense, however, it did mention probability once which is what a trader needs to pay attention to. Now there are two aspects in trade management and risk management that need to be addressed. Position sizing and stop loss. Position sizing is how you control the number of units correlated to your account, or the exposure to the market your account will endure. Stop loss, on the other hand, is how you prevent trades getting out of hand, and wiping your account.

It goes without saying probability is your closest friend in forex, if you are trading it. If you are investing then this is a whole different ball game. In general traders will throw a ratio at a trade and hope it sticks. Like in example w/l 1:3 1:4, 1:2 and 1:1. This is a phase where people are just beginning to figure out that stops matter, like a lot. But what they don’t realize is that in this phase is when people are most likely to stop hunt and it’s these exact traders who tend to lose on trade after trade because price suddenly goes against them.

In example:

Bullish hidden divergence, increasing volume, higher low.

Looks good SL placed at lowest low approx 12 pips from price of the most recent candle.

But what happened?

A massive amount of buying and selling pressure came in, this could mean many things: News, banks and hedgefunds stop hunting to reduce slippage or aliens ?

A massive amount of buying and selling pressure came in, this could mean many things: News, banks and hedgefunds stop hunting to reduce slippage or aliens ?

So how do you prevent this? You have options to choose from many of which go against the usual trader psychology, but this is good because while others are being wiped out you can still maintain a leg in the game.

#1 Volatility stops: https://www.tradingsetupsreview.com/ultimate-guide-volatility-stop-losses/

The dumbed down version: https://www.babypips.com/learn/forex/volatility-stop

#2 Chart pattern stops(dangerous): Avoid these

#3 Time stops: https://www.babypips.com/learn/forex/time-stop

Leave a Reply