EUR/GBP Technical Analysis: 50-day SMA, descending channel push bears toward 0.8500

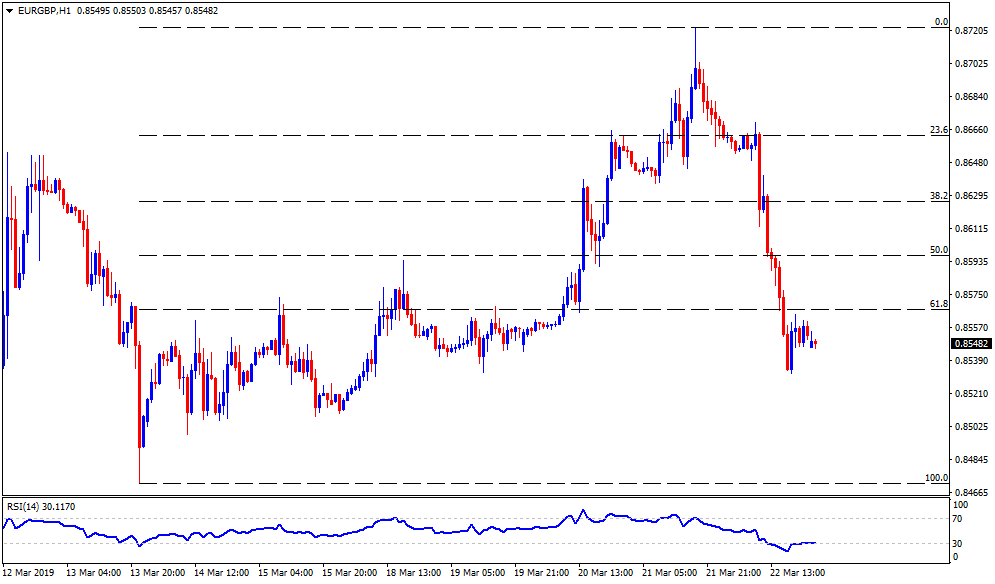

EUR/GBP daily chart

- EUR/GBP is little changed near 0.8550 at the start of Asian trading on Monday.

- Following its failure to successfully cross 50-day simple moving average (SMA), the pair is likely declining towards mid-month low around 0.8500.

- Though, the current month low surrounding 0.8470 and support-line of two-month-old descending trend-channel, at 0.8430 now, can entertain sellers afterward.

- During additional selling pressure beneath 0.8430, 61.8% Fibonacci expansion (FE) of January 11 to March 21 moves, at 0.8360, could become bear’s favorite.

- Meanwhile, 0.8640 and 50-day simple moving average (SMA) level of 0.8680 may restrict the quote’s near-term upside ahead of diverting market attention to 0.8715/20 resistance-confluence comprising 38.2% Fibonacci retracement of January – March downturn and upper-line of the said channel.

- If at all buyers manage to conquer 0.8720, 50% Fibonacci at 0.8790 and 200-day SMA level of 0.8840 could flash on their list.

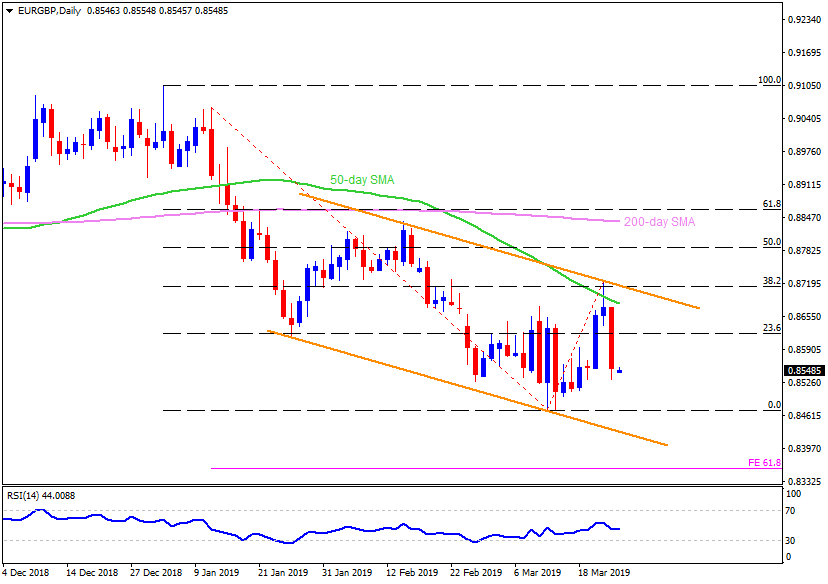

EUR/GBP 4-Hour chart

- 0.8670 is likely an intermediate halt between 0.8640 and 0.8680.

- On the downside, 0.8530 seem adjacent support to watch.

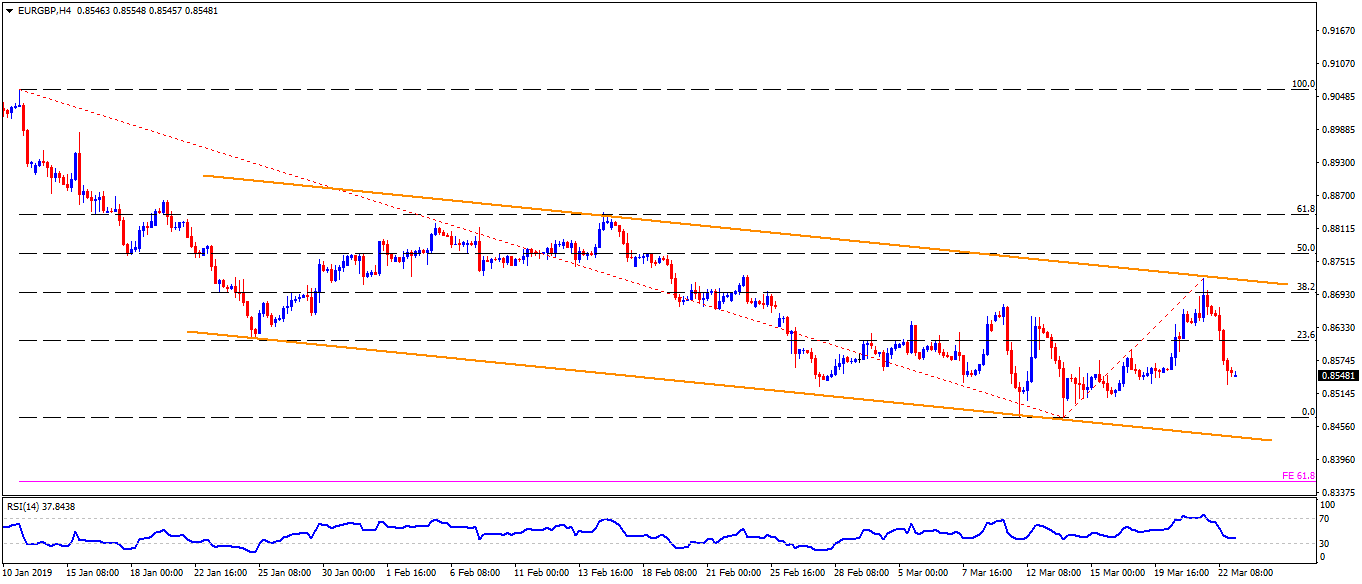

EUR/GBP hourly chart

- Latest top at 0.8570 could become the closest resistance with 0.8510 being expected additional support.